Will Oracle Amazon Cloud Computing War Boost Oracle's Shares Price?

According to Oracle (ORCL), Oracle OpenWorld 2016, which is being held September 18 – September 22, in San Francisco, is the industry's most important business and technology conference for the past 20 years.

In the conference, Oracle is aggressively focusing on the cloud. The company announced a list of new and enhanced cloud services and informed that it signed an agreement to acquire privately held cloud access security broker Palerra. According to Oracle, Palerra offers a unique combination of visibility into cloud usage, data security, user behavior analytics, and security configuration, with automated incident responses. Customers can respond to cloud security incidents in real-time, protecting sensitive company data and workloads across all of the leading cloud services.

The new acquisition along the July 28, announcement of the acquisition of NetSuite (N), the very first cloud company, demonstrates Oracle's decision to be a leader in cloud. Moreover, in the conference, Oracle Executive Chairman, and Chief Technology Officer, Larry Ellison said that Amazon.com, Inc. (AMZN) databases are 20 years behind the latest release of the Oracle Database in the Cloud. Ellison also said:

"Oracle's new technologies will drive the Cloud databases and infrastructure of the future. Amazon are decades behind in every database area that matters, and their systems are more closed than mainframe computers."

Oracle is trying to take cloud computing customers from Amazon AWS. If it succeeds it can increase its cloud revenues significantly and boost its shares price. According to Oracle, its second-generation Infrastructure-as-a-Service (IaaS) data centre solutions will offer customers a much higher technical performance than Amazon Web Services (AWS) and at a lower price. According to the IT research company Gartner, IaaS is expected to increase at a compound annual growth rate (CAGR) of 32% until 2020, the highest rate in the cloud market.

On September 15, Oracle reported its first quarter fiscal 2017 financial results. The company missed expectation on both top and bottom line, what caused its shares to fall 4.7% in the next trading day.

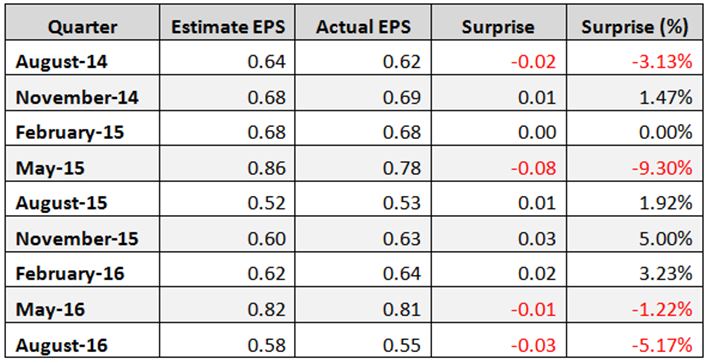

Oracle's adjusted earnings-per-share of $0.55, missed expectations by $0.03 (5.2%). Revenue increased 1.7% from the same quarter a year ago to $8.595 billion, however below consensus of $8.7 billion. The company missed earnings-per-share estimates in its last two-quarters, after beating expectations in its previous three-quarters, as shown in the table below.

In the report, Oracle CEO, Safra Catz said:

"Our Cloud business plus our On-Premise Software business grew 7% in constant currency in the first quarter, on a non-GAAP basis. The overall top-line growth of our two strategic businesses was driven by non-GAAP SaaS and PaaS revenue growing 82% in constant currency, substantially outperforming our guidance. As our SaaS and PaaS business continues its rapid growth, we expect its gross margins to climb from 62% this quarter toward our 80% target."

