Two Indicators Begging Bullish On The US Economy

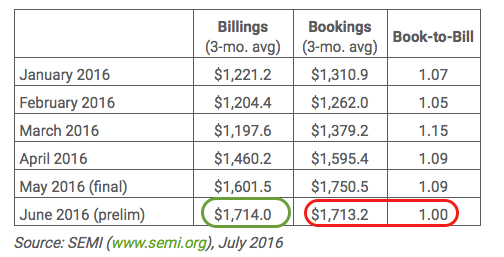

I realize it has not been fashionable to be positive on the US economy lately, given a host of global economic, political and terror related items to worry about (that I might add, have little to do with the US economy). And with the ultimate fundamental underpinning being constant Central Bank pumping, this doubt is not surprising. But we have been working on positive signs in the Semiconductor Equipment sector (AMAT, LRCX, KLIC, MKSI, etc.) for months now and are currently on a four month positive trend in the sector's 'bookings' data (the slight decrease in June represents still elevated business activity). This is a forward looking sector on the economy. It worked as a Canary in a Coal Mine for the last economic bounce and market up cycle in early 2013 and it can work again. From SEMI, the latest Book-to-Bill data (for June):

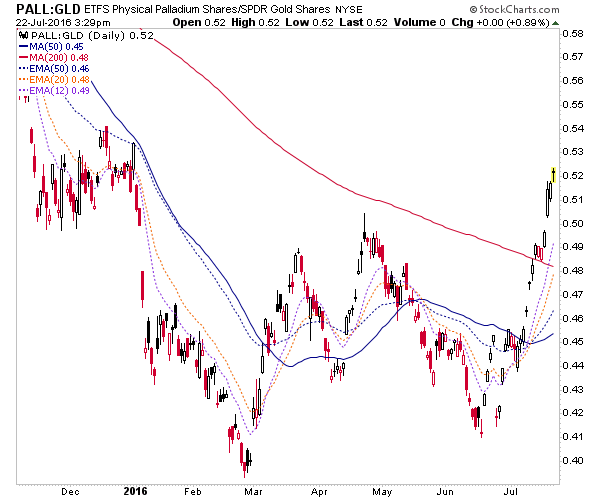

In 2013 we used a cross reference of a ratio between a precious metal that is economically sensitive in a positive way (Palladium) and one that is sensitive in a negative or counter-cyclical way (Gold). While the downtrend in PALL vs. GLD has not yet been eliminated on longer-term charts, progress is certainly being made.

A combination of a continued strong SEMI 'b2b' and a continued strong Palladium-Gold ratio would signal a positive cyclical economic environment. My current expectation is that there can be some turbulence for markets in the short-term, a bullish intermediate-term and then, given the man-made stimulus the whole thing is propped upon to begin with, a bearish long-term view of the economy and markets.

I am long the Semiconductor Equipment sector (along with Healthcare and only select global areas) and always value gold as a portfolio counterweight. But gold is counter cyclical, remember that.

Disclosure: Subscribe to more