5 Stocks To Watch This Week 8/10

(Photo Credit: Paul Lowry)

In this week’s 5 Stocks to Watch, we take a look at the names with the largest shifts in EPS consensus ahead of earnings reports.

Monday, August 10

![]()

Tuesday, August 11

![]()

Friday, August 14

Take Two Interactive (TTWO)

Information Technology, Software | Reports August 10, after the close

On August 4, the Estimize EPS consensus for TTWO stood at $0.22. It has now been revised upward to $0.32, a 45% jump in just a few days, and higher than Wall Street and corporate guidance of $0.30. Revenues of $353M have only fallen slightly from $356M on that date, in line with the Wall Street consensus.

What to watch for: Other game makers have been performing very well this season, with Electronic Arts and Activision Blizzard both beating on the bottom-line. TTWO has an incredibly strong pipeline for the rest of the year with planned releases of NBA 2K15, Civilization: Beyond Earth, Evolve and others. One concern is that new releases will not be able to match the popularity of the Grand Theft Auto franchise which is not set to release its next installment until 2017.

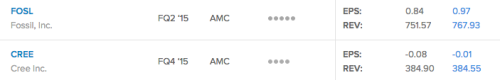

Fossil (FOSL)

Consumer Discretionary, Textiles, Apparel and Luxury Goods | Reports August 11, after the close

Since July 27, the Estimize EPS consensus for FOSL has fallen to $0.97 from $1.07, a 10% drop, but still above Wall Street’s $0.84 estimate. The Estimize consensus calls for EPS of $0.02 vs. Wall Street’s $-0.03, suggesting a YoY decline of 86%. Revenues of $781.7M have fallen to $767.9M, as compared to Wall Street’s estimate of $751.5M.

What to watch for: Michael Kors, one of Fossil’s main licensing partners, blew expectations out of the water when they reported results last week, mainly lead by strength in jewelry and watches. This bodes well for Fossil. As weakness in handbags for some of the luxury goods retailers wanes they are beginning to invest more in the jewelry space, with FOSL recently signing a licensing agreement with Kate Spade. The one drawback: the stronger dollar will still cut into the bottom-line this quarter.

Cree Inc. (CREE)

Information Technology, Semiconductors | Reports August 11, after the close

On July 13, the Estimize EPS consensus for CREE stood at $0.07, it has now been revised downward to -$0.01, a 114% decrease, yet still better than the Wall Street consensus of -$0.08. Revenues of $384.6M have increased slightly $384.1M on that date, just about in line with the Wall Street consensus.

What to watch for: Semiconductors were expected to hit rock bottom this quarter, due to the negative impact of currency headwinds and the freefall of the PC market. However, expectations were set too low, and many of the names in the industry such as Intel, Avago, and KLA-Tencor were able to pull through, boosting the industry EPS growth to 30% for the quarter. It looks like it’s possible this has happened with Cree, as expectations have dropped by 114% in the last month. On next week’s call investors will want to hear about the company’s recent acquisition of APEI, a leader in power modules. Cree hopes the acquisition will further establish their position as a leader in the SiC power electronics space and expand R&D capabilities.

Cyberark (CYBR)

Information Technology, Software | Reports August 11, after the close

Since July 17, the Estimize EPS consensus for CYBR has increased to $0.13 from $0.10, a 30% increase, and well above Wall Street’s $0.06 estimate. Revenues of $35.5M have increased from 33.1M on that date, above Wall Street’s $32.3M.

What to watch for: Overall the cybersecurity space has performed well this season, with peers such as QLYS, PANW, FTNT, FEYE, CKP all beating expectations. CYBR is the preeminent growth name in the industry especially among point solutions and still has room to grow, with financial services being the largest industry it serves. The company has been increasing IT spending and investments in R&D which could impact the bottom-line, also, the large amount of competitors in the field remain a concern.

J.C. Penney (JCP)

Consumer Discretionary, Multiline Retail | Reports August 14, before the open

On July 16 the Estimize EPS consensus for JCP stood at -$0.26, it has now been revised downward to -$0.44, a 40% decrease, yet still better than the Wall Street consensus of -$0.50. Revenues of $2.864B have actually increased from $2.828BM on that date, just about in-line with the Wall Street consensus.

What to watch for: The retailer everyone loves to hate reports Q2 results on Friday. Despite reporting negative EPS in the last 13 quarters, the retailer has shown improvements, beating the Estimize consensus by 16 cents last quarter. Investors will want to see that JCP can hit low-single digit comparable store sales guidance that management provided, and that sales growth remains above inventory growth after several years of the opposite being true. Another big concern are the deep discounts the department store is having to offer to push product, bringing into question their ability to improve margins.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.