5 Dividend Stocks To Buy In The Sector Bucking Market Volatility

While the stock market has been volatile over the first couple of weeks of 2015, the high quality real estate investment trusts – REITs – I follow in The Dividend Hunter, among others, have been marching steadily higher. The major REIT index recorded a 32% return for 2014 and the trend has continued into 2015. This sector could be the big winner going forward as other industries are still trying to get their acts together.

So far this year, REITs have provided a positive offset to other types of higher yielding stock investments that have been hit by fears from lower energy prices or higher interest rates. The challenge now is to invest in REITs that can continue to pay attractive returns to investors and will not be hit with their own market correction later this year. Looking deeper into the sector, there are a few sub-categories that stand out ahead of the crowd as great investments.

The universe of property owning REITs are subdivided into a half dozen or so categories based on the types of properties they own. Each commercial real estate sector carries its own risk, yield and growth characteristics. Real estate in 2015 may turn out to be significantly different than what investors have found comfort in over the last several years. While I always focus on current yield vs. projected dividend growth, currently my REIT analysis is also focused on specific real estate sectors where I think the growth prospects are best. Here are five REITs from the sectors offering great opportunities for profits in 2015.

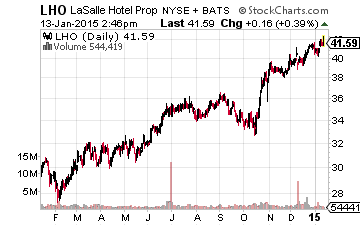

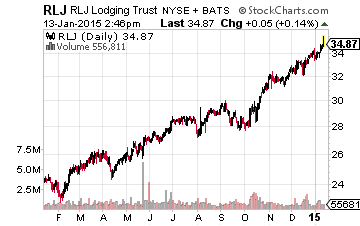

Lodging Sector: The hotel market may be the most cyclical of the different types of commercial real estate. An accelerating economy is good for hotels. Lack of new supply construction is good for hotel rates. Both positive factors are currently in play. The mid-cap lodging REITs are in a good position to grow revenues through acquisition, rehabilitation of older hotels, or a combination strategy.

LaSalle Hotel Properties (NYSE: LHO) has a market cap of $4.3 billion and a current yield of 3.6%. This REIT last increased its dividend in July 2014 and should do so again after the second quarter of this year. Last year the dividend was increased by 34%. The 2015 dividend increase should again be in the 30%+ territory.

RLJ Lodging Trust (NYSE: RLJ) has a market cap of $4.6 billion and yields 3.4%. RLJ also increased its dividend for the second quarter of 2014, adding 36% to the distributions paid to investors each quarter. I expect RLJ to mirror LHO and again increase its dividend in July, increasing the quarterly payout by 25% to 30%.

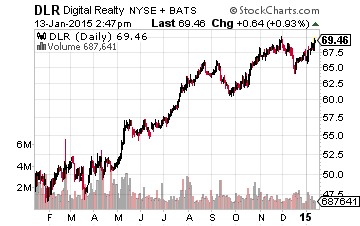

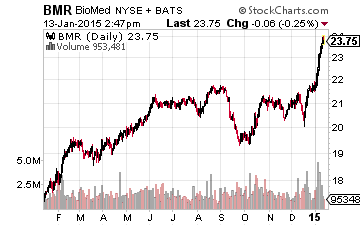

Industrial Sector: Economic growth will benefit industrial companies and the REITs that lease them facilities such as warehouses, data centers, and laboratories. These REITs let you ride the wave of U.S. industrial resurgence and collect a nice and growing dividend yield along the way.

Digital Realty Trust, Inc. (NYSE: DLR) has a market cap of $9.3 billion and yields 4.75%. DLR owns over 130 data centers located throughout North America, Europe, Asia, and Australia. The need for data storage by both tech companies and other businesses such as banks and manufacturers will grow significantly for the foreseeable future. DLR should increase its dividend in March. Last year the quarterly payment was increased by 6.4%.

Biomed Realty Trust Inc. (NYSE: BMR) has a market value of $4.7 billion and yields 4.4%. Biomed owns and leases laboratories and office space for companies involved in life sciences research. Clients include large and small public companies along with universities and research institutions. The BMR dividend has been growing by 4% per year and the company will pay a special dividend at the end of better than forecast annual results.

Single Family Rentals Sector: This is a new REIT sector that came out of the 2008-2010 real estate market crash. Since late 2012, several new REITs were formed to buy single family homes out of foreclosure and turn them into portfolios of rental properties. The challenge for these companies has been to rehabilitate the thousands of previously owned homes, get them rented and generate enough cash flow to pay a reasonable dividend to investors. The companies are just now crossing the cash flow thresholds necessary to pay meaningful dividends.

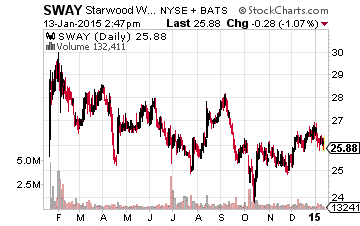

Starwood Waypoint Residential Trust (NYSE: SWAY) has been the quickest to reach dividend growth potential. This $982 million market cap REIT yields 2.15% and I expect the dividend to at least double by the end of this year.

Disclosure: I currently do not have positions in the stocks discussed here.

I've just released the latest update to my new more