5 Stocks To Watch After The Market Closes Today - Wednesday, Feb. 22

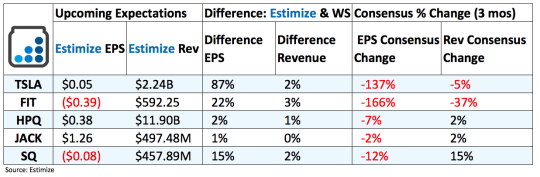

Tesla (TSLA): Tesla blew out expectations for the third quarter, with EPS coming in 67 cents higher than the Estimize consensus and $1.25 higher than what Wall Street was expecting after recording record deliveries and production. Third quarter gains consisted of 22,000 deliveries, down 10% sequentially, 12,700 of which were Model S vehicles and 9,500 Model X. This puts total deliveries for 2016 at 76,230, slightly below the goal of 80-90k. The company blamed the transition to new Autopilot hardware to the hold up in production from October through early December. One strong spot was demand, with Q4 net orders for the Model S and Model X at an all time high, and 52% higher than Q4 2015. Any insight on the release of the Model 3 and the integration of SolarCity could play a role in investors sentiment towards forward earnings.

Fitbit (FIT): Wearable technology came and went in a matter of a couple years, leaving Fitbit in a position of weakness moving forward. The stock declined nearly 60% in the past 12 months with a large portion of that drop originating from management cutting guidance for the fourth quarter. With weak holiday sales on deck for the quarter to be reported, investors hope the company will introduce a new line of products or provide additional insights on restructuring efforts for fiscal 2017. However with new competition emerging in the deteriorating wearable technology, don’t expect a turnaround to surface in the near term. Forward estimates at Estimize project Fitbit to incur a loss for the next 4 quarters on notably weaker top line performance.

Hewlett-Packard (HPQ): HPQ capped off its first full year on a sour note following the spin off of HP Enterprises. Net revenue dropped 6%, not including lost revenue from HPE, in fiscal 2016 to $48.2 billion owing to weak commercial and consumer printer sales. In the fourth quarter printer revenue declined 8% from a year earlier, broken down to a 10% drop in commercial units, 3% in consumer hardware and 12% from supplies. Surprisingly, personal system sales increased by 4% despite a perceived downturn in the PC market. To offset some of the recent losses, HPQ is pivotting to the highly profitable cyber security sector. The company’s newest product, HP Sure Click, offers advanced protection to address the heightened concerns of digital attacks.

Jack in the Box (JACK): For three consecutive quarters Jack in the Box posted better than expected top and bottom line performance with accelerating growth. In the most recent report the company posted a 2% increase in same store sales across all Jack in the Box stores, broken down to a 0.5% increase in company owned stores and 2.4% in franchise. Qdoba restaurants increased 0.8% largely a byproduct of Chipotle struggles over the past 15 months. Like other restaurants, Jack in the Box continues to make investments in technology driven investments, renovating stores and new menu offerings. Its new focus on catering and expanding the breakfast menu to help stir up traffic.

Square (SQ): Jack Dorsey can’t crack the proverbial puzzle of Twitter but he certainly make meaningful with Square thus far. Square is coming off consecutive earnings and revenue beats as it inches closer to profitability. The third quarter, in particular, delivered strong core payments on a 39% increase in gross payment volume. This comes along with continued traction in its chip readers and a catalogue of new software and services. Square is seeing similar success with Square Capital which surpassed $1 billion in total originations with more than 35,000 business loans spanning $208 million. Ongoing progress in the overall mobile payments space along with its financing service bodes well for the outlook of Square.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.

thanks for sharing