Ten Undervalued Stocks For The Defensive Investor

There are a number of great companies in the market today. By using the ModernGraham Valuation Model, I’ve selected the ten most undervalued companies reviewed by ModernGraham. Each company has been determined to be suitable for Defensive Investors according to the ModernGraham approach.

Defensive Investors are defined as investors who are not able or willing to do substantial research into individual investments, and therefore need to select only the companies that present the least amount of risk. Enterprising Investors, on the other hand, are able to do substantial research and can select companies that present a moderate (though still low) amount of risk. Each company suitable for the Defensive Investor is also suitable for Enterprising Investors.

Equity Residential (EQR)

Equity Residential is a real estate investment trust.

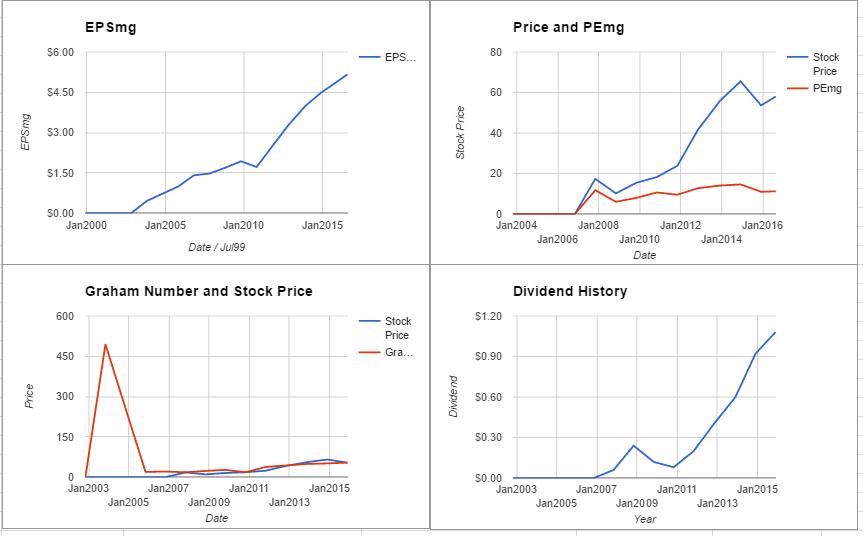

Equity Residential qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the low current ratio. The Enterprising Investor has concerns regarding the level of debt relative to the current assets. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $2.15 in 2012 to an estimated $5.79 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.39% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Equity Residential revealed the company was trading below its Graham Number of $90.07. The company pays a dividend of $2.11 per share, for a yield of 3.2%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 11.29, which was below the industry average of 34.03, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-24.85. (See the full valuation)

Eastman Chemical Company (EMN)

Eastman Chemical Company (Eastman) is a specialty chemicals company that produces a range of advanced materials, chemicals and fibers.

Eastman Chemical Company qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the low current ratio. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $3.14 in 2012 to an estimated $5.89 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.51% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Dow Chemical Co (DOW)

The Dow Chemical Company (Dow) is a manufacturer and supplier of products used primarily as raw materials in the manufacture of customer products and services across the world.

Dow Chemical Co qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the low current ratio. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $1.21 in 2012 to an estimated $3.85 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 2.2% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Travelers Companies Inc (TRV)

The Travelers Companies, Inc. is a holding company.

Travelers Companies Inc qualifies for both the Defensive Investor and the Enterprising Investor. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $5.49 in 2012 to an estimated $9.6 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.52% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Baxter International Inc (BAX)

Baxter International Inc., through its subsidiaries, provides a portfolio of essential renal and hospital products, including home, acute and in-center dialysis; sterile intravenous (IV) solutions; infusion systems and devices; parenteral nutrition; biosurgery products and anesthetics, and pharmacy automation, software and services.

Baxter International Inc qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the low current ratio. The Enterprising Investor has no initial concerns. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $3.6 in 2012 to an estimated $5.21 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 0.38% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Baxter International Inc revealed the company was trading below its Graham Number of $56.99. The company pays a dividend of $0.48 per share, for a yield of 1% Its PEmg (price over earnings per share – ModernGraham) was 9.25, which was below the industry average of 40.07, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-1.18. (See the full valuation)

Robert Half International Inc. (RHI)

Robert Half International Inc. provides specialized staffing and risk consulting services.

Robert Half International Inc. qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the high PB ratio. The Enterprising Investor has no initial concerns. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $1 in 2012 to an estimated $2.41 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 3.79% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Robert Half International Inc. revealed the company was trading above its Graham Number of $22.3. The company pays a dividend of $0.84 per share, for a yield of 2.2%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 16.07, which was below the industry average of 21.38, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $5.37. (See the full valuation)

Ryder System, Inc. (R)

Ryder System, Inc. is engaged in offering transportation and supply chain management solutions.

Ryder System, Inc. qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the low current ratio. The Enterprising Investor has concerns regarding the level of debt relative to the current assets. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $3.07 in 2012 to an estimated $5.23 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.68% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Discover Financial Services (DFS)

Discover Financial Services (DFS) is a direct banking and payment services company.

Discover Financial Services qualifies for both the Defensive Investor and the Enterprising Investor. In fact, the company meets all of the requirements of both investor types, a rare accomplishment indicative of the company’s strong financial position. The Enterprising Investor has no initial concerns. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $3.26 in 2012 to an estimated $5.16 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.37% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Discover Financial Services revealed the company was trading above its Graham Number of $57.8. The company pays a dividend of $1.12 per share, for a yield of 1.9% Its PEmg (price over earnings per share – ModernGraham) was 11.23, which was below the industry average of 20.62, which by some methods of valuation makes it one of the most undervalued stocks in its industry. (See the full valuation)

Bed Bath & Beyond Inc. (BBBY)

Bed Bath & Beyond Inc. and subsidiaries is a retailer selling an assortment of domestics merchandise and home furnishings, which operates under the names Bed Bath & Beyond, Christmas Tree Shops, Christmas Tree Shops andThat! or andThat!, Harmon or Harmon Face Values, buybuy BABY and World Market, Cost Plus World Market or Cost Plus.

Bed Bath & Beyond Inc. qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the poor dividend history. The Enterprising Investor is only concerned with the lack of dividends. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $3.63 in 2013 to an estimated $4.91 for 2017. This level of demonstrated earnings growth outpaces the market’s implied estimate of 0.18% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Invesco Ltd. (IVZ)

Invesco Ltd. (Invesco) is an independent global investment management company.

Invesco Ltd. qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the low current ratio. The Enterprising Investor has concerns regarding the level of debt relative to the current assets. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $1.3 in 2012 to an estimated $2.15 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 2.37% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)