The Ghost Of Crypto Anarchy

Today we bid farewell to the Godfather of the Cypherpunk movement, which gave birth to bitcoin.

If you've never heard of Tim May (may he rest in peace), I refer you to his words of 1992. This short passage was so ahead of its time that it may as well have been written last Tuesday.

Today's Highlights

- Sell Off Continued

- Breakouts Forming

- Bounce off the Floor

Traditional Markets

The global sell-off in the stock markets continues. For a brief moment after the bell rang at the New York Stock Exchange, it did seem like there would be some sort of bounce, but by the end of the session, the major indices were back at the lows.

The S&P500 index fell within a single point of its lowest rate this year (yellow line).

(Click on image to enlarge)

The negative sentiment has carried through into Asia, but it seems the Europeans are a bit more optimistic today, especially in Germany where the DAX is in green.

The feeling is that we could be getting some much-needed relief from the US Federal Reserve as they head into their two-day meeting today. So things might calm down as we approach the announcement tomorrow evening.

Breakout Time

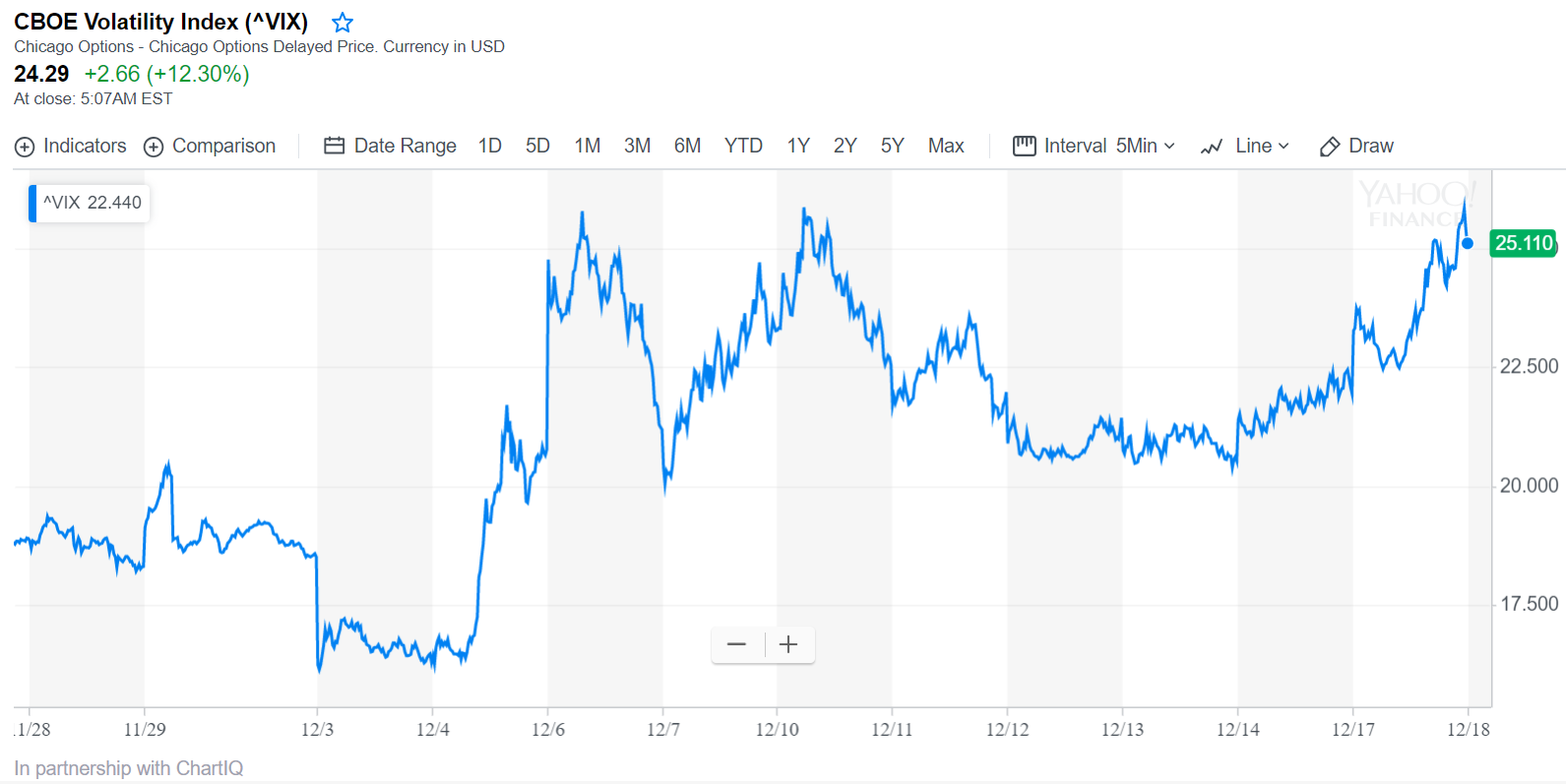

Looking at some of the other assets out there, volatility has increased over the past few sessions. Here we can see the VIX volatility index making a move to the upside over the last few days along with the selloff in the stocks.

(Click on image to enlarge)

With that, it pays to take a look at the US Dollar, which continues to push the highs with some upward facing consolidation. This will be critical going into the Fed meeting, where they are largely expected to raise rates.

