5 Best Performing Nasdaq Stocks Of 2015

In the countdown to 2016, U.S. stocks look to end a lackluster year on a disappointing note. Several factors added to the woes, including sluggish global economic growth, currency devaluation in China, low commodity prices and continued strength in the dollar. While the plunge in oil prices decimated energy companies and adversely affected junk bonds, the surge in the dollar had a negative impact on U.S. multinationals’ overseas sales figures.

The U.S. dollar surprisingly gained more than 10% this year, on top of a 12% gain last year, even though the Fed raised interest rates for the first time in a decade.

In the case of interest rates, investors initially liked the idea of ultra-low interest rates as they aided economic recovery, lending a bull run to the markets. However, repeated procrastinations led investors to believe that the Fed lacked confidence in U.S. economic growth, leading to a decline in stocks.

Investors had expected a rate hike as early as the first quarter of 2015, but it did not come until the December meeting. Meanwhile, the market experienced a 12% correction during the August-September period when China devalued its currency, which eventually dented investor sentiment. Additionally, geo-political concerns in regions like Yemen, Ukraine and Syria added to the bearish sentiment.

The Dow Jones Industrial Average’s (DJI) year-to-date return has fallen 1.5%, and the S&P 500 (INX) is more or less on track to end flat. However, the Nasdaq has a spring in its step, with the tech-laden index having gained 6.6% so far in 2015. In the past several years, the Nasdaq has outperformed other major indexes, but this time results have been even more convincing.

Strong gains from a few supernova stocks, including Amazon.com, Inc. (AMZN - Analyst Report), Netflix, Inc. (NFLX - Analyst Report) and Alphabet Inc. GOOGL boosted the Nasdaq. While shares of Netflix are up 140% this year, Amazon’s shares have more than doubled. Moreover, limited exposure to the beleaguered energy sector has helped the index to settle in positive territory.

Going forward, as long as oil prices remain near multi-year lows, the Nasdaq may outperform other broad-based indexes. The end of the year Santa rally is also expected to lift the index further. Since 1971, the Nasdaq witnessed a gain of more than 80% during the last five trading days of the year, for an average yearly gain of about 1.3%.

However, the Nasdaq was not immune to its share of setbacks this year. The big decline in biotech stocks dragged the index almost 13% in August from its late July high. In September, Hillary Clinton’s plan to prevent “price gouging” for specialty drugs also limited biotech’s advances. Nevertheless, the fundamental strength of the biotech sector won out in the end, eventually having a positive impact on the Nasdaq. In fact, the index remained above the key psychological level of 5,000 this year.

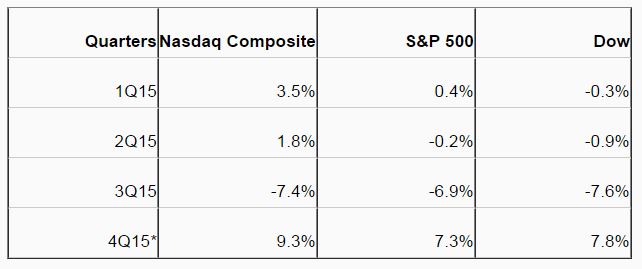

Quarterly Performance

The Nasdaq had extended its winning streak to 10 quarters during the second quarter of this year, its longest stretch of quarterly gains ever. However, the index lost steam during the third quarter, only to strongly bounce back in the fourth. The index has yielded better results than the S&P 500 and the Dow in three out of four quarters as evident from the following figures:

Returns as of Dec 24, 2015

First Quarter: The World Bank reduced its global economic growth outlook for 2015 and 2016, while a slump in oil prices and political uncertainty in Greece had a negative impact on the broader markets in January. The Nasdaq dropped 2.1%. However, an agreement on Greece’s bailout program boosted investor sentiment in February, and the Nasdaq gained a whopping 7.1%. In March, the crisis in the Middle East and a stronger dollar affecting Q1 earnings results dragged benchmarks down, with the Nasdaq losing 1.3%.

Second Quarter: The Nasdaq gained 0.8% in April. A slew of positive earnings results including Apple Inc. (AAPL - Analyst Report) helped the index end in the green. New deals between Mylan N.V. (MYL - Analyst Report) and Teva Pharmaceutical Industries Limited (TEVA - Analyst Report), and Mylan N.V. and Perrigo Company Public Limited Company (PRGO - Analyst Report) also boosted the index. In May, the index gained 2.6% mostly due to broad-based gains in biotech stocks. However, uncertainty over Greece’s bailout program weighed on the broader markets in June, dragging the index down 1.6%.

Third Quarter: Eased fears regarding the Greek debt negotiations, the Fed’s optimism about the economy and some encouraging earnings results from Intel Corporation (INTC - Analyst Report) and Amazon boosted the Nasdaq in July. The index gained 2.9%. However, in August the index plunged 6.9% as earnings of major media companies including Viacom, Inc. VIAB declined due to a steep fall in TV-subscribers.

Moreover, the weak Chinese economy and yuan’s devaluation weighed on the broader markets. The index continued to decline in September after Hillary Clinton’s comments to prevent “price gouging” for specialty drugs had a massive negative impact on biotech stocks. The index slumped 3.4%.

