The Market Does Not Understand Apple

Simplicity is the ultimate sophistication when it comes to investing. Buying a high-quality business with attractive valuation levels can be a powerful strategy to generate market-beating returns over the long term.

Apple (AAPL) stock looks like a particularly compelling investment when considering the company's financial quality and valuation levels together. This is arguably because the market is underestimating Apple's ability to generate consistent profitability and revenue growth due to its unique competitive advantages and fundamental qualities.

Quality And Value By the Numbers

Quality and value drive investment returns, and investors can invest in companies with strong quantitative indicators in terms of those two variables to obtain market-beating returns over the long term.

The following quantitative system is based on a ranking algorithm focused on a combination of financial quality and valuation. Each stock in the investable universe receives a quantitative ranking, which is an average of these two factors: financial quality and valuation.

The financial quality factor is a combination of gross margin, free cash flow margin, return on investment, return on equity, and long-term growth expectations. A stock is ultimately a share in an ownership of a business, so shares in companies with superior profitability metrics and above-average growth expectations create more profits for investors over the long term.

The value component of the ranking system includes valuation ratios such as forward price to earnings, price to earnings growth, price to free cash flow, and enterprise value to EBITDA. The lower the entry price in an investment, the higher the potential returns for investors on a forward-looking basis, especially when the business is fundamentally solid.

Leaving all the mathematical considerations aside, the main rationale behind the quantitative system is actually quite simple and easy to understand. We want to buy high-quality companies for a conveniently low price, the system is basically using multiple metrics and indicators to find that kind of companies.

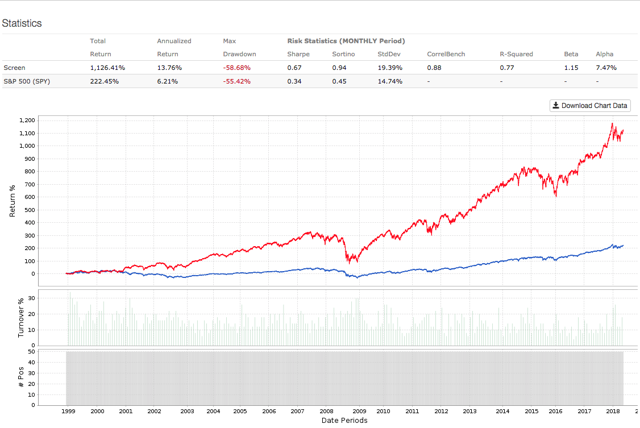

The quantitative system has produced solid backtested performance over the long term. The chart below shows how the 50 stocks with the highest quantitative ranking in the S&P 500 Index performed in comparison to the SPDR S&P 500 (SPY) ETF since 1999. The backtesting assumes an equal-weighted portfolio, monthly rebalanced, and with an annual expense ratio of 1% to account for trading expenses.

Data from S&P Global via Portfolio123

The system more than doubled the benchmark, with annual returns of 13.76% per year versus an annual return of 6.21% for the market-tracking ETF in the same period. In other words, a $100,000 investment in the SPDR S&P 500 ETF in January of 1999 would currently be worth around $322,500, and the same amount of capital allocated to the portfolio recommended by the system would have a much larger value of $1.2 million.

Apple Looks Remarkably Attractive

Apple is one of the companies selected by the quantitative system, meaning that the stock is in the best 10% of stocks, according to a combination of financial quality and value indicators.

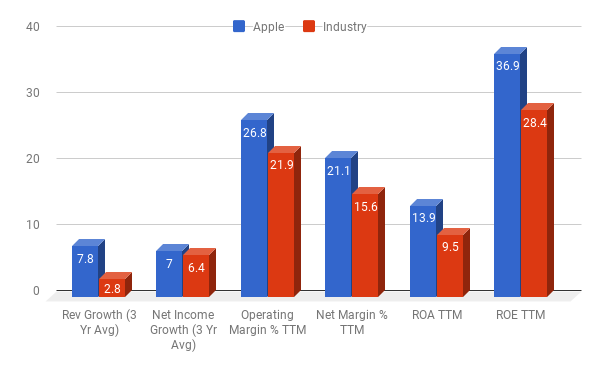

In terms of profitability, the company is far superior to the competition. The chart below compares Apple versus the average industry player based on a multiplicity of financial quality indicators. Apple comes ahead of the competitors across all of the indicators considered: revenue growth, net income growth, operating margin, net margin, return on assets (ROA) and return on equity (ROE).

