3 Reasons Why We’re Near A Top

There are a few major alarm bells ringing which signal a top in this bull cycle could occur in the next few months. I will review those ominous signals in this article. Then I will review the latest news in the battle to get healthcare reform passed Congress. The one obvious positive the GOP has in its corner is that it’s still early in the term. The initial proposal by Paul Ryan was brushed aside by conservatives, but because President Trump said the plan was up for negotiation, there is a possibility something will get done. The establishment needs to make the conservatives feel like they had their say in the plan before they’ll support it.

I consider it bullish for stocks if healthcare passes Congress by the end of the year. It will be interesting to see how small business and consumer confidence surveys show the reaction to the lack of tax reform and an infrastructure plan in the first 8 months of Trump’s term. Will they lose hope or will they maintain optimism? It shouldn’t be a surprise that these plans will take many months to become law, but if the economy is weak, consumers and businesses will lose patience. It’s possible that a recession can be over by the time reforms are passed.

Reason 1

The first ominous sign the market is showing is real NYSE margin debt growth is near the peak of the cycle which is higher than the last two cycle peaks. I drew an increasing trend-line from the past two peaks in the chart below. The level of margin debt exceeded the trend line in April 2015 and is about to pass it once again. Margin debt trading becoming overleveraged was the cause of the 1929 crash.

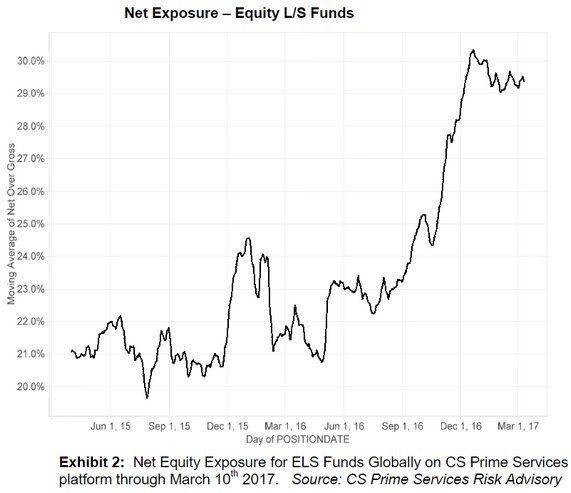

Unsurprisingly, the levered exposure is mainly on the long side. It’s not a realistic trading strategy to be net short stocks in this market. The only time you can successfully short is by picking individual overvalued names. As you can see from the chart below, the net long exposure among long/short funds has moved toward the long side since Election Day.

Reason 2

It’s not just long/short funds who are buying stocks. Households are extremely invested in stocks. When households have a large position in stocks, it’s, on average, a bad time to invest. The chart below shows U.S. household stock allocation and subsequent returns of the S&P 500. When stock allocation is in the top quintile, stocks only return 3.66% per year. The allocation as of 12-31-2016 is 53.51%. The average allocation in the top quintile is 54.90%. I can say with 99% certainty that the household allocation to stocks has increased this year judging by investor sentiment. It is clearly a bad time to buy stocks for the long-term based off this information.

Reason 3

I have been discussing the relationship between buybacks and the total value of bonds being offered recently. I mistakenly said I was wrong for saying declining bond issuance caused less buybacks to occur in my last article. This initial proclamation was correct. The reason for my confusion was the timing of the access to the information. We already have the value of bonds being issued in the first two months of 2017, but we still don’t know the total buybacks for 4Q 2016.

Putting my confusion aside, the total buybacks declined in Q2 and Q3 from the peak in Q1 2016. I expect the total buybacks in Q4 will also be lower because of the decline in bond issuance. In 4Q 2016, firms issued only $59.5 billion on a SAAR which was down from $224.6 billion in 3Q, $327.9 billion in 2Q, and $570.5 billion in 1Q. I wouldn’t say it’s bad news that buybacks dropped in Q4, since it’s already over. It would only be bearish if the future total buybacks were about to fall. Looking at the recent value of bonds issued will tell us how Q1’s total buybacks will look.

Remember, Q1 2016 was the peak. The bond issuance in January and February increased from $252 billion last year to $296.9 billion this year. This means buybacks are probably ramping higher right now. The problem is that this growth in bond issuances is unsustainable. It annualizes to 18% growth which is higher than the recent trend of low single digit growth. This could be the last hurrah for debt issuance.

Healthcare

Changes are being made to the initial Ryancare plan to get as many GOP backers as possible. Getting centrists and conservatives on board is difficult because they have opposing needs. There have been three tweaks to the bill.

The first tweak is block granting Medicaid money to the states instead of having a cap system. This lets states run their healthcare system instead of the federal government. The second change is giving states the ability to impose work requirements for Medicaid users. Both these changes help win the support of conservatives. The conservative Republican Study Committee now endorses the plan, but the Freedom Caucus is still against it. This is a step in the right direction for the plan, but, in its current state, it cannot pass Congress. There is still a chance for it to pass, but it will take a few more months, at least.

The next tweak is extending the tax credits to low-income people to help them pay for healthcare. In the original plan, low income people’s spending on healthcare increases. The higher tax credits will be for older Americans. The problem with this tweak to get centrists on board is it offends conservatives since it increases government spending.

One way to get conservatives on board could be to impose a work requirement mandate instead of having it as an option. The bright side to the odds of a compromise is that the issue is very complex which means there can be many puts and takes on each side to get this done. We’re not at a point where one issue is going to make or break support. It wouldn’t be surprising for that to arise in the future, but there’s still hope it won’t.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more