A Bearish Setup May Develop

- SPX Monitoring purposes; Neutral

- Monitoring purposes Gold: Short GDX @ 22.20 on 8/7/17

- Long Term Trend monitor purposes: Neutral

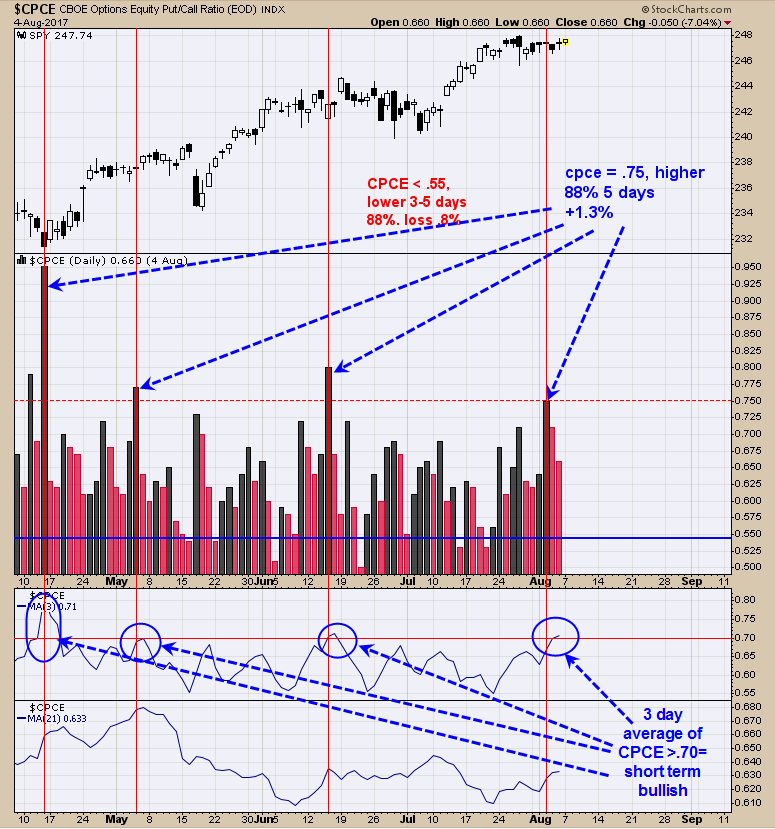

The Equity Put/Call ratio closed at .75 last Wednesday and reading .75 and high have predicted a bounce in the market, 88% of the time, within the next 3 to 5 days with an average gain of 1.3%. The chart above (noted in blue) shows time when the Equity Put/Call reached .75 and higher and what the market did over the next several days. The second window up from the bottom is the “3 day average of the Equity Put/Call ratio”. Reading above .70 also predicts a bounce and since it covers more than one day readings, it carries more weight. Covered short SPX 8/3/17 at 2472.16 = gain .22%; Short SPX 8/2/17 at 2477.57.

Today the SPY closed high than the previous day and the VIX closed lower than the previous day suggesting the short term rally may continue another day. A bearish setup may develop if the SPY hits a new high and the VIX makes a higher low. This setup could lead to a multi week correction and something we are watching for. The NYSE McClellan Oscillator remains below “0” in a bearish manner. The Equity Put/Call suggests a bounce could last another couple of days. Other indicators that would help for a top signal is for the Equity put/call ratio reach .55 or lower. We will see how the market performs in the next couple of days and watch for this potential setup. If a top signal is triggered the pull back would have a target near 2440 range on the SPX.

The second window up for the bottom is the Up down Volume Percent with a 50 day moving average. Readings above “0” are bullish for GDX and below “0” bearish and its last close came in at -8.55. Notice also it has made a lower low then its July low where GDX is still above its July low suggests GDX could head to its July low. Next window up is the Advance/Decline percent with a 50 day moving average. It too is below “0” and has made a lower low below the July low suggests GDX could be head to it July low (21.00 range or possible lower). The COT report for August 4 showed the Commercials at 143K Short which is bearish for Gold. Short GDX on 8/7/17 at 22.20.

Disclosure: None.

Disclaimer: Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance ...

more