$21 Trillion And Counting: Fed Misdirection And Powell's Powder Puff Presser (Part 4)

<< Read Part 1: $21 Trillion And Counting: Why This Time The Fiscal Wolf Is Really At The Door

<< Read Part 2: $21 Trillion And Counting: Why Deficits Didn't Matter During The Age Of Monetization, 1987-2017

<< Read Part 3: $21 Trillion And Counting: Forget The Dot Plots - It's QT, Stupid!

So they made it official yesterday: It's three hikes in 2018. But as we said in Part 3, if you care one whit about the plot of the dots you do indeed have your eye on the wrong ball.

Nevertheless, to repeat: The Fed's massive balance sheet expansion under QE destroyed the historical federal funds market long ago. Under present circumstances, "rate" increases are simply an exercise in pleasuring US banks with another IOER windfall on their $2.1 trillion of excess reserves.

To be precise, it amounts to $5 billion per raise (25 bps), meaning that after yesterday's action to lift the IOER rate to 1.75% the banks will be harvesting money from the Fed at a $37.6 billion annual rate; and when the third increase of 2018 occurs later in the year, the run rate will by $47.2 billion.

Indeed, should the FOMC finally get the rate in its monetary potemkin village to its ultimate target of 3.40%, it would need to pay the banks, in theory, $70 billion per year to do so (actually it will be less once the Fed shrinks its balance sheet and drains off excess reserves as per below).

We won't bother to say that back in the day banks generally hated Fed rate increases because it meant a "tightening" cycle was underway. That, in turn, would often squeeze their NIMs (net interest margins), and would eventually cause a fall off in loan demand and a shrinkage of their portfolios of earning assets.

To be sure, some coped better than others via superior credit and funding management techniques, but an interest raising cycle did require every bank to work hard to avoid being squeezed on its margins, volume of business, or both.

No more!

In the world of IOER, the banks need to do nothing but stand around and suck their collective thumbs. And, of course, collect another $5 billion for their troubles each time the Fed raises!

So call it what you will. But it's not normalization, and the fraud of IOER increases has precious little to do with the real tightening crunch and yield shock just around the corner.

In the meanwhile, it's just possible that one of the euthanized members of the Fed's oversight committees on Capitol Hill might be finally provoked to ask out loud: Is Uncle Sam really borrowing money to pay the Fed interest on its public debt holdings so that these burdens on future taxpayers can be gifted to Jamie Diamond et. al. today?

Really?

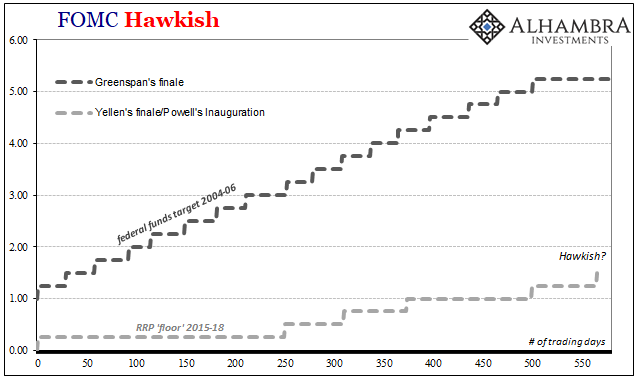

That these ritualistic IOER increases are functioning as a great misdirection---whether intentional or not ( we think it is the latter)----is underscored by the two charts below.

The first shows the difference between a real tightening cycle and the current sham rate increases. Thus, during the last interest rate raising cycle between June 2004 and June 2006, Greenspan raised rates 17 consecutive times; and it did mean something.

That's because massive QE had not yet been invented and the nation's bank balance sheets were not yet bloated by $2 trillion + of excess reserves. In fact, during the entire raising-cycle excess reserves fluctuated between $1-$2 billion. To be clear---- that was billions, not trillions.

Accordingly, banks did need to borrow from each other to even out reserve imbalances. By then, of course, the rise of overnight sweep accounts had rendered the whole concept of reserves against (mainly demand) deposits largely obsolete and thereby reduced the sting of Greenspan's hikes considerably.

