A Look Inside Contrafund

Where does its outperformance come from?

Ordinarily, I don’t pay much attention to week-by-week gyrations of the fund market, but this past week’s volatility piqued my interest in the Lipper performance report that is regularly tossed over my transom.

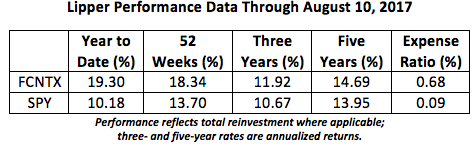

Of the 25 largest funds, says the new report, the Fidelity Contrafund (OTC: FCNTX) still tops the table with a 19.3 percent year-to-date gain. The $84.3 billion fund has performed pretty well over the long term as well, coming in third over the past 52 weeks, first over three years and grabbing another third-place ribbon for its performance over five years.

What’s most interesting about Lipper’s Top 25 roster is that it includes exchange-traded funds, making a comparison between Contrafund and the behemoth SPDR S&P 500 ETF (NYSE Arca: SPY) – all $242.5 billion of it -- easy. As it turns out, Contrafund consistently outdoes the index-tracking SPY portfolio over several of Lipper’s discrete timeframes.

So, what’s Contrafund’s secret sauce? How does the fund beat out so many active funds as well as the widely held benchmark ETF? Some folk would say comparing Contrafund to SPY is an apples-to-oranges judgement. Contrafund, they say, is a growth fund while SPY is a core, or blend, portfolio. But is that really the difference? Just HOW much growth is in the Contrafund?

A factor X-ray of the fund – provided by the FTSE Factor models – shows that there’s quite a bit, actually. About 66 percent of the funds’ returns over the past five years can be attributed to growth. The remainder is derived via high momentum. Lo and behold, SPY’s growth exposure of 68 percent is nearly identical to Contrafund. And, like the Fidelity fund, SPY’s residual returns are also owed to momentum but, for the index tracker, it’s LOW momentum.

What’s momentum? It’s the Holy Grail for trend followers. Momentum represents the persistence of price movements over time. Momentum stocks are expected to produce short-term excess returns in the future based on their strong recent performance. Of course, trend reversals are inevitable and can quickly erase any accumulated gains. Momentum, by its nature, is cyclical.

Contrafund’s knockout returns over the past five years have come from a powerful one-two punch of growth and momentum. Growth and high momentum historically have been the ideal factor combo for the expansion phase of an economy. SPY relies upon growth without the underlayment of cyclicality.

With this in mind, we see that Contrafund is, as advertised, a growth fund. But so, too, is SPY. No, Contrafund buyers pay a premium for momentum, not growth. Given an active share of 59.5 percent, the fee for Contrafund’s momentum is the better part of 108 basis points And, with an annualized alpha these past five years of 141 bips, investors are getting a 1.3-to-1 payback.

Not quite as good as coming up with “21” at most blackjack tables, but it’s not bad.

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option ...

more