A Few Reasons To Be Cautious About Chevron

One of the favorite investments of those individuals interested in dividend growth is oil and gas giant Chevron (CVX). Indeed, it seems as though a bullish article on the company gets published on this site almost on a daily basis. However, the company has a number of challenges which it must overcome in the next few years that many of these analysts overlook.

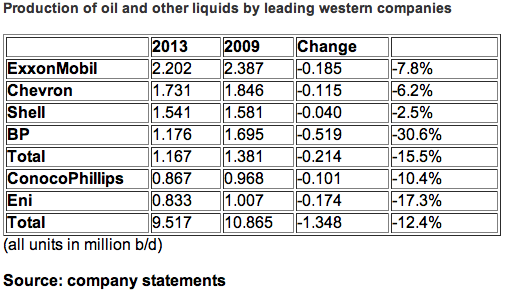

One of the problems that the company needs to address is its declining production. This is a problem that Chevron shares with many of its large Western peers. This chart shows how the company's average production rate has varied over the 2009-2013 period for Chevron and several other large oil companies:

Source: Platts

As this chart shows, Chevron's average daily production declined by 6.2% over the 2009 to 2013 period. This is a problem because there are only two ways for an oil and gas company to increase its revenue: increasing its production or selling its oil for higher amounts of money. As oil prices have fallen considerably over the past year, Chevron is not going to be able to grow its revenues by collecting higher prices for the oil and gas that it sells. Even were it the case that oil prices had remained high, this would still not be a reliable way for Chevron to grow its revenues as the prices for both oil and gas are completely outside of the company's control. Thus, by far the most reliable way for an oil and gas company to grow its revenue is to grow its production and this is clearly something that Chevron has failed to do.

This shows in the company's revenues, which have consistently declined over the past few years. Here are Chevron's annual revenues over the 2011-2013 period, over which time oil prices were somewhat stable:

![]()

Source: Yahoo! Finance

It is likely that Chevron's revenue will continue to decline over the full year 2014 due to the sharp decline in oil prices that occurred during the latter half of the year.

These declining revenues have put pressure on other areas of the company's finances, which brings us to another problem that Chevron must address - its cash flow. One metric that dividend investors evaluating a company should be familiar with is free cash flow. Investopedia defines free cash flow as,

"A measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value. Without cash, its tough to develop new products, make acquisitions, pay dividends, and reduce debt."

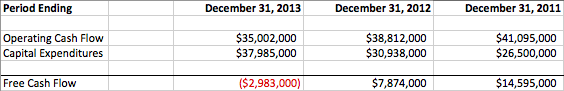

Thus, the amount of money that a company can afford to pay out to its shareholders through either dividends or share buybacks is directly dependent on its free cash flow. Unfortunately, Chevron's free cash flow has been declining, just like the company's revenue. Here is Chevron's free cash flow during each of the past three years:

Source: Assembled from Data Sourced from Company Statements

As this chart shows, Chevron's free cash flow declined to negative levels in 2013. Thus, the company did not actually generate enough cash to pay any dividend to shareholders, let alone the dividend and stock buybacks that it actually spent money on. Furthermore, this is not a problem that was confined to a single year. In 2012, Chevron had $7.874 billion in free cash flow but paid out $6.885 billion in dividends to its shareholders and spent another $4.142 billion buying back its own stock. Thus, during both 2012 and 2013, Chevron failed to generate sufficient cash to support both its dividend and stock buyback programs.

The company has been supporting these payments to shareholders by taking on debt. In 2012, Chevron borrowed a total of $2.047 billion in order to partially pay for its dividend and share buybacks. In 2013, the company borrowed an additional $8.246 billion. These borrowings were one reason why Chevron's outstanding long-term debt more than doubled over the 2011-2013 period, going from $9.812 billion to $20.057 billion.

Ultimately, this is an unsustainable situation. A company cannot continue to finance dividends and share buybacks with debt indefinitely. Chevron will need to correct its declining production and free cash flow in order to continue delivering the dividend growth that investors have come to expect over an extended timeframe.

Disclosure: I am long several oil stocks and MLPs as are several clients. I have no positions in oil futures.