5 Stocks To Watch This Week - 21 September, 2015

(Photo Credit: jshyun)

While the third quarter earnings season unofficially begins on October 8 when Alcoa reports, there are 37 companies from the Estimize universe releasing results for Q3 next week. These are the ones to watch.

Monday, September 21

Tuesday, September 22

![]()

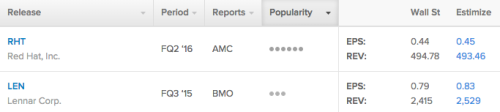

Red Hat (RHT)

Information Technology - Software | Reports September 21, after the close

The Estimize consensus calls for EPS of $0.45, a penny higher than both Wall Street and company guidance. In contrast, the Estimize community is expecting revenues of $493.5M, slightly lower than the Street’s prediction of $494.8M and guidance of $494.0M.

What to watch: Red Hat had been a market darling for most of this year, until just last month when it’s stock price fell to the lowest point this year at $68.96. Shares are now trading at $71.14, about flat for the year, and underperforming the NASDAQ which has returned approximately 8% year-to-date (YTD). However, Red Hat’s fundamentals have been strong, with EPS beating expectations in the last 4 quarters. The company has successfully built an attractive pipeline of products and in the process accumulated market share. Its key business units such as cloud computing and its open-source Linux operating software are expected to continue to impress investors. Furthermore, strategic partnerships with household names such as Dell, Intel and IBM have proved to be a win for the company. One note of caution, however, is the RHT’s high valuation. With forward P/E at 70X, any disappointment on the earnings or revenue figures will likely cause the stock to re-rate downwards.

Carnival Corp (CCL)

Consumer Discretionary - Hotels Restaurants & Leisure | Reports September 22, before the open

The Estimize consensus calls for EPS of $1.66, higher than the Wall Street consensus of $1.63 and corporate guidance of $1.58. The Estimize community is also expecting higher revenues of $4.797B as compared to the Street’s estimate for $4.786B, yet lower than guidance of $5.120B.

What to watch: The stock’s performance has been impressive lately as strong demand in cruise/travel and lower fuel costs boost profits and market expectations. Carnival’s stock has risen substantially this year with a capital return of 17% YTD relative to the S&P 500 which has fallen nearly 4%. Carnival is currently trading at a forward PE Ratio of 29X which is above its five year average of 20X. The company has a number of fundamental positives working in its favor at present. The ongoing global economic recovery is helping drive growth in cruise line and travel demand, depressed oil prices are helping to reduce Carnival’s expenses and yield per customer increases have all contributed to Carnival beating the Wall Street EPS consensus for the last eight consecutive quarters. Investors will want assurance that the recent uplift in margins can be maintained if oil prices gradually rise over time. Carnival’s CEO Arnold Donald previously made mention that the lower fuel costs were not the main contributor to increased earnings despite fuel costs representing 14.6% of sales in 2014.

Lennar Corp (LEN)

Consumer Discretionary - Household Durables | Reports September 21, before the open

The Estimize consensus calls for EPS of $0.83, higher than the Wall Street consensus of $0.79. The Estimize community is also expecting higher revenues of $2.53B as compared to the Street’s estimate for $2.42B.

What to watch: The homebuilder space is a story of the haves and the have-nots at this point. While the pace of home sales remained strong throughout the summer, the cost of property and labor has also increased. Lennar and its peer D.R. Horton have been two of the winners in the space, while PulteGroup and Toll Brothers have felt the pinch. Lennar has consistently put up double-digit top and bottom-line (with the exception of Q2 2014) growth since Q1 2012, congruent with the upswing in the housing market. Lennar’s diverse revenue mix, large land supply and consistent order growth is expected to drive revenue in the upcoming quarter. Higher job numbers, a reassuring economy, increasing consumer confidence, moderating home prices, affordable interest rates, rising rentals and a limited supply of inventory are leading to steady demand trends in the housing industry. Of course the oncoming headwind could be increased costs and pricing pressures for the homebuilder due to a tightening labor market and increased material costs.

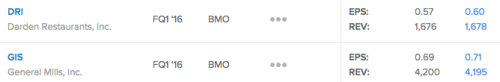

General Mills (GIS)

Consumer Staples - Food Products | Reports September 22, before the open

The Estimize consensus calls for EPS of $0.71, higher than the Wall Street consensus of $0.69. However, the Estimize community is expecting lower revenues of $4.185B as compared to the Street’s $4.20B.

What to watch: General Mills in currently in the middle of a global restructuring where management intends to lay off between 675-725 employees (of 40k) by May 2017 in order to cut costs and boost earnings. As an immediate result of the changes, General Mills is expected to take a hit to the value of approximately $62M caused mainly by the requirement to pay termination benefits. The benefits derived from the restructuring is expected to be between $45M-$50M in cost savings per annum. Similar to competitors such as ConAgra, GIS is facing challenges related to product mix. As consumers continue to move towards healthier products, demand for General Mills products including Cheerios and Betty Crocker cake mix is waning. Although, the company recently agreed to phase out artificial flavors and colors from all of its cereals by 2017. This adds General Mills to a continually growing contingent of food retailers that are scrapping artificial ingredients, including Kraft, Subway and Taco Bell, among others. Year-to-date General Mills has performed relatively well providing investors with a capital gain of 8.25%.

Darden Restaurant (DRI)

Consumer Discretionary - Hotels Restaurants & Leisure | Reports September 22, before the open

The Estimize consensus calls for EPS of $0.60, three cents higher than the Wall Street consensus. The Estimize community is anticipating slightly higher revenues of $1.678B as compared to the Street’s estimate for $1.676B.

What to watch: Trends in casual dining have remained strong this year as the middle-class, typically the target for casual dining spots, have seen higher disposable incomes due to lower gas prices, rising employment and lower inflation etc. As such, competition has been fierce. To take peers on head-to-head, Darden spun off its less popular Red Lobster unit last summer to focus more on its Olive Garden business. That seems to be paying off, Olive Garden saw overall sales increase 12% last quarter, with same store sales up 3.4%. However, there has been some concern around traffic which was down 2% in the spring, with the chain relying heavily on its regulars. Higher food costs led to an increase of menu prices by 2%. Other well known chains owned by Darden, such as LongHorn Steakhouse and The Capital Grille have also been doing incredibly well. Since the completion of the sale of Red Lobster, Darden Restaurants’ shares have soared over 55%.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.