Yum Brands: Double Digit Growth In The Next Two Years

Investment Thesis

Yum! Brands Inc. (YUM) continues its plan to re-franchise its restaurants. Its franchised rate has reached 94% in Q2 2017. The company expects to reach 98% franchised rate by 2018. Benefits are already felt from management’s effort as its Q2 2017 report revealed improving same-store and system sales growth. Its operating margin also improved considerably. With its growth initiatives in place, the firm should be able to grow its earnings by double digits through 2019.

Q2 2017 Financial and Operating Update

In Yum’s latest quarterly report, the company delivered operating EPS of $0.68, down from $0.75 a year earlier. The decrease was primarily due to the separation of Yum China (YUMC) from the company. Excluding this special item, the company’s EPS would have increased by 21% year over year.

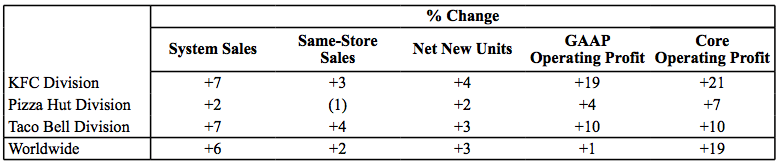

As the table below shows, Yum’s system sales increased by 6% driven by 174 net new restaurants that contributed to half of its growth. Its same-store sales also grew by 2% year over year. Both KFC and Taco Bell experienced strong same-store sales growth while Pizza Hut division remains weak.

Source: Q2 2017 Earnings Release

During Q2, Yum re-franchised 244 restaurants, including 40 KFC, 163 Pizza Hut and 41 Taco Bell restaurants. By the end of the quarter, its global franchise ownership mix has reached 94%. The company expects to reach 98% franchised rate by the end of 2018 with majority of the re-franchising completed in 2017.

As a result of its re-franchise effort, the company continues to see improving operating margin. During the past quarter, its KFC division’s operating margin reached 31.5%, up by 540 basis points year over year. Operating margin for its Pizza Hut division reached 38.1%, up from 30.3% a year ago. Finally, its Taco Bell division’s operating margin increased to 33.4%, up from 29.8% from prior year. Management has expressed that they are maintaining their 2017 full year guidance that its core operating profit will grow by mid-single-digit Management is also optimistic about adding additional KFC stores in the United States after years of net store closures.

Growth Initiatives

The firm has several initiatives in place to grow its business. We will highlight a few below:

Deliveries

At the moment, about 20,000 Yum restaurants offer delivery, including most Pizza Hut restaurants, and about 5,000 KFC restaurants. For Pizza Hut, delivery speed has been an issue. The company has hired consultants to help reduce delivery time and increase digital transactions at Pizza Hut restaurants.

Management is hoping to expand deliveries to include more KFC restaurants and Taco Bell restaurants. Delivery comes with great benefits for restaurants as delivery orders generally carry higher revenue per order. It also offers the opportunity for Yum to reach to customers who are unable to go to one of Yum’s restaurants (e.g., late at night, Sports events, gathering events, etc.).

Digital Transactions and Loyalty Program

Pizza Hut recently just announced the launch of the first ever US loyalty program, Hut Rewards. The program allows its members to earn and redeem points through online or mobile orders only. The company appears to be following the steps of Starbucks (SBUX) where its rewards program has been very successful in driving revenue growth, and McDonald's (MCD ) where the firm also launched their loyalty program recently. Pizza Huts’ hopes this program to result in more frequent customer orders and higher revenue growth.

Fast Casual Delco Model in Pizza Hut Restaurants

Back in 2014, Yum introduced a new restaurant model for its Pizza Hut division called Fast Casual Delco (Delco: delivery and carry out). Unlike traditional pizza delivery business, the new fast-casual style allows consumers to dine-in. This new restaurant style, although still in testing stage, will allow Pizza Hut to compete with other fast-casual restaurants Chiptole and Panera Bread. So far, about 100 franchise chains have participated in the test. We think this will allow the company to further its Pizza Hut division revenue. However, management did not provide any schedules when they will roll out the new model.

We like what we hear from these initiatives and are optimistic about the long-term benefits these initiatives will bring to the company. As a result of these initiatives and other cost-saving efforts, management is hoping that it can achieve an average annual return of 15% over the next two years.

Financial Health

Yum has about $9.5 billion of long-term debt at the end of Q2 2017. Its long-term debt to capitalization ratio of 281%, signifying its high-leverage. This is not abnormal as it runs a franchise. However, its interest coverage ratio is 4.24x year to date is worse than last year’s 8.22x. While no immediate threat to the company’s viability, we need to continue to monitor its balance sheet and leverage.

Dividend Growth Analysis

Following the Yum China spinoff, Yum reduced its quarterly dividend from $0.51 to $0.30 per share. This is equivalent to a yield of 1.62%. With improving EPS, we see future dividend increase in the high single-digit to low-double digit range.

Valuation

Yum is currently trading at 26.3x of the current year EPS estimate of $2.81. Consensus estimates from 25 analysts have the company reporting EPS of $3.18 per share. Although this PE ratio is slightly above peers, we believe it is warranted given its scale and competitive advantage. Using the 2018 EPS estimate and the current PE ratio, we derived a target price of $83.63. With the dividend, we have a total return of 11.4%.

Investor Takeaway

With improving operating margin, same-store growth and net store addition, we are optimistic about Yum’s future business prospect. Not only that, the firm also has growth initiatives to accelerate its revenue and earnings growth rate. With a return of low double digit range, we believe Yum is a good investment choice.