Zomato Looks Unimpressive And Precarious

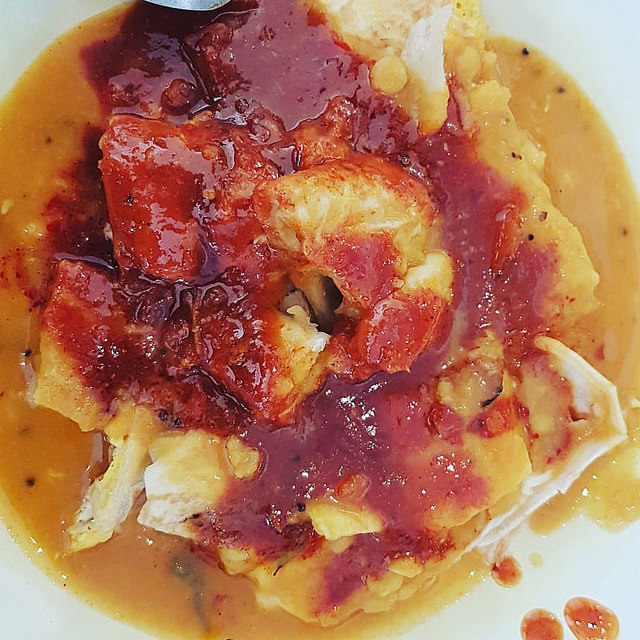

Photo Credit: Vernon Chan/Flickr.com

The foodtech market in India once attracted considerable funding as it was considered promising. However, the market has now become overcrowded and price wars as well as weak logistics and delivery infrastructure are taking a toll on the industry. In 2016, over 37 foodtech startups in India shut down while nine were acquired. Former Billion Dollar Unicorn Club member Zomato had to slam the brakes on its heavy spending on acquisitions and focus on its unit economics.

Zomato’s Journey

Gurgaon, India-based Zomato was founded in 2011 by IIT graduates Deepinder Goyal and Pankaj Chaddah. The idea of Zomato came into being when the two founders noticed that a lot of people were lining up in their office cafeteria to look at the menu cards and order food. They realized that they could help these people by simply putting these menu cards online. Soon, Zomato was born.

Zomato is an online restaurant search and discovery service that has a portfolio of over 1.4 million restaurant listings across 23 countries. Through its portal, users can access restaurant menus, photos, locations for GPS, and even share ratings and reviews of restaurants. Zomato also has an active social network as it allows its users to create their own network of foodies. Through the social feature, users can check in at restaurants with friends and save a personal foodie timeline of their food memories. Today, it has a following of over 90 million monthly visitors globally.

Zomato earns revenues primarily through advertising. They have native advertising on their apps and site and also earn advertising revenues by charging restaurant owners a fee for publishing promotional offers through Zomato’s listings.

Zomato’s Initiatives

Zomato has also been expanding its service offerings. It now offers food delivery and a point-of-sale (PoS) system called Zomato Base that enables restaurants to manage their operations from a single platform.

Zomato recently announced two more initiatives to increase revenue and profitability. Zomato Red will provide consumers an annual membership service to avail of offers at restaurants. Zomato Infrastructure Services (ZIS) or “cloud kitchens” will be using its data repository of restaurants that have recently shut down to build a new business unit that will rent out kitchen space to restaurants for increasing their ability to deliver food. It plans to have a revenue share deal with ZIS users.

In September 2016, to improve the delivery experience, Zomato acquired logistics technology startup Sparse Labs for an undisclosed sum. Sparse Labs has developed an Android-based mobile application which transmits delivery executives’ location to both the restaurant and the consumer in real-time. This is its tenth acquisition and this technology is expected to be critical for Zomato as 80% of its delivery orders are fulfilled by restaurants while rival Swiggy owns its delivery fleet. Zomato charges 7.5% to 15% of the order value for delivery while Swiggy charges 20%.

Zomato’s Financials

The site earns revenues through native advertising and through premium listing of promotional offers. About 12,000 restaurants advertise on Zomato. In the fiscal year ended March 2016, its revenues grew 91% to INR 184.97 crores (~$27.3 million). But increasing revenues are not translating into improved margins. Over the same period, loss before tax increased 262% to INR 492.3 crore (~$72.6 million).

Zomato has been on a downhill ride since its $52 million acquisition of US-based UrbanSpoon in January 2015. In October 2015, it fired 10% of its workforce. In May 2016, investor HSBC Securities and Capital Markets downgraded the company’s valuation from $1 billion to $500 million, based on concerns over its advertisement-heavy business model, growing competition in the food ordering space, and money-losing international operations. It then rolled back its physical operations in seven countries – US, UK, Sri Lanka, Ireland, Chile, Canada, and Brazil – to reduce its operating costs by 81% from $9 million to $1.7 million.

Zomato has also been working hard to monetize each operation. In February 2016, it claimed that it achieved operational profitability in six markets: India, the United Arab Emirates, Lebanon, Qatar, the Philippines and Indonesia. It now claims to be running with positive unit economics in the Indian and UAE markets, claiming a margin of INR 20 (~$0.3) in India and INR 50 (~$0.8) in the UAE per order, despite outsourcing deliveries.

So far, Zomato is venture funded with $223.8 million from investors including Temasek Holdings, Info Edge, Sequoia Capital, and Vy Capital. Its last round of funding was held in September 2015 when it raised $60 million in a round led by Temasek Holdings and Vy Capital at a valuation at about $1 billion.

In November 2016, Zomato was reported to have hired global investment bank Morgan Stanley to raise a new financing round for its aggressive investments in food delivery and cloud kitchens. It remains to be seen if VCs are impressed with its efforts to cut costs and increase profitability.

Overall, $223.8 million in financing to turn in ~$30 million in revenue and ~$75 million in losses isn’t a business investors would be jumping up and down to invest in. Overfunding and loosy goosy execution, total lack of fiscal discipline, lack of focus on fundamentals have been plaguing a set of Indian Consumer Internet companies. These same companies, however, have been instrumental in changing the habits of consumers, getting them used to transacting online, writing reviews, etc. Perhaps, the real beneficiaries of this evolution would be the next generation of startups that operate with more caution, more fiscal discipline, and less capital, and can deliver compelling metrics just because others have done the market making work over the last decade.

In the US, Salesforce.com paved the way for numerous SaaS startups to scale much faster, and with much better unit economics by doing all the market development work alongside a select few other players who pioneered Cloud Computing. India, I believe, will see similar evolution in multiple sectors.

Sramana Mitra is the founder of One Million by One Million (1M/1M), a global virtual incubator that aims to help one million entrepreneurs ...

more