It Will Restart All Over Again In The Small Things

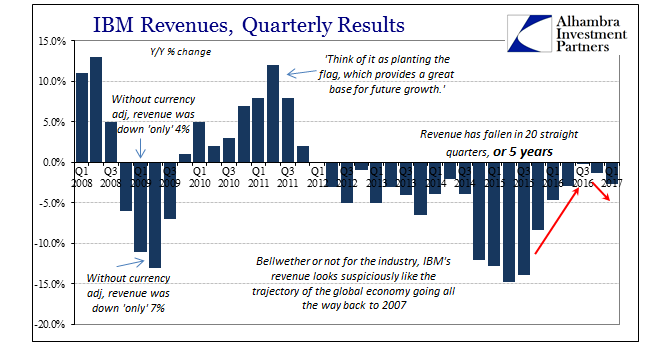

Six months ago back in October, IBM reported what seemed to be encouraging results. Though revenues at the company were down for the eighteenth consecutive quarter, they were so by the slimmest of margins, just -0.3%. For Big Blue, that had been the best revenue comparison since the first quarter of 2012 back when global recovery was the most plausible. The positive momentum was attributed to the company’s shift toward the new growth model, cloud, SAAS, and other next step technologies in lieu of IBM’s traditional hardware products.

Fortune reported at the time:

Some analysts expressed optimism that the company’s 44% gain in cloud revenue shows that IBM CEO Ginni Rometty’s plans to focus on higher-growth businesses are working. At Fortune’s Most Powerful Women Summit, Rometty emphasized IBM’s commitment to Watson and related technologies, saying that while “some companies are high-growth,” IBM is “high-value.”

One such analyst from Zacks Investment Research was more blunt:

This suggests that IBM is finally turning around its fortunes as new strategic business lines like cloud computing, big data and mobile security are growing in double digits.

By this point after going on so long, it is clear that a lot of interest in the company’s circumstances is pure morbid curiosity, the sort of macabre entertainment you might get from watching a train wreck in ultra-slow motion. But that isn’t the whole story, there is a bellwether in there still and it tracks pretty closely at least the direction of the global economy if not always its intensity (though I believe even by that parameter IBM’s results aren’t that far off).

The worst quarter in terms of revenue was Q3 2015 and the storm of “global turmoil” that in (statistical) hindsight was a surefire downturn both in the US and almost everywhere else. Throughout last year, IBM’s revenue like the economy as a whole improved, which is to say that it stopped getting worse. Like “reflation”, it was merely extrapolated that lower negative growth rates and even some positive ones meant the malaise was done and the world turned over (positive, for once). The “rate hikes” at the end of 2016 and toward the start of 2017 confirmed, for the mainstream, this had to be the case.

For IBM, at least, it hasn’t turned out that way. Rather than turning positive in Q4 2016 in the straight line extrapolation of improvement, the company reported declining revenue again and at a slightly faster rate. The quarterly figure of -1.4% wasn’t a huge decline by any means, but it was certainly the wrong direction against expectations. The latest quarterly results released yesterday only furthered the opposite case that much more. Revenues that were thought verging on breakout are now half a year with none to be found; actual revenue was just $18.2 billion in Q1 2017, down 2.8% year-over-year and the lowest for Big Blue in a good long time.

Many will be quick to dismiss these results yet again as just IBM being IBM; the standard for 21st century tech dinosaurs being left behind by the next new age. As with most things, there is truth to the indictment. But, again, the revenue history for this particularly company is uncomfortably close to matching the shifting trajectory of the global economy which by 2007 standards at least would have been wholly unsurprising. Their products are sold all over the world and as true capex are quite sensitive to macro changes whether idiosyncratic to whatever country, monetary conditions, or the global economy that follows the money.

(Click on image to enlarge)

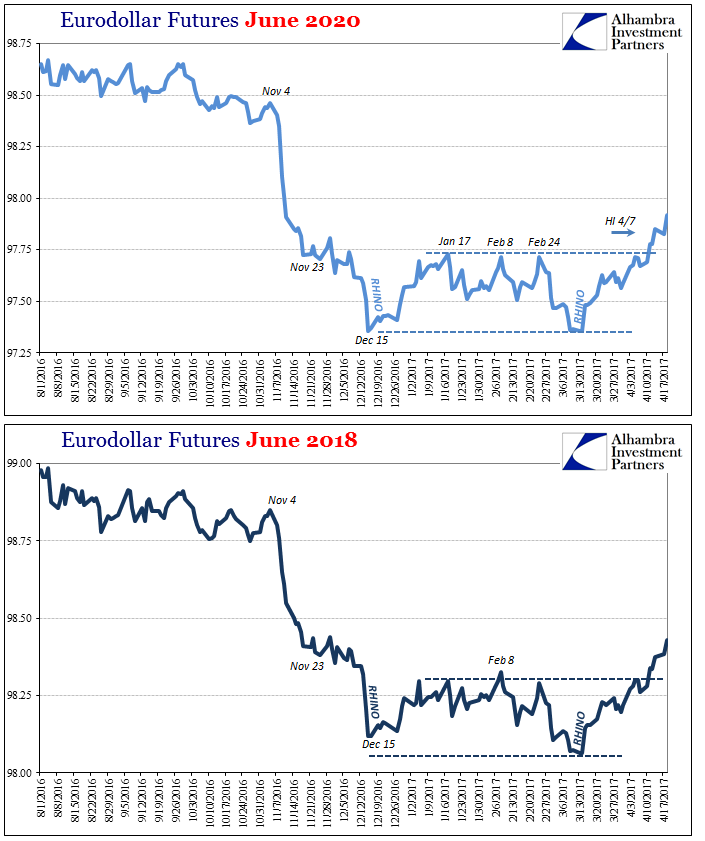

If you think IBM means nothing more than its own success or failure, obviously none of this will matter. On the other hand, if there remains even the slightest relationship to the marginal macro environment, the past six months have to be concerning in a way that doesn’t bode well for “reflation” and everything thereafter. We already know (too) well that nothing has really changed, but so far outside of the auto sector while there isn’t exactly growth taking place there isn’t further contraction, either. Unless something somewhere actually does change in a meaningful way (not very likely) we are just patiently waiting for the next downward “cycle.” And it will start small so that it can be characterized afterward as “unexpected.”

(Click on image to enlarge)

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

Sadly the downward drop is less transparent to most because it is masked by the weaker dollar which is not good as many may say. Your assets are worth less and US exports. That said, large global companies can use sales outside the US to support their numbers. What is another concern, is the lower dollar stokes inflation which gives the Federal Reserve less lateration in their policy decisions.