Will TSLA Ever Pay A Dividend?

The appeal of growth stocks like Tesla, Inc. (TSLA) is that they have the potential for huge returns. However, they typically do not offer investors the steady income of regular dividends. For this reason, investors such as retirees—who often buy stocks primarily for dividends—have typically shied away from growth or “momentum” stocks like Tesla.

Instead, income investors usually flock to high-quality dividend growth stocks such as the Dividend Aristocrats, a group of stocks in the S&P 500 Index with 25+ consecutive years of dividend growth.

Over time, any company – even Tesla – could make the decision to start paying dividends to shareholders, if it becomes profitable enough. In recent years, investors saw this first-hand in the technology sector. It was once though inconceivable for Apple, Inc. (AAPL) to ever pay a dividend, but it initiated a dividend in 2012 after reaching a more mature business state.

However, the ability for a company to pay a dividend depends on its business model, growth prospects, and financial position. While many growth stocks have made the transition to dividend stocks, it is doubtful Tesla will join the dividend-paying ranks any time soon.

Business Overview

Tesla is an automotive manufacturer. It was founded in 2003. Since then, it has grown into the leader in electric vehicles, and it also has business operations in renewable energy. Tesla generated revenue of $11.8 billion in 2017. Today, Tesla stock has a market capitalization of $62 billion.

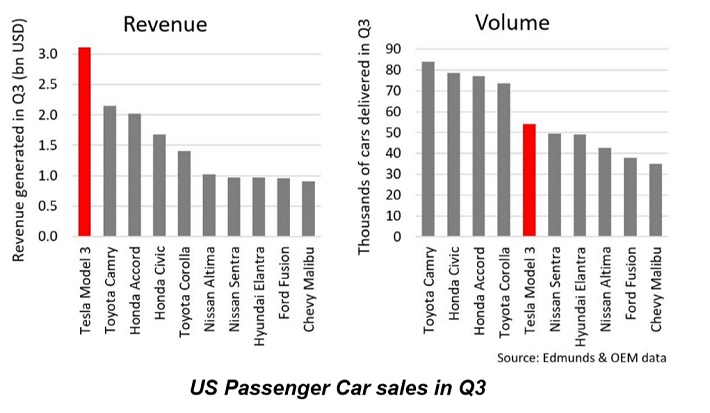

Tesla’s most recent quarterly earnings report showed the company made important progress towards stabilizing its financial position. The Tesla Model 3 was the #1 passenger car in the U.S. last quarter, in terms of revenue, and it was the fifth-highest selling car in terms of sales volumes.

Source: Quarterly Earnings

Tesla reached average weekly Model 3 production of roughly 4,300 units per week in the third quarter. With a focus on cost control, this allowed Tesla to generate GAAP net income of $312 million. The company had a gross margin above 20% for its Model production in the most recent quarter, which was above company guidance. Tesla also generated free cash flow—meaning operating cash flow minus capital expenditures—of $881 million for the quarter.

Tesla’s energy businesses also continued to grow. Energy storage deployments grew to 239 Megawatt hours, an increase of 18% from the previous quarter, and 118% from the same quarter last year. Tesla expects to triple its energy storage deployments in 2018 compared to last year. Tesla deployed 93 Megawatts of solar energy generation systems last quarter, up 11% from the previous quarter.

Tesla recorded a net profit of $1.75 per share last quarter, a strong showing of profitability. However, the company still generated a net loss of $6.56 per share over the first three quarters of 2018. While Tesla’s nine-month loss was an improvement from the net loss of $7.80 per share over the first three quarters of 2017, the company nevertheless seems to be far away from reaching consistent profitability.

Growth Prospects

Tesla’s primary growth catalyst is to expand sales of its core product line, as well as generate growth from new vehicles. In addition to the flagship Model S sedan, it has broadened its portfolio. Tesla is now looking to SUVs such as its Model X for growth, as well as from the smaller, more affordable Model 3.

Tesla is investing heavily in strategic growth, through acquisitions as well as internal investment in new initiatives. First, Tesla acquired SolarCity in 2016 for $2.6 billion. Tesla is also ramping up vehicle production. Last year, it started production of battery cells for energy storage products at its Gigafactory 1 facility. Tesla also operates the Gigafactory 2 solar power facility, and plans are in place to begin construction on the Gigafactory 3 in Shanghai. There will even be a Gigafactory 4 and a Gigafactory 5 in the not-too-distant-future.Tesla’s growth and success is part of the growth story for lithium stocks.

Tesla’s Ability To Pay Dividends

Tesla has experienced rapid growth of shipment volumes and revenue in the past several years. But ultimately, a company’s ability to pay dividends to shareholders requires success on the bottom line as well. While Tesla has been the epitome of a growth stock through its top-line growth and huge share price gains, it has still not become a consistently profitable company. Without earnings and free cash flow, a company simply cannot afford to pay a dividend to shareholders. In fact, consistently losing money means a company will have trouble keeping its doors open, if losses persist over time.

Tesla has reported losses consistently over the past several years. For example, despite generating revenue of $11.8 billion in 2017, Tesla reported a net loss of $1.96 billion. On a per-share basis, Tesla lost $11.83 per share last year. Looking back further, Tesla has lost money each year for the past decade. It goes without saying that a money-losing company has to raise capital to continue to fund operations. To that end, Tesla has sold shares and issued debt, both of which make paying a dividend even more difficult.

Tesla’s share count increased by 15% in 2017, and the company’s long-term debt rose by $4.42 billion last year. Tesla ended 2017 with $15.35 billion in total long-term debt on the balance sheet, compared with cash and cash equivalents of $3.47 billion at year-end. Tesla’s growing debt will need to be repaid, and with a weak credit rating and interest rates on the rise, debt repayments will be a considerable burden on the company’s ability to pay a dividend to shareholders.

Making matters worse is that Tesla’s equity issuances over the several years have diluted existing shareholders. Its share count rose by 39% in the past five years. This will also challenge Tesla’s ability to pay a dividend, because with so many shares outstanding, initiating even a small dividend would cost the company a significant amount of cash.

Final Thoughts

Tesla has been among the market’s hottest stocks over the past 10 years. Shareholders who had the foresight to buy Tesla at any time in the past have been rewarded with huge returns through a soaring share price.

However, investors looking for dividends over the long run should probably take a pass on Tesla stock . The company needs to use all the cash flow at its disposal to bring its operations to profitability, invest in growth initiatives, and pay down debt. As a result, it is unlikely Tesla will ever pay a dividend, at least not for the foreseeable future.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more