5 Things To Watch This Week - August 31, 2015

(Photo Credit: nick damico)

Tuesday, September 1

![]()

Thursday, September 3

![]()

![]()

Friday, September 4

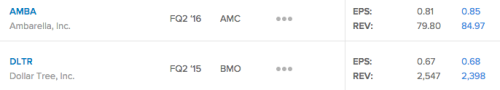

Ambarella, Inc. (AMBA)

The Estimize Consensus calls for EPS of $0.85 vs. Wall Street’s $0.81. The Estimize Consensus predicts revenue of $84.97M compared to the Street’s $79.80M.

What to watch for: Ambarella, developer of HD video compression and image processing products, has experienced a rapid increase in stock price, 150% over the past year. One of their biggest clients, GoPro, uses Ambarella SoCs (System on Chip) for their HD cameras and is responsible for that rally, with AMBA stocks reacting positively to GoPro’s better-than-expected Q2 earnings. SoC heavy products such as the GoPro HERO4 collection also accounted for more than 50% of revenue, confirming high sales for Ambarella. Also, the recent hype in drone technology further expand the market for Ambarella, increasing investor confidence.

However, the stock experienced its first major price drop on August 20th as Qualcomm announced that they will be developing their smartphone SoCs for drone applications as well. The stock took another hit last week as a result of China’s currency devaluation as Ambarella products will now be more expensive. So whether or not Ambarella can regain its upward momentum depends on its earnings Tuesday.

Dollar Tree (DLTR)

The Estimize Consensus calls for EPS of $0.68 vs. Wall Street’’s $0.67 and guidance of $0.66. The Estimize Consensus predicts revenues of $2.4B compared to the Street’s estimate of $2.55B and guidance of $2.20B.

What to watch for: Dollar Tree is now the largest deep-discount retailer in the country, after it’s acquisition of Family Dollar Stores, they now operate 13,500 stores nationwide, vs. competitor Dollar General’s 11,000. That acquisition is huge for DLTR and should help with operational and distribution efficiencies as the company charges forward with store expansion plans, especially into new markets, as well as with their omni-channel development to capture the online market. Dollar Tree stores typically occupy small neighborhoods, too small for Wal-Marts. But the discount wars are heating up as Wal-Mart and even Target eye smaller neighborhoods. Wal-Mart plans to open up 200 smaller stores this year alone, bringing the total up to 700 of its 3,200 stores worldwide. Target is further behind, but has made opening up their TargetExpress stores a main priority going forward. The dollar store industry has been strong recently, with DLTR’s stock up about 9% YTD.

VeriFone Systems (PAY)

The Estimize Consensus calls for EPS of $0.46 in-line with Wall Street and a penny higher than corporate guidance. The Estimize Consensus predicts revenues of $499.9M compared to Wall Street’s estimate of $502.8M and guidance of $497.5M.

What to watch for: VeriFone produces electronic payment terminals and makes money from customer transactions. The company is poised to do well for the rest of the year as demand rises for Europay, Mastercard, Visa (EMV) terminals and as mobile payments increase in popularity. Newer credit cards have EMV chips that help protect a holder from fraud. Starting in October, all merchants are required to use the latest payment terminals that support EMV chips as opposed to the older systems that only read magnetic strips. Those that don’t will be liable for fraud that takes place in point-of-sale transactions, a liability previously taken on by credit card issuers. Near field communication, the technology that allows two devices to communicate via radio waves when in close vicinity, is another area that will benefit the company. This is the technology that enables mobile wave-and-pay phone payments at merchant registers through apps such as Google Wallet and Apple Pay.

Medtronic, Inc. (MDT)

The Estimize Consensus calls for EPS of $1.04 vs. Wall Street’s $1.01. The Estimize Consensus predicts revenues of $7.08B compared to Wall St.’s Estimate of $7.03B.

What to watch for: The stronger dollar has been a source of stress for many multinationals for the past year, and Medtronic may feel even more of a pinch as they derive 40% of their sales from abroad. However, one bright spot it the recent acquisition of Covidien which now makes Medtronic the largest medical device producer in the world with a market cap of $104B. The acquisition was officially completed in January and famously survived the White House crackdown on corporate tax inversion, with Medtronic buying Ireland-based Covidien and thereby lowering their yearly tax corporate tax rate to 12.5% from 35%. Not only was this the largest “medtech” deal ever, but it was the largest tax inversion. The company maintains the acquisition was just as much about corporate strategy as it was about taxes. Since the completion of the takeover, MDT stock is off about 4.5%.

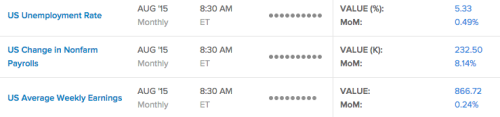

Jobs Data

On Friday we get an important read on U.S. employment as Nonfarm Payrolls, Unemployment and Average Weekly Earnings are reported for the month of August.

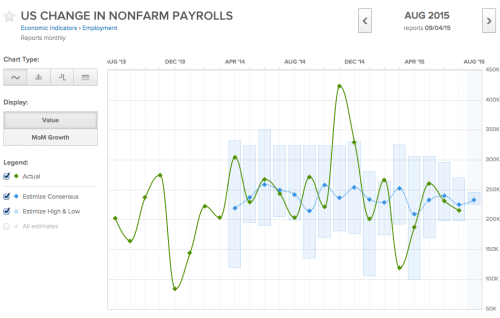

Change in Nonfarm payrolls: Nonfarm payrolls had a rough second quarter, with readings from both June and July missing the Estimize consensus and falling MoM by 11.15% and 6.93%, respectively. For August, the Estimize community are predicting a reading of 232.5, a MoM increase of 8.14%. Nonfarm payrolls represent around 80% of the workforce in the United States and therefore is a good representation of the health of the US private sector.

US Average weekly earnings: After putting up lackluster numbers for most of the year, average weekly earnings came in at $864.65 in July, the highest level of the year, and the second highest MoM increase of 0.49%, just behind January’s increase of 0.57%. Despite the latest increase, wage growth is still not where it should be at this point in the recovery considering how far unemployment and nonfarm payrolls have come. Estimize predicts an August reading of $866.72 representing a slight MoM growth rate of 0.24%.

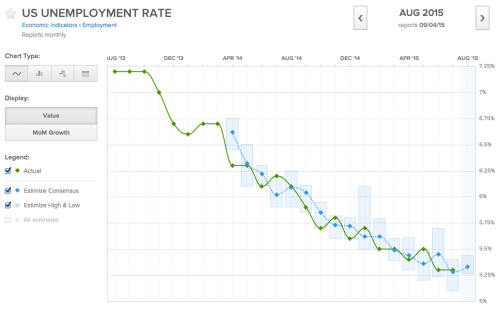

Unemployment rate: For June, Estimize predicts unemployment will remain unchanged at 5.3% for the third consecutive month. The unemployment rate has been on a gradual decline from its peak of 10% in October 2009, following the global financial crises.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.