Fourth Quarter: The Nasdaq came back strongly with a 9.2% gain in October lifted by better-than-expected earnings results from Apple. A jump in healthcare stocks also helped the index to end in positive territory for the month. The index extended its gain in November, adding 1.1%. During November, merger and acquisition news between Dyax Corp. DYAX and Shire plc SHPG had a positive impact on the index. However, the index slipped into the red in December as a plunge in crude prices continued to affect the broader markets.

Tech Enjoys Broad-Based Gains

The technology sector enjoyed broad-based gains in 2015 that helped the Nasdaq move north. Year-to-date, the Technology SPDR gained 4.6%, the third highest among the S&P 500 sectors. Shares of Alphabet Inc, Amazon and Microsoft (MSFT - Analyst Report) have been making giant strides, gaining 44.3%, 113.6% and 19.9%, respectively, on a year-to-date basis, thereby giving a boost to the overall tech sector.

Alphabet’s search market share is a big positive, which, along with its focus on innovation, strategic acquisitions and Android OS should continue to generate strong cash flows. Amazon’s platform strategy and AWS will spur future growth, while Microsoft being the leader in the cloud computing market will continue to perform well in the near future.

Meanwhile, shares of Apple are down 2% for 2015. However, the company has cash reserves of historic proportions that went past the $200 billion mark last summer, which made it the first company to cross that threshold. Additionally, the success of iPhone 6 and iPhone 6S boosted the company’s third quarter earnings results.

Among Internet stocks, shares of Facebook, Inc. FB are up 33% for the year. The social media giant benefited from some smart acquisitions including photo-sharing service Instagram, which attracts 400 million monthly users. The company is also poised to get a revenue boost once Oculus launches the Rift early next year. Separately, semiconductor stocks got a boost from the Tax Credit extension.

Biotechs Bounce Back

Biotech stocks were hit hard in September following a tweet by Hillary Clinton about the pricing of drugs. Clinton said that she will lay out a plan to restrict “price gouging” in the specialty drugs market. Her announcement came in after she came across an article in The New York Times about a drug whose price was raised from $13.50 a tablet to $750. Concerns about accounting practices had also led to a sharp decline in biotech companies.

However, encouraging third quarter earnings results by Gilead Sciences Inc. (GILD - Analyst Report), Alexion Pharmaceuticals (ALXN - Analyst Report) and Amgen (AMGN - Analyst Report) helped the biotech sector to stage a rebound. Several biotech majors including Biogen (BIIB - Analyst Report), Amgen and Alexion also upped their guidance for 2015. Moreover, product approvals and encouraging pipeline updates are expected to boost the sector. Overall, the NASDAQ Biotechnology index delivered a year-to-date return of 12%. The rally in biotech stocks also helped the Nasdaq.

Zeroing in on Top 5 Nasdaq Performers

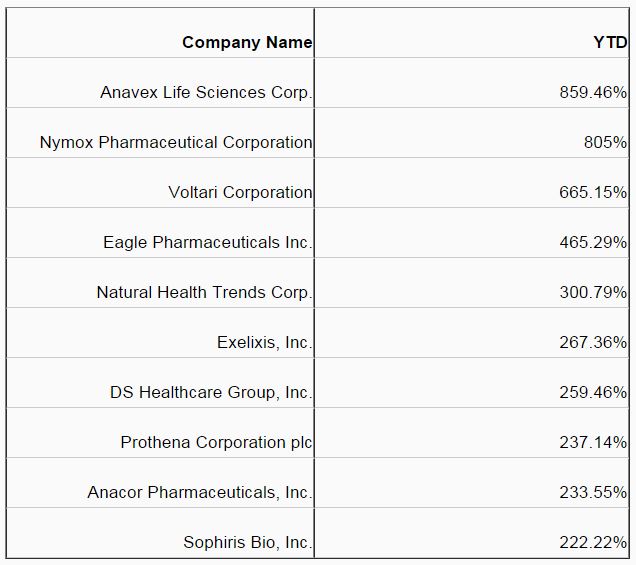

The chart below lists the top 10 Nasdaq performers on a year-to-date basis:

In addition to this list we’ve also selected five top Nasdaq performers based on an impressive Zacks Rank, positive current year estimated growth rate and year-to-date returns. The favorable Zacks Rank should help these stocks to continue gaining in 2016 as well.

Eagle Pharmaceuticals Inc. EGRX focuses on developing and commercializing injectable products primarily in the critical care and oncology areas. EGRX has returned 465.29% year to date. Current year estimated EPS growth rate is above 100% and it carries a Zacks Rank #2 (Buy).

Recro Pharma, Inc. REPH is a clinical stage specialty pharmaceutical company. REPH has returned 218.53% year to date. Current year estimated EPS growth rate is 58.20% and it carries a Zacks Rank #2 (Buy).

Energy Focus, Inc. EFOI designs, develops, manufactures and markets fiber optic lighting systems. EFOI has returned 198.17% year to date. Current year estimated EPS growth rate is above 100% and it carries a Zacks Rank #2 (Buy).

Hanwha Q CELLS Co., Ltd. HQCL is engaged in providing energy solutions. HQCL has returned 154.27% year to date. Current year estimated EPS growth rate is above 100% and it carries a Zacks Rank #2 (Buy).

LightPath Technologies, Inc. LPTH manufactures proprietary collimator assemblies. LPTH has returned 138.54% year to date. Current year estimated EPS growth rate is above 100% and it carries a Zacks Rank #1 (Strong Buy).

more