5 Dividend Growth Stocks With Bond-Like Safety

In a small sub-sector of the dividend stock universe, there can be found some of the most consistent and reliable dividend growth stocks in the entire market. Backed by strong contracts with guaranteed price increases, these stocks can be safe investments that produce an accelerating dividend stream year after year.

The approximately 200 publicly traded real estate investment trusts (REITs) own a wide range of different types of commercial real estate. The REIT sectors run from multi-family apartments to hotels, shopping centers, industrial buildings, and Class A office buildings. Each commercial property sector has its own set of risks and market cycles. Investors who crave a high level of long-term stability, along with attractive yields compared to other income investments, can fill that urge with what are called triple-net lease REITs.

Under a triple-net commercial property lease, the tenant must pay property taxes, building insurance, and maintenance/repairs in addition to rent. With this type of lease, the tenant assumes the risks of most of the variable costs of the property and the owner collects rent checks with little or no associated expenses to pay. The triple net REITs use this type of lease to generate income from free-standing properties, such as convenience stores, retail stores, and restaurants.

Commonly, leases are for 10 years or more, locking in long-term payment streams. Because of the long-term leases and the lack of regular property ownership expenses, the net lease side of commercial real estate is commonly compared to owning bonds, which are also typically longer term and pay regular interest payments.

Similar to evaluating bonds, the safety factor of a triple-net lease REIT can be analyzed by looking at the credit quality of the companies leasing the real estate properties owned by the REIT. Additional safety/risk criteria include the number of properties owned and the diversity of clients. One area where these REITs have a definite advantage over bonds is the rising rent payments built into the lease agreements. Most long-term, triple-net lease contracts have built in annual rent escalators, generating a growing cash flow stream for the REIT. There are less than 10 REITs in the triple-net subsector, and I have selected a few to cover today and go over their investment potential.

The A Team: Two net lease REITs that stand apart for longevity and steadily growing dividends.

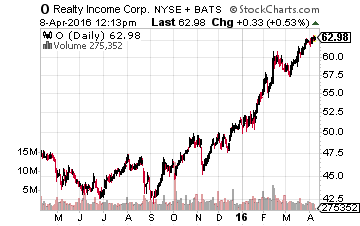

Realty Income Corp (NYSE: O) calls itself “The Monthly Dividend Company” and it has delivered on that tag line. The company has paid almost 550 consecutive monthly dividends. That’s over 45 years of payments. The dividend has been increased for 75 straight quarters or over six straight years. Currently, Realty Income owns 4,500 properties on net long-term leases and continues to buy more.

The properties are leased to 240 different tenants including companies like Walgreens, Fed Ex, and Dollar General. These are Realty Income’s top three tenant companies. The O shares have been hot, climbing 30% in just the last six months. Investors getting in now should be ready to buy more and average down if the share price drops. The stock yields 3.8%.

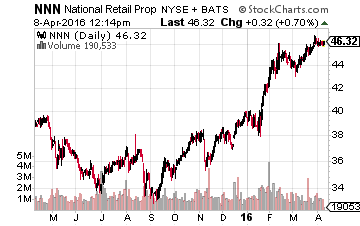

National Retail Properties, Inc. (NYSE: NNN) has increased its quarterly dividend for 26 straight years. The company owns 2,200 properties with over 400 different tenant companies. The average remaining term on leases is over 11 years. This means the dividend is tremendously safe and will continue to grow. NNN shares are up 24% in the last six month and the stock also yields 3.8%.

The B Team:

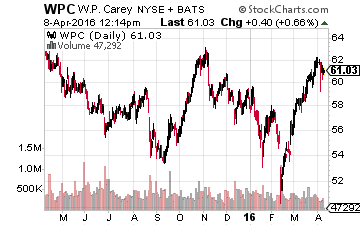

W.P. Carey Inc. REIT (NYSE: WPC) is a net-lease REIT with a very strong long-term track record that is currently going through a transition process. The company owns 870 properties with 222 tenants and an average 9 years of lease term remaining. A couple of factors make WPC different from its peers. About 35% of WPC’s properties are in Europe, providing diversification out of the U.S. The company also acts as the investment and property manager for several non-public REITs, and the fees from these businesses account for 20% of annual revenues.

Over the last several months W.P. Carey has gone through a surprise CEO change and has discussed a spin-off of the private REIT management business. The dividend growth rate over the last five quarters has slowed to a snail’s pace compared to the previous three-year period. I would like to see the company get some management stability and bring the cash flow and dividend growth back above 5% per year. The stock currently yields 6.4%.

The New/Turnaround Plays

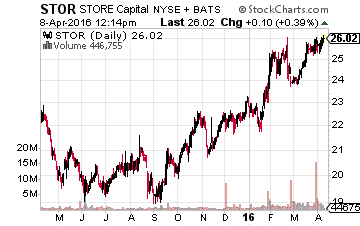

Store Capital Corp (NYSE: STOR) came into the market with a November 2014 IPO. Although it is new as a public stock, the company owns 1,325 properties with 300 tenant customers and has a $3.6 billion market cap. This is a solidly mid-sized REIT. The company’s top three clients are Gander Mountain, American Multi-Cinema, and Applebee’s. The majority of STOR’s clients do not have official credit ratings, so the company focuses on the rent-paying ability of each individual property. This is a new REIT, but so far it has taken the right steps to become one of those long-term, growing the dividend every year, triple net lease REITs. STOR yields 4.2%.

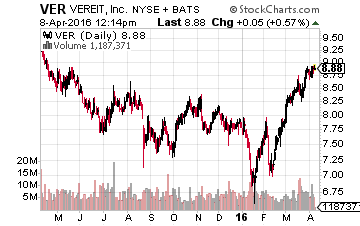

Vereit Inc. (NYSE: VER) is the net-lease REIT that has risen from the ashes of the late 2014 accounting scandal at American Realty Capital Properties (ARCP). ARCP went public in 2011 and started acquiring properties at a breakneck pace with the goal of quickly becoming the largest net-lease REIT. But, in late 2014 it was revealed that the CEO was falsifying the books, and the company was not close to profitable or able to cover its dividend payments.

A new CEO and management team was brought in to straighten out the mess. The dividend was suspended for about a year-and-a-half and the name was changed. Dividend payments resumed in September 2015. The company still has a high level of debt compared to its peers but the current dividend rate has better coverage than the other net lease REITs. You definitely need to do your homework about this company and decide if the risk profile fits your investment criteria before buying shares. VER yields 6.2%.

Disclosure: There are currently over twenty of these stocks to choose from in my more