(Click on image to enlarge)

However, since the rate hike is expected to be dovish, we could just as easily see a downward breakout. Watch this space.

Gold is also looking for a breakout of the psychological barrier at $1,250 an ounce.

(Click on image to enlarge)

Ever avantgarde, crude oil has already broken below $50 yesterday, a staunch indication that the oversupply issues aren't quite behind us.

(Click on image to enlarge)

Just for good measure we'll add in the USDJPY as well here. Especially if the dovish rate hike does indeed do the Dollar in, and Asian traders look for saftey in the Yen, we could see 112.22 give way.

(Click on image to enlarge)

Crypto Bounce Acquired

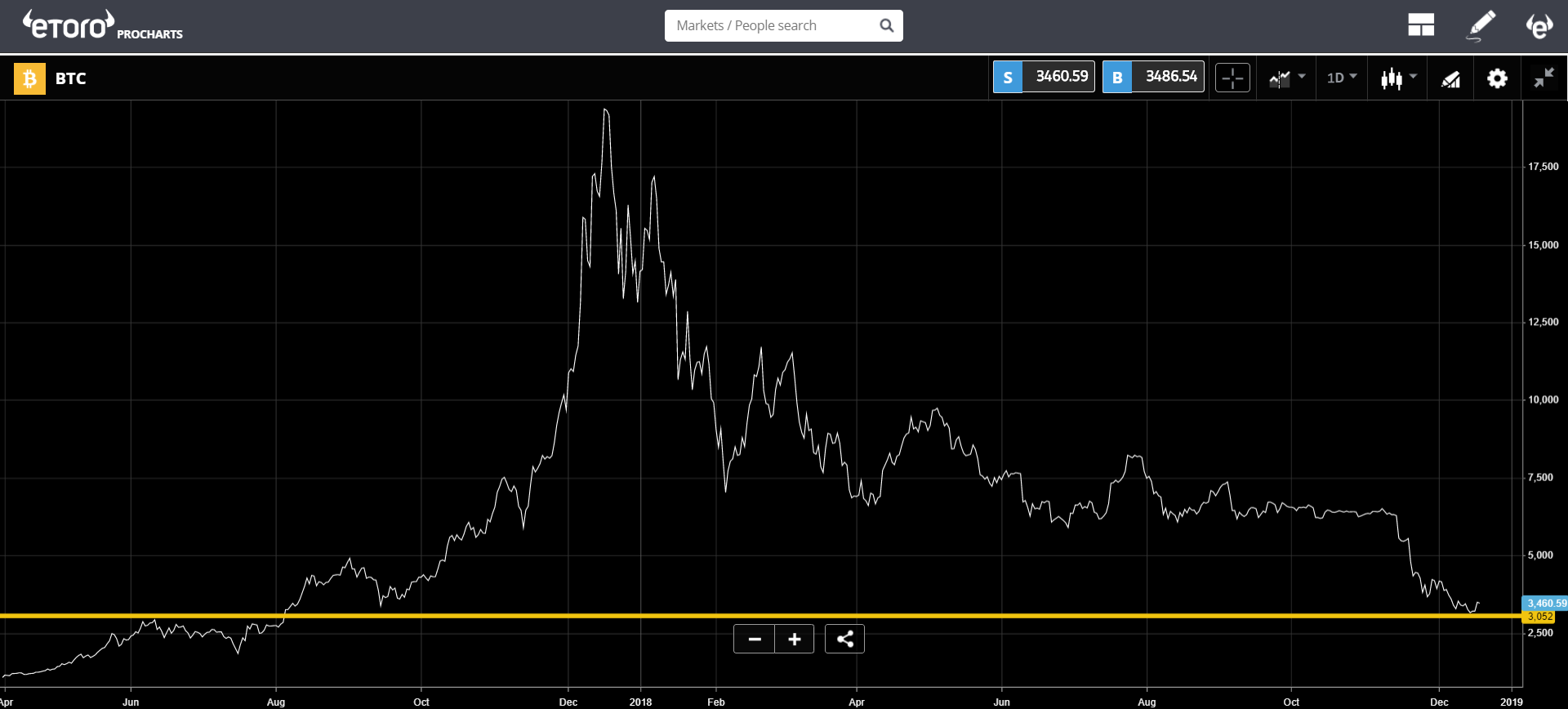

Yesterday, on the 10th anniversary of Bitcoin's all-time high, we did manage to see a strong push off the floor. Though it's not clear what exactly caused the bounce, it does appear to be a short squeeze that took out a few of the high-risk traders. I did put up a few charts on Twitter as it was happening.

Ever since the break below $5,000 we've been talking about light support at $3,500 and heavy support at $3,000, so this bounce off the $3,000 level couldn't be more picture perfect.

(Click on image to enlarge)

The biggest winner emerging from this move was EOS, which rose a total of 29% within a few short hours. Yet still nowhere near its all-time high of $23.33.

(Click on image to enlarge)

Though it is possible that we do continue downward from here, this type of movement is very encouraging for technical analysts and may just end up creating a bottom for this battered market possibly even giving way to a bullish trend in 2019. Who knows... maybe we'll get a Santa Claus Rally after all.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more