3 Smart Beta Sector ETFs Winning The Index War

Smart beta ETFs often been labeled with a mixed reputation for their inventive style of index construction. Generally speaking, an enhanced index that screen stocks by fundamental qualities rather than market capitalization carries a higher fee and alternative industry weightings. It may also give greater consideration to smaller companies with a penchant for higher volatility and risk.

Most investors find themselves benchmarking their performance versus a market cap weighted standard such as the SPDR S&P 500 ETF (SPY) and its underlying sector components. This has been the gold standard for decades.

Nevertheless, common sense would dictate that there are certain market environments where each index methodology will thrive separately. The following ETFs offer a unique glimpse into individual sectors where smart beta has produced significant alpha (performance above the benchmark) versus a traditional market cap equivalent.

Consumer Staples

Consumer staples companies have always been a defensive area of the market, yet investors have been consistently rewarded in these stocks for their non-cyclical business models. One smart beta ETF that captures that has excelled in this arena is the First Trust Consumer Staples AlphaDEX Fund (FXG).

This ETF is based on the StrataQuant® Consumer Staples Index, which ranks stocks according to recent price performance, sales growth, book value, cash flow, and return on assets. The stocks with the highest scores are selected for inclusion in the index, which is rebalanced on a quarterly basis. The end result is a portfolio of 40 stocks that is markedly different that the sector benchmark Consumer Staples Select Sector SPDR (XLP).

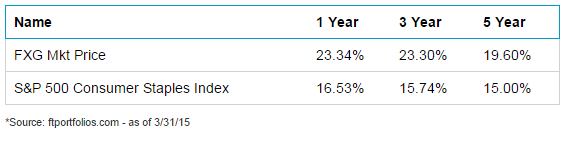

The unique screening methodology in FXG has focused the portfolio heavily on food products and retail companies rather than household goods. As you can see in the table below, this has resulted in significant performance gains over 1, 3, and 5-year time frames.

FXG does charge a much higher expense ratio of 0.67% versus 0.15% for XLP. However, investors in this fund have been rewarded with markedly higher returns for that additional expense.

Continue reading this article here.

FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this post. ...

more