Still, the Fed rate increases did tend to bite on the margin; and the rise from 1.0% to 5.25% (orange bars) in 24 months did measurably impact the economics of the money markets.

Viewed in another way, the Fed's current tightening ruse puts you in mind of the old saw about the number of clowns it takes to change a light bulb. In the case of the Fed, it's three and counting, as Jeffrey Snider reminds:

Whatever the future case, this past history is shameful. How can an exit process last through three Chairman across the span of just about five years and counting? You might get the sense that the economy isn’t so great, and that policymakers really don’t know what they are doing. Greenspan was no better when it came to money and bonds, but he completed 17 hikes in two years.

As we indicated above, this cycle of increases in the Fed's target interest rate is all misdirection because the Fed is petrified by one thing alone, and its not an unexpected flare-up of inflation or getting "behind the curve".

To the contrary, fear of a stock market hissy fit is the sum and substance of what it's doing, and why it's doing it. And when all is said and done, the new chairman made that perfectly clear during the course of his clumsy post-meeting imitation of a Yellen presser.

Indeed, the whole kabuki dance of forward guidance and the spectacle of grown adults at the Fed finger-painting their dots in each new issue of the Fed's quarterly monetary coloring book isn't a monetary policy at all; it's a price-keeping operation designed to stabilize the equity markets at their absurdly over-valued levels.

The Fed's working theory, of course, is that if it tiptoes lithely around the Wall Street's swaying tower of speculation, the gamblers will stay calm and keep buying the dips.

How long this stealthy appeasement of the trading gods is supposed to last, they don't say. And we are quite sure we know why.

To wit, they have no clue about where they are going or what comes next. They have mutilated every law of sound money and have inflated the greatest bubble in human history. Now they are simply hanging on for dear life----even as they chant a brave Keynesian tune about an alleged Goldilocks Economy.

What we mean is that the whole economic narrative and choreographed path of rate increases embodied in the Dot Plot is an elaborate charade that has little to do with the "incoming data", and everything to do with the S&P 500.

Likewise, the Fed's sloppy and rubbery macro-economic framework amounts to nothing more than a crude rendition of the Phillips Curve trade-offs. Yet the latter was invalidated decades ago, and, more to the point, is utterly irrelevant in a global economy drowning in excess capacity, cheap labor, mountainous debt and statist domination of domestic credit, global trade and exchange rates.

Needless to say, the Fed's ritual incantations about the purported glowing pink health of the main street economy and its alleged capacity to easily absorb their "lower for longer" rate raising Kabuki has become absolutely annoying in its mendacity and monotony.

Do they really think everyone is as ignorant, or heedless, as the case may be, as the Wall Street day traders and hedge fund swingers?

For instance, you would think Jay Powell is not so tenaciously attached to school marm Yellen's 19-labor market indicators as to miss the real main street story. To wit, as the February report again documented, there has been no net increase in manufacturing production in 10 years!

In fact, manufacturing output in February still printed 2% below its level of November 2007. Yet in what logical universe does that irrefutable condition add-up to a "strong economy"?

Needless to say, that question has evidently not occurred to Jay Powell. Yesterday he emitted the usual Fed-speak rubbish about the nation's "strong economy", thereby proving he is as clueless about the central banking calamity which he now nominally heads as were his three predecessors.

Indeed, he actually, and surely inadvertently, hit the nail on the head when he insisted that the Fed's "primary means" of normalization and monetary tightening would be through the ruse of "adjusting" its interest rate target; and that the balance sheet shrinking campaign would remain on auto-pilot, barring some drastic "unexpected" economic collapse.

So there you have one of the greatest central banking follies of all time. Powell, like his three money-printing predecessors, really cares only about the S&P 500 and for good reason: One more spectacular crash like the 50-60% plunges in 2000-2002 and 2008-2009, respectively, is more than its franchise to exercise plenary control over the US financial system can withstand.

Yet by putting the Fed's bond-dumping campaign, which is the real tool of monetary tightening, on auto-pilot, he will surely bring about the yield shock that will trigger the very equity implosion that he and his posse fear most.

