Tesla Posts Record Loss – And Stock Price Goes Up!

Guest Post by Eric Peters

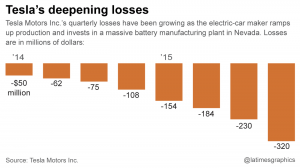

Elon Musk’s Tesla (TSLA) just posted its biggest loss to date – $430 million in three months – but Tesla stock prices climbed 10 percent after the announcement.

What to make of this?

It’s like being in a nursing home, beside the bed of your blind, dementia-addled 94-year-old grandmother and the doctor just told you she probably hasn’t got much time left – but you decide to go out and buy her a new car.

With the difference being that you’re buying grandma the car.

In Tesla’s case, it’s taxpayers who are buying the cars – for the affluent virtue-signalers who “buy” them at massively subsidized but massively high prices.

Even so, Elon still can’t make a buck on these things.

Not that it matters.

The conga line of suckers seems endless. In part because of Elon’s Rasputin-like ability to bedazzle the media, which reports every promise with the gush of a 16-year-old girl effusing over her prom date and never reports that her date raped her after the prom.

Mum is always the word when it comes to Elon.

For example – and most recently – the media gushed over the arrival (sort of) of the “affordable” Model 3, sticker price only $35,000! Which is only $15,000 more than a well-equipped Honda Civic sedan, which does the job of getting from A to B vastly better, if the metrics are cheaper and easier and more conveniently.

But the media has not told you that the “affordable” $35,000 Model 3 isn’t available. Only the $40,000 Model 3 currently is.

And it’s only twice as expensive as a well-equipped Honda Civic. But what’s $20,000 between friends, eh?

Keep in mind, too, that both the $35,000 Model 3 and the $40,000 Model 3 are really more like $50,000 Model 3s – if you take away the subsidies and price them such as to account for their true cost to manufacture and sell at a profit – as opposed to giving each away at a loss, as Elon has been doing for the past 15 years.

Another thing the media hasn’t been telling you is that there are ghost fleets of brand-new Teslas sitting idle in parking depots – much like the excommunicated VW diesels, but with a difference.

People wanted the diesels – and bought them, too. VW was forced to buy them back – often from reluctant-to-give-them-up owners – and force-retired them over picayune and pedantic “cheating” on government emissions certification tests.

But the idled Teslas are sitting because of quality control problems that make them unready for presentation to marks (whoops, buyers). These are problems which would result in the implosion of any other car company once word got out but word doesn’t get out because Elon’s cars are electric and so The Future; the deficits are simply not discussed for fear of alarming the marks (er, buyers) who might have second thoughts.

Some of whom already are having them, regardless.

These are the people who’ve asked for their money back – the deposits they made on cars not yet received – and it’s not a few of them. Thousands of them have been getting uneasy over the serial promising and never delivering.

Elon promises – again – that Tesla will make money by the fall. Well, fall is about two months away, bucko – and things do not look good.

“The projection of profitability in the second half of the year is admirable, but is based on selling a far more expensive version of the Model 3 then many consumers had expected,” says Rebecca Lindland, the executive analyst at Kelley Blue Book, publishers of the car value guides. “Can they sustain profitability if and when they start selling the more affordable $35K version? Insights into the quality and quantity of the reservation pipeline, while boring, would provide investors with confidence with profitability projections.”

This is exceedingly gentle analysis. More giving the benefit of every doubt to this latter-day P.T. Barnum – who is proving old P.T.’s observation about suckers being born every minute to have been the understatement of the century.

Tesla recently laid off about 9% of its staff – so the posted losses would have been even higher and in fact, are higher. They have just been flim-flam’d around.

But the fundamental problem with Tesla isn’t that its cars are electric. It is that they are electric high-performance luxury sports sedans. The idiocy – the effrontery – of this ought to be self-evident but like the Emperor’s new clothes, no one wants to talk about it.

Elon can’t tout the economy of his cars – because he touts performance, luxury and style and gadgets. In order to appeal to the guilt-addled virtue signalers who are his audience and want to preen green but not in a Prius. They want something like the Mercedes S-Class they gave up because of its politically incorrect V8 engine. But they’re not giving up the the performance and gadgets and the snob appeal.

Enter Elon.

But if the cars are not economical, then why are they being subsidized? Put more finely, why are taxpayers being mulcted to subsidize the purchase of high-performance luxury-sport sedans, whether electric or otherwise?

The high-end luxury car market is an inherently small market – and more to the point, it’s a market defined by indulgence. Why is indulgence being subsidized by the government? It is not very. . . progressive.

Nor very green, for that matter.

If Elon had focused on that as the main design criteria, his cars would be less flashy, less quick but much more.. .economical. They might even be cost-competitive with $20,000 Honda Civics and people might actually buy them not to virtue signal but because they made economic sense.

But then, the high-end virtue signalers would not have been interested. So the bonfire of cash waxes, grows brighter.

It’s just a shame it’s not Elon’s cash that’s fueling the fire.

Disclosure: None.