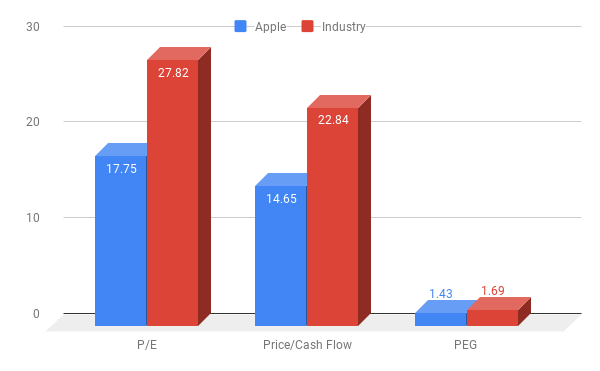

In terms of valuation, the stock is more than conveniently priced. Wall Street analysts are, on average, expecting Apple to make $13.26 in earnings per share during next fiscal year. Under this assumption, the stock is trading at a forward price to earnings ratio of 13.9 times earnings expectations. This represents a significant discount versus an average price to earnings ratio around 16.5 for companies in the S&P 500 index.

In comparison to the average stock in the industry, Apple is also quite undervalued. The chart below shows how the company is priced at below-average levels in terms of price to earnings, price to cash flow, and price to earnings growth.

From a quantitative perspective, the main takeaway is quite clear. Apple stock is aggressively cheap for such a high-quality business, if statistical evidence is any valid guide, this means that the stock is well positioned for attractive returns going forward.

The Market Does Not Understand Apple

When the numbers for a company look exceptionally attractive, it makes sense to wonder why that is the case. Is there something important that the numbers are not showing, or is it that the market is mispricing the stock?

In Apple's particular case, the company is priced like a classic hardware business. However, hardware companies typically have razor-thin profit margins and little or no competitive differentiation. Apple, on the other hand, is a world-class consumer technology company with outstanding competitive strengths, and that's why Apple generates a financial performance level that typical companies in the hardware industry can only envy or admire.

Most companies in the hardware sector have no pricing power at all, and smartphone manufacturers are always competing on prices, which obviously hurts profit margins. Apple, on the other hand, registered a year-over-year increase of 11% in average selling prices for the iPhone segment last quarter, from $655 to $728 per unit. It takes a special business to successfully raise prices in an industry in which most competitors are cutting prices as much as possible. This speaks volumes about the value of the Apple brand.

A critically important area in which the market seems to be underestimating Apple is revenue predictability. Hardware companies usually see declining revenue growth over time due to growing competition and/or technological obsolescence in the industry.

On the other hand, Apple has proven an impressive ability to transcend not only products but even industries. The company has successfully expanded from computers to music players, then to smartphones and tablets and, finally, to smartwatches. Even more important, the services division is becoming an increasingly important growth driver for Apple on a forward-looking basis.

Services is now the second largest segment for Apple behind the iPhone, and it's growing at full speed. Services revenue during the second quarter of fiscal year 2018 amounted to $9.19 billion, growing by an impressive 31% year over year. To put the numbers in perspective, Netflix (NFLX) made 3.7 billion in revenue last quarter, so Apple's services business is almost 2.5 times the size of Netflix.

Management said, two quarters ago, that the installed base of active devices surpassed 1.3 billion, increasing by 30% over two years. Nearly 90% of iPhone users return for another iPhone when they renew their devices, so this provides a key strategic advantage in terms of recurrent revenue over the long term. Besides, the company's devices now function like digital storefronts for the much vigorous services segment.

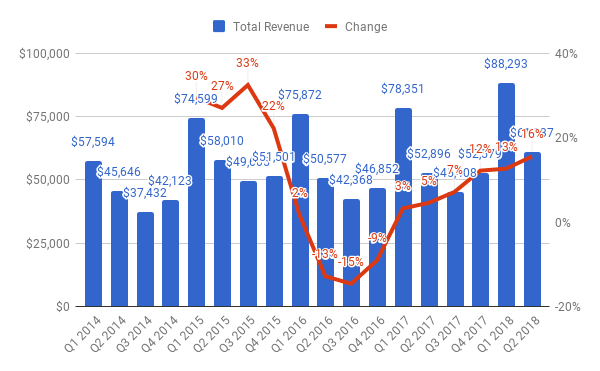

Industries such as smartphones and computers are clearly maturing in the past few years, but Apple has reported accelerating revenue growth in the last six consecutive quarters. This shows that Apple is no average hardware manufacturer by any means.

In a nutshell, the market is pricing Apple like a hardware business, but financial performance numbers show that Apple is truly a powerful consumer brand that is increasingly expanding into new products and services. This mispricing is creating a buying opportunity for investors in Apple stock.

Capitalize on the power of data and technology to take the guesswork out of your investment decisions. Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold-hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure: I am/we are long AAPL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more