Consider another straw in the wind. The Donald is surely correct about the destructive off-shoring of the US economy since 1987---even if it was hatched in the Eccles Building, not the USTR or Commerce Department.

Yet when is the last time the Fed addressed this calamity or even noted that it is getting worse again?

And "worse" is a mild word for it. During the November-January three month period, the current account deficit plunged to $650 billion at an annual rate.

As to how that is going to reverse in an economy running on cheap debt, Powell didn't say; nor did he explain how a country can borrow its way to prosperity forever, world without end.

Likewise, he expressed some mystification about why wage rates have remained so subdued at an alleged unemployment rate at 4.1%, and surmised that the Phillips Curve may have developed some looseness in the steering gear. He even got some applause from the financial press for candor on the topic.

Oh, puleese!

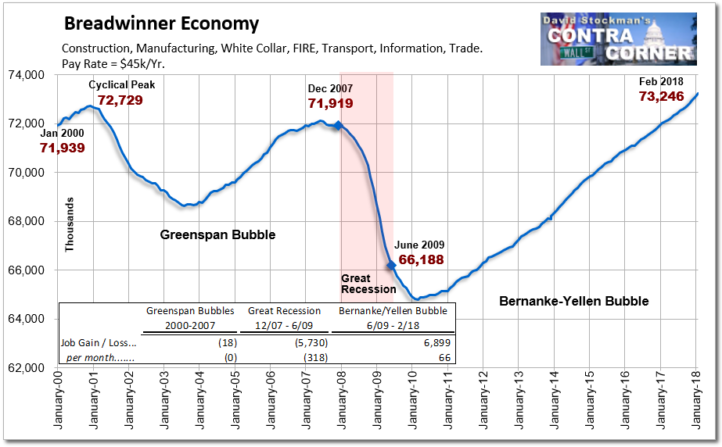

Has he not noticed that the U-3 unemployment rate is a trend-cycle adjusted projection from the bowels of the BLS numbers factory that basically doesn't correlate with or measure anything useful in the real main street economy? Or that virtually all of the jobs created since the year 2000 have been in the fiscally dependent HSS ( health and education) sector or Part-Time economy.

The fact is, the 165 billion unutilized adult labor hours in the US economy we mentioned in Part 2 can readily fill the slow growth in demand for these positions; and that's all the badly crippled US economy has generated since the turn of the century.

There is no wage pressure because off-shoring, $2.4 trillion of imports and no growth in demand for breadwinner jobs have kept wage growth pinned to the floorboards. Indeed, there is still no growth in demand for full-time, full pay "breadwinner" jobs after 19 years of non-stop monetary stimulus and monetary central planning.

Maybe there's some linkage there?

In this respect, just read the post-meeting communique: It consists of such aspirational mush that it could have been written by any first year econ major at any third-tier college in America.

Under any other circumstances, the statement and Powell's content-free bloviation at his presser might be considered an acute embarrassment.

By the spoken and written words which emanate from the Eccles Building have only one purpose: That is, to avoid triggering still another crash and still another failure by the monetary politburo to sustain its underlying conceit that it can deliver a permanent Nirvana of full employment prosperity by falsifying finance asset prices.

Zero Hedge made the same point a lot more bluntly. But if you do not understand the stock market propping motivation behind the Fed's interest rate-raising campaign, the great yield shock around the corner will indeed come as a shock:

When it comes to the Fed's quarterly (and soon monthly) press conferences, it's widely expected that the Fed chair will manipulate and goalseek the message to reach a desired market outcome. After all, if the past ten years have taught us something, it is that the Fed only cares about the market reaction and micromanaging equities. And to do that, the chair will do and say anything, obfuscating - in the best Alan Greenspan tradition, putting the audience to sleep - as only Janet Yellen can, and generally lying as much as needed to give traders the comfort that the Fed is "with them."

This gets us back to Chairman Powell and his powder-puff presser.

What was really going was made absolutely clear by the nation's chief magician as he stumbled through his first presser. To wit, he actually does believe the IOER raising scam is for real, and that the Fed's impending $2 trillion bond dumping campaign (QT) is no big deal.

In fact, of course, it's the whole deal.