4 Post-Sell-Off Bargain Stocks In Biotech

Investors are getting whipsawed as the market cannot overcome increasing concerns around China, slowing global growth, the continuing collapse of both energy and commodity prices as well as a corresponding decline in currencies and economies of commodity based countries like Brazil, Malaysia, Australia, Russia and Canada among others. The slide continued Monday as Shanghai had its largest one-day drop since 2007 in trading to begin the week.

Equities posted their biggest declines in a week since September 2011 as the S&P 500 fell back almost six percent in five trading sessions. The Volatility Index doubled for its biggest one week advance on record. High beta sectors have been particularly vulnerable during this sell-off. The Russell 2000 small cap benchmark is off some 11% off their recent highs.

The biotech sector after a miraculous run that saw the main indices shoot up more than 50% in a year until this recent pullback have given up 15% from their recent peak. On a brighter note, myriad promising and attractive small cap biotech stocks are selling for substantial less than they were a few weeks ago. I continue to put more of my “dry powder” into the less volatile large cap growth plays in the sector and added a few shares of Amgen (NASDAQ: AMGN) and Gilead Sciences (NASDAQ: GILD) late last week.

In the small cap part of this space I am sticking with concerns that have upcoming catalysts on the foreseeable horizon that could boost their share prices if positive. Here are several possible new positions I am currently considering.

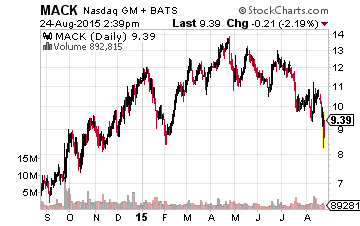

Let’s start with Merrimack Pharmaceuticals (NASDAQ: MACK) which is down some 20% from its highs in July despite easily beating both top and bottom line expectations when it reported quarterly results on August 10th.

The company should know whether its lead oncology candidate MM-398 is approved by the FDA for the treatment of pancreatic cancer after the compound produced positive phase III trial results sometime in late October. Phase I results for MM-398 for the indications of glioblastoma and pediatric sarcoma should be out by the end of the year as well. Over the past few weeks, Oppenheimer, Cantor Fitzgerald, and Brean Capital have reiterated or initiated Buy ratings on Merrimack with price targets ranging from $13.00 to $16.00 a share. After its recent sell-off, the stock goes for just less than $10.00 a share.

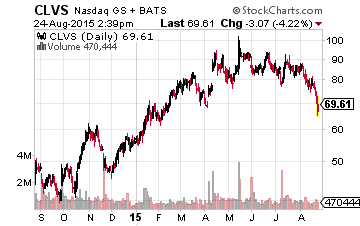

Next up is Clovis Oncology (NASDAQ: CLVS) which is down some $20.00 a share from its recent highs two months and now goes for just over $70.00 a share. The company should be providing an update on its main drug candidate “rociletinib” at the World Lung conference from September 6th through the 9th, rociletinib could gain FDA approval and launch commercially over the next few months. In addition Phase II trial results for its compound “lucitanib” for breast cancer should be out by the end of 2015. Both Mizuho and JP Morgan have reiterated their Buy ratings on Clovis this month. Both banks have $103.00 a share price targets on this cancer concern.

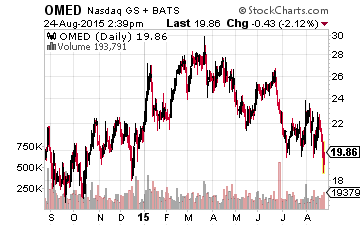

Let’s move on OncoMed Pharmaceuticals (NASDAQ: OMED) which is down approximately 20% from highs two months ago. The company is a clinical-stage biotechnology company dedicated to improving cancer treatment by creating novel medicines that address the fundamental biologic pathways critical to tumor initiation, growth, metastases, and recurrence.

OncoMed is advancing six first-in-class anti-cancer stem cell product candidates in early stage trials and a variety of others in its pre-clinical pipeline. It has collaboration deals in place with Celgene (NASDAQ: CELG), GlaxoSmithKline (NYSE: GSK) and Bayer. The company has several upcoming catalysts before the end of the year. OncoMed Pharmaceuticals has three Phase I trial results coming out in the next few months. The company has some $200 million in cash on its balance sheet, about one-third of its market capitalization. Piper Jaffray and BMO Capital both have $43.00 a share price target on OncoMed that currently goes for just over $20.00 a share.

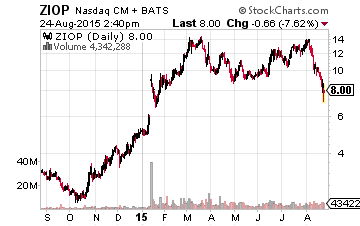

ZIOPHARM Oncology (NASDAQ: ZIOP) is a small immunotherapy concern I have written about since late last year when it was trading at under $3.00 a share. The stock touched $14.00 a share to start this month, but the sell-off in the market and biotech has brought ZIOP back to around $8.50 a share. The company has a couple of partnerships with larger industry players and its main drug candidate “IL-12” is in one mid-stage study for breast cancer and is in two phase 1 studies — one focused on B-cell malignancies, and the other patients with glioblastoma, an aggressive form of brain cancer.

ZIOPHARM has been the frequent target of buyout rumors this summer. The company will present data on IL-12 at the International Immunotherapy Conference in September and follow that up by presenting Phase I data on IL-12 in glioma at another conference in November. Either event could be a positive catalyst for the stock.

I don’t believe analysts have a good feel on how deep this correction may turn out to be. However, investors should start to use these lower entry points to accumulate some positions in these types of small promising but speculative concerns incrementally.

Disclosure: Long CELG, ZIOP, AMGN, GILD.

Interesting... thanks.