10 Reasons Why Apple Stock Is Under-Priced

There are many reasons to suggest that Apple (NASDAQ:AAPL) stock is undervalued. Apple's PE has declined from over 17 in April to current PE of 12.7 while its future prospects remained unchanged if not improved. Its relative valuation too appears cheaper than its competitors. In the current post and next we will go through ten reasons why Apple stock is under-priced.

#1: Apple's implied EPS growth rate of ~9.6% is not only too low, it is ~64% below Apple's 4-year average EPS growth rate.

Apple's estimated EPS growth rate is way below the company's historical five year average growth rate. Yahoo! Finance, under Analyst Estimates, estimates Apple's EPS to be $9.85 this current year and to grow to $10.80 next year. Implying a 9.6% EPS growth rate.

But Apple has grown EPS by an average of 26.57% in the last 4-years (59.75%, -9.98%, 13.56 and 42.95% from 2011-2012, 2012-2013, 2013-2014 and 2014-2015 respectively) as shown in the Figure below.

Source: FY Ended September 26, 2015

This means that Apple's expected EPS growth rate of 9.6% is ~64% below Apple's historical 4-year average growth rate of 26.75%. Expecting a company's EPS growth rate to decline by 64% would make sense if that company was facing imminent and detrimental headwinds. But this is not the case for Apple.

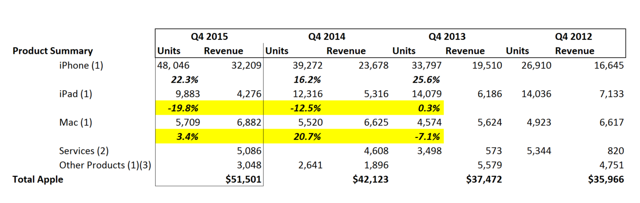

Apple recently entered new markets with Apple Pay and Apple Watch. All these new products are sources of potential revenue growth. In addition, Apple's Q4 2015 results brought in a record revenue of $51.5 billion and net profit of $11.5 billion, with profit up 31%. This shows that Apple's growth potential is still alive and strong, and to expect a very low growth rate from a company that has consistently performed really well seems misguided.

#2: Apple has had an average of ~ 35% growth rate in profit margins in the last 5-years. Considering the size of the firm, Apple should be given credit for being able to be defined as a growth company for so many years.

Source: Apple SEC Filing FY Ended September 26, 2015

For a company with $633.6 billion in market capitalization as of 11/17/2015, growing margins at a rate of a small growth company is indicative of a stock more likely to outperform. Apple has managed to maintain such high margins because of the luxury nature of its brand. But Apple is not a luxury product in the common sense.

Apple is a premium product at the top of the mass market. Apple's products are mass-produced, mass-distributed and price-sensitive - just like a normal mass product. According to an article on Luxury Daily by the CEO of White Light Consulting, Lorre White, Apple is a premium brand masquerading as a luxury one.

Being a premium brand that is sometimes perceived as a luxury brand allows Apple to utilize two important profit avenues: premium prices and turnover. This allows Apple to charge a high enough price but also gives it the flexibility to optimize on both sales and profits by mass-producing its products. This is what makes the stock and future prospects really attractive.

#3: Apple has great management execution, and it has given investors reasons to be trusted. On the 24th of August, in the midst of slowing economic growth in China, shrinking consumer sentiments and declining revenues from companies exposed to China, Apple CEO Tim Cook released a statement on Jim Cramer to reassure Apple investors that Apple's China growth was still intact.

"As you know, we don't give mid-quarter updates and we rarely comment on moves in Apple stock," Cook wrote. "But I know your question is on the minds of many investors."I get updates on our performance in China every day, including this morning, and I can tell you that we have continued to experience strong growth for our business in China through July and August." He continued saying, "obviously I can't predict the future, but our performance so far this quarter is reassuring. Additionally, I continue to believe that China represents an unprecedented opportunity over the long term as LTE penetration is very low and most importantly the growth of the middle class over the next several years will be huge," Cook added.

They kept investors in the loop and managed to deliver growth in a market with declining consumer sentiments and slowing economic growth. This is in stark contrast to what Walmart did. They did not give investors any heads-up, hence the reason the stock was punished, falling by ~34% this year from its January high of $90.47.

Hence the reason why Tim Cook's effort to keep investors informed and lessen investor panic should be seen as a positive sign of management's attempt to create a more transparent and shareholder friendly environment.

#4: Ability to withstand currency and consumer sentiments headwinds: In recent months, we have seen how a powerful dollar has negatively affected multinational firms. The negative impact was worse for companies with strong exposure to China. No wonder companies like Nike (NYSE:NKE) saw a 10% jump when they reported a strong fiscal first-quarter 2016 results. Results that saw growth in China sales. Therefore, it is important that we acknowledge and appreciate the fact that Apple managed to beat estimates despite both the strong currency headwinds and the slow-down in consumer sentiments in China.

Source: Westpac MNI

According to Westpac MNI, China's consumer sentiments are at their lowest in over 7-years. Therefore, seeing Apple grow its China sales by 99% year-over-year amidst declining sentiments is a testament to Apple's brand not only being a premium brand but also the fact that China is a huge growth potential for Apple.

#5: Activation cycle and reselling old iPhone in developing markets. iPhone unit sales growth was 22.3% in Q42015~6.1% more than they were in Q42014. iPhone 6s and iPhone 6s Plus should not be expected to surpass iPhone 6 and 6 Plus because iPhone 6 and 6 Plus release was equivalent to a new product launch (change in phone size for the first time). Implying that the hype and demand associated with a new launch cannot be extrapolated to product extensions. In addition, Apple can still buy back old phones and sell them in emerging markets. That way, it can maintain its brand reputation and cut cost while still innovating.

(Source: Apple's Q4, 2015, Press Release)

#6: Ability to grow its Q415 revenues by 34% in a segment that accounts for ~42% of its total sales. China is not Apple's biggest segment. Based on the recent quarter, Americas accounts for ~42%, Europe accounts for ~ 24% and Greater China accounts for ~ 21% of Apple's total revenues. Apple has been growing in its biggest market (~34% in Q415). This is another aspect of Apple that is left untouched, and yet it is one the most fascinating facets of the company. The ability to maintain and grow its dominant position in the 'Americas' segment reiterates the fact that the brand is still strong and growing.

Disclosure: I do not hold any positions in the stocks mentioned in this post and don't intend to initiate a position in the next 72 ...

more