5 High Flying Stocks About To Crash

These five stocks have had impressive runs, but now is the time to sell your shares. A culmination of cheap debt and a commitment to keep share prices higher in the near-term has built a bubble in these five stocks. Beware, as any piece of bad news could send their stock prices cratering.

The bull market in stocks is well into its sixth year but are the cracks finally showing?

It isn’t all that obvious for most, where companies are throwing large amounts of cash to shareholders, helping prop up the market.

But buybacks and dividends can only buoy the market for so long, earnings growth is already slowing, as we saw last quarter. During the first quarter, S&P 500 companies paid $242 billion to shareholders, topping the previous record in 2007.

Yet, this all comes at the expense of longer-term growth initiatives. Specifically, many companies have been reducing capital expenditures and research and development spending over the last five years. So instead of investing for the future, companies are settling for higher stock prices in the interim.

In 2013, companies in the S&P 500 spent 36% of their operating cash flow on dividends and buyback, versus 18% in 2003. And over that same time period, capital expenditure spending was cut to just 29% of operating cash flow.

In an interview last week, famed investor Bill Gross said that both stocks and bonds are in a bubble, noting, “I sort of have a sense of an ending. I think that the 35-year bull market in bonds and in stocks is ending.”

But nobody really wants to hear that. It goes against their narrative, meaning the days ofeasy money are over.

Even the “sell in May and go away” mantra was debunked, with the S&P 500 up last month. However, it may have just been a head fake. Based on what we’re seeing, it looks like “sell in May” remains true, it’s just been pushed out a month this year.

As Warren Buffett has said, “You only find out who is swimming naked when the tide goes out.” When the market does start to reset, there are a handful of companies that have been built on false hope that will see a hard reset. Here are the five stocks to sell in June:

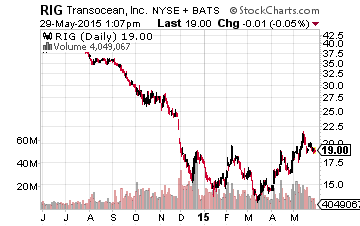

No. 1 Stock to Sell in June: Transocean (NYSE: RIG)

Already up 15% over the last month, Transocean has been helped by a brief rebound in oil prices. But there’s still plenty of room for concern for this offshore driller. For starters, Transocean has close to $4 billion in debt maturing over the next three years.

Paying that debt gets increasingly tough when you have a large number of contracts ending. Over half of its revenues will be at risk as Transocean’s contracts roll-off over the next 18 months.

With that, Transocean is still paying a 3.2% dividend yield. That should prove to be low hanging fruit as the company looks for ways to save money. It’s been cutting its dividend, but a full blown suspension is likely. Transocean could also be forced to cancel the construction of new drill ships, not expected to be delivered until 2017. But that would be a way to save money, albeit at the risk of hindering long-term growth.

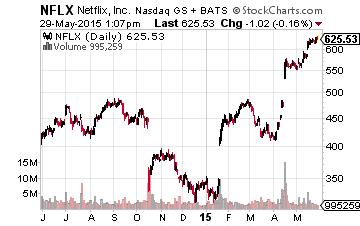

No. 2 Stock to Sell in June: Netflix (NASDAQ: NFLX)

This is a high flyer that could come crashing down pretty quickly. The stock has soared 80% year to date and now trades at over 6.5x sales. However, there will be pain in the interim. This comes as Netflix’s key growth opportunity lies in international markets, but this part of its business remains unprofitable. And will remain unprofitable for the foreseeable future. You also have the fact that creating and acquiring country-specific content and marketing isn’t cheap.

Investors are overlooking these international issues, for now, given the market euphoria. There’s also the rise of Hulu and Amazon Prime also forcing the price of content higher, squeezing margins further.

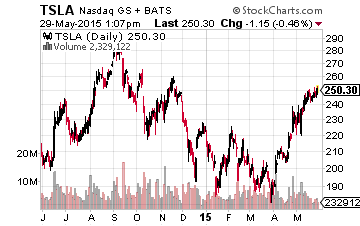

No. 3 Stock to Sell in June: Tesla Motors (NASDAQ: TSLA)

Yet another high flyer, Tesla shares are trading above 9x sales. We noted in February that it may well be the biggest mistake of the year. In part, given the uncertainty that comes with investing in the car company. The market has built up unreal expectations for the company, including the excitement over its entry into the energy storage business.

The key takeaway remains that General Motors (NYSE: GM) can sell more cars in a week than Tesla in an entire year. And yet, when you invest in Tesla, you’re paying $250 a share for just $28 a share in revenues. Whether electric vehicles will hit mass adoption is something we won’t know for many years. In the meantime, it still has to spend cash on assembly plants, without bearing any real fruit — faith-based investments like Tesla tend not to fare well in a market reset.

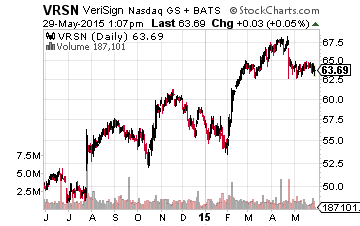

No. 4 Stock to Sell in June: Verisign (NASDAQ: VRSN)

Verisign has been pitched by many investors as a cash flow generating machine, which it is, but it has some key risks. It also trades at over 6x sales. The big risk for Verisign is that growth in domain names is slowing, especially in terms of .com and .net domains, which is Verisign’s bread and butter.

With apps and social networking, having the .com domain has become less important than ever. ICANN, the government overseer of domains, has also opened up other domains, decreasing the market share of .com domains.

Verisign has been raising debt and repatriating international cash to keep shareholders happy with buybacks. However, with the balance sheet now leveraged, it won’t be able to rely on buybacks any longer.

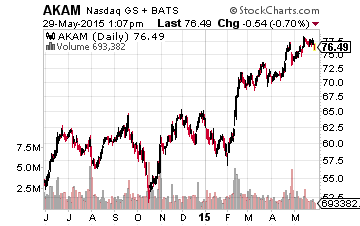

No. 5 Stock to Sell in June: Akamai Technologies (NASDAQ: AKAM)

Akamai has a strong presence in the fixed line Internet content delivery, but competition is what will put the squeeze on Akamai. For now, it manages the largest network of content delivery servers close to users, but Akamai doesn’t have any technical advantages in terms of delivering content. In investing terms, it has no moat.

Plus, trading at close to 7x sales, it’s already a bit rich. Investors have overlooked competition. Specifically, companies that are optimizing video and content to be delivered over wireless networks, where Akamai does not have a meaningful presence.

In the end, expensive stocks and those that are being forced to spend money on short-term fixes, whether it be buybacks or large amounts of debt, will be hit the hardest this year as the financial manipulation that has propped their stock prices up gets rooted out by a market downturn.

Disclosure: None.

They’re the kind that are an integral part of the reliable income strategy ...

more