A High Energy Rally

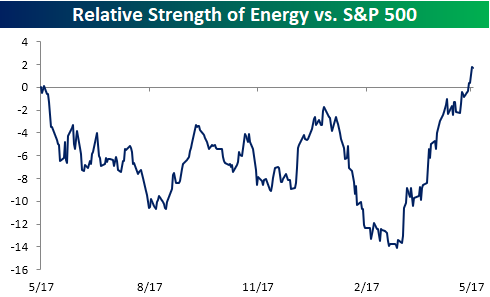

Sentiment in the market has a way of changing on a dime. A case in point is the Energy sector. In addition to hitting a 52-week high on Thursday, a number of internal measures for the sector have been pointing higher. For starters, check out the sector’s relative strength versus the S&P 500. In the span of two months, the sector went from underperforming the S&P 500 by its widest margin in over a year to outperforming by its widest margin in a year.

Breadth in the sector has also been strong. As highlighted in our Sector Snapshots report on Thursday, 97% of the stocks in the sector are currently above their 50-day moving averages. That compares to a level of 57% for the entire S&P 500 and 76% for the next closest sector (Technology). Not only are nearly all of the stocks in the sector above their 50-DMAs, but a good chunk of them are also hitting 52-week highs.In yesterday’s session alone, over 40% of the stocks in the sector hit 52-week highs. That was the highest one-day percentage for the sector since late 2016. Suddenly, investors can’t get their hands on enough energy stocks. Crude oil at over $70 a barrel as a way of doing that!