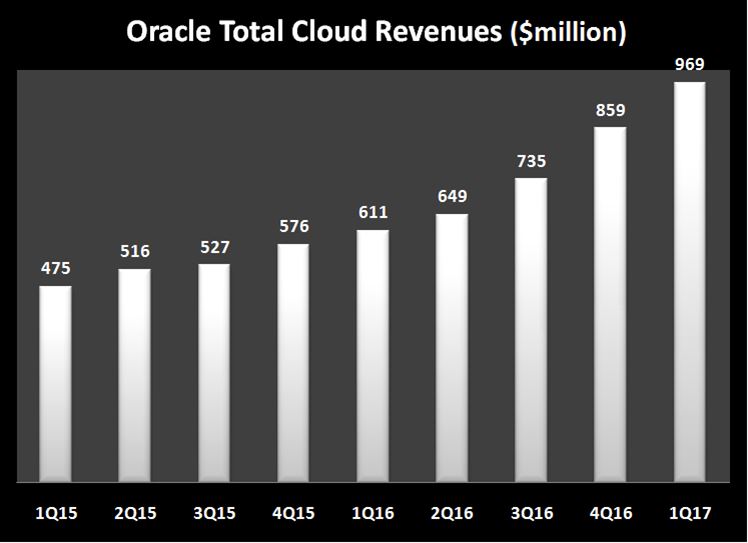

Although total cloud revenues of $969 million accounted for only 11.3% of Oracle's revenues in the first fiscal quarter of 2017, cloud revenues growth has been impressive. Cloud revenues were up 12.8% from the previous quarter and up 58.6% year-over-year. At the same time, total on-premise software revenues of $5,822 million were down 23.2% from the previous quarter and down 0.4% year-over-year.

Source: company's reports

Oracle Stock Performance

Since the beginning of the year, ORCL's stock is up 8.2% while the S&P 500 Index has increased 5.8%, and the Nasdaq Composite Index has gained 5.7%. However, since the beginning of 2012, ORCL's stock has gained only 54%. In this period, the S&P 500 Index has increased 72%, and the Nasdaq Composite Index has risen 103.3%. According to TipRanks, the average target price of top analysts is at $44.44, which indicates an upside of 12.5% from its September 22 close price, which appears reasonable, in my opinion.

Chart: TradeStation Group, Inc.

Valuation

Oracle's valuation metrics are pretty good. The trailing P/E is at 18.77, and the forward P/E is low at 13.72. The quick ratio is extremely high at 4.90, the price to free cash flow is at 32.61, and the Enterprise Value/EBITDA ratio is low at 10.03.

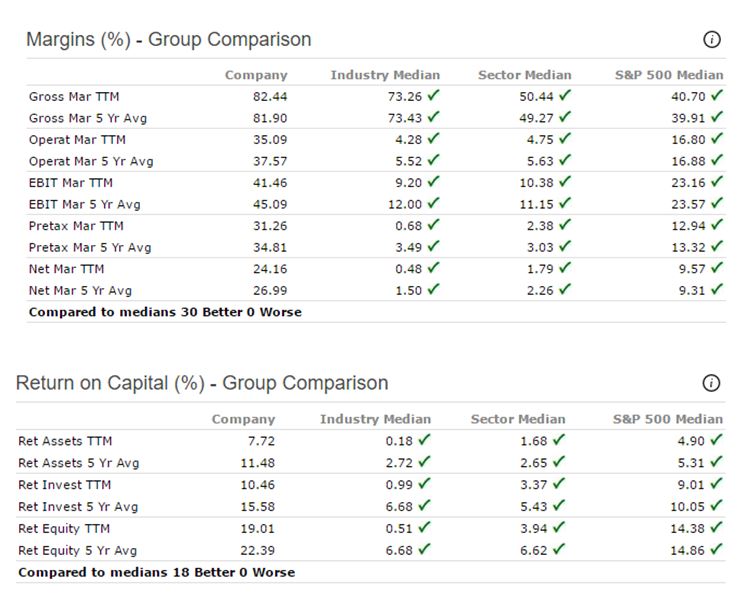

In addition, Oracle's Margins and Return on Capital parameters have been much better than its industry median, its sector median, and the S&P 500 median as shown in the tables below.

Source: Portfolio123

Conclusion

Oracle is aggressively focusing on the cloud. The company announced a list of new and enhanced cloud services and informed that it signed an agreement to acquire privately held cloud access security broker Palerra. Oracle is trying to take cloud computing customers from Amazon AWS if succeeds it can increase its cloud revenues significantly and boost its shares price. According to Oracle, its second-generation IaaS data centre solutions will offer customers a much higher technical performance than Amazon AWS and at a lower price. The average target price of top analysts is at $44.44, which indicates an upside of 12.5% from its September 22 close price, which appears reasonable, in my opinion.

Disclosure: None.