3 Leading Indicators Warn Of Economic Slowdown For The U.S.

Leading Indicators Foretell Slowdown in U.S. Economy

Indicators are popping up left, right, and center, saying that an economic slowdown could be ahead for the U.S. economy. At the very least, ignoring these indicators could be a big mistake.

Mind you, it’s the leading indicators that are ringing bells of a potential economic slowdown.

What are these indicators? The three most important ones are disposable income, the personal saving rate, and average spending habits.

Disposable Income Tumbles

It should come as no surprise that American consumers greatly affect the economy. If the average American cuts back on buying goods and services, the U.S. economy will witness an economic slowdown.

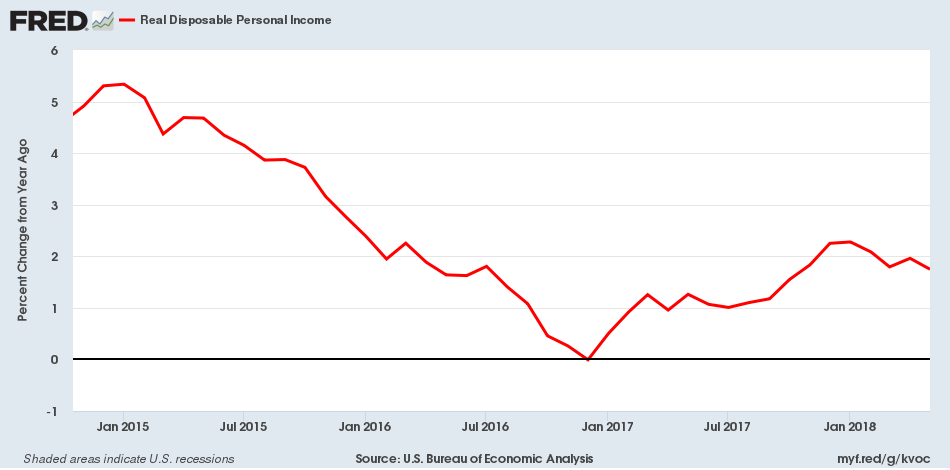

The below chart shows changes in the real disposable income of Americans.

(Click on image to enlarge)

(Source: “Real Disposable Personal Income,” Federal Reserve Bank of St. Louis, last accessed July 16, 2018).

While real disposable income has recently been increasing by two percent, the growth rate has tumbled a lot over the past few years. This is a far cry from early 2015 when disposable income was growing at five percent.

If disposable income drops, it directly impacts consumption, and ultimately, the overall economy.

Saving Rate Dropping 50%

The following chart plots the saving rate of Americans. Lately, they have not been saving much—just three percent of their income.

(Click on image to enlarge)

(Source: “Personal Saving Rate,” Federal Reserve Bank of St. Louis, last accessed July 16, 2018).

Why do savings matter? If people have a lot of savings, they’ll be more inclined to eventually buy houses, cars, or other major items. That contributes to consumption and, therefore, economic growth.

If savings are tumbling, it’s nothing but bad news for the U.S. economy. In early 2015, Americans were able to save six percent of their income. Now, that figure is around three percent—a drop of around 50%.

Auto Inventories Suggest That Recession’s Already Here

The below chart displays auto inventories in the United States. Note the gray area, which represents previous U.S. economic recessions.

As you can see, auto inventories in the U.S. have been dropping in recent times. In June 2017, there were 1.2 million vehicles in inventory; in May 2018, there were only 0.9 million. This is a decline of close to 27% in a little less than a year.

(Click on image to enlarge)

(Source: “Domestic Auto Inventories,” Federal Reserve Bank of St. Louis, last accessed July 16, 2018).

Why do auto inventories matter? They tell us about the buying habits of Americans, as well as about business confidence. If auto inventories are declining, it warns businesses to not expect much demand and, therefore, to not build up their inventories further.

There’s something else you can see on the chart above: whenever auto inventories have witnessed a violent swing to the downside, the U.S. economy has already been in a recession. And that’s exactly what’s happening these days.

U.S. Economic Outlook: Trouble Could Be Ahead

If you are looking to the mainstream media to tell you where the U.S. economy is headed next, you could be misguided. They may not be telling you that the leading indicators are loud and clear: an economic slowdown could be looming.

However, if you think that the U.S. economy will fall off a cliff all of a sudden, know that this won’t be the case. It is going to take a lot of time for everything to develop.

I have said it before and I will say it again: late 2018 and early 2019 may not be very good for the U.S. economy. Around that time, we could see bad economic data show up across the board.

If you are an investor who bought into the idea that the stock market will continue to provide robust gains, it may be time to pause and rethink.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more