Will NFLX Ever Pay A Dividend?

The decision whether a company should pay a dividend is a complex one. Dividends can be a major part of a company’s capital allocation strategy. For example, the Dividend Aristocrats are a group of 53 stocks in the S&P 500 that have raised their dividends for 25+ years in a row.

Other companies do not pay dividends at all, and use cash flow for other purposes, which might include growth investments, acquisitions, debt repayment, or share buybacks. The technology sector includes many stocks that do not pay dividends to shareholders, particularly Internet-based companies.

Netflix (NFLX) does not currently pay a dividend, and never has as a public company. That does not necessarily mean non-dividend paying stocks are a bad investment. Far from it—Netflix stock has increased nearly nine-fold from its five-year low price of $40 in October 2013.

Many large technology companies now pay dividends to shareholders, which brings up the question: will Netflix ever pay a dividend?

Business Overview

Netflix is a media giant, with more than 130 million memberships in over 190 countries around the world. Netflix offers a wide variety of second-run television shows and movies, and also produces its own original content.

Source: Content Presentation, page 6

The company started out as a DVD-by-mail provider, but in recent years has shifted to streaming content over the Internet.

Netflix subscribers get access to a huge library of TV series, documentaries, and feature films across a wide variety of genres. Netflix has invested heavily in curating and producing the best content, which has been crucial to its massive subscriber growth in recent years.

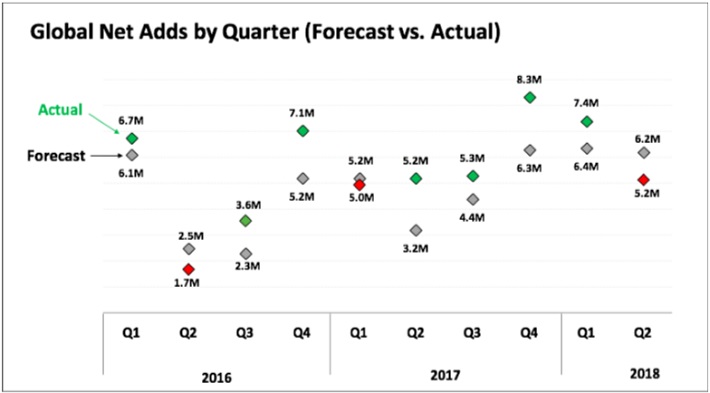

Source: Earnings Presentation, page 2

This has resulted in huge revenue growth over the years. From 2013-2017, Netflix grew revenue by approximately 28% per year. Earnings-per-share have grown at a 48% annual rate in that time, but despite that growth, Netflix still does not pay a dividend.

One reason for Netflix’s lack of a dividend is that the company is not highly profitable. Netflix had earnings-per-share of $1.25 per share in 2017, for a low earnings yield of approximately 0.35%. Netflix has very high content costs, which explains its low earnings yield and lack of a dividend.

Reasons For Paying A Dividend

Dividends are an important part of many companies’ capital allocation programs. Some companies, such as Dividend Aristocrats like Walmart (WMT) and Johnson & Johnson (JNJ), have raised their dividends for several decades running. A few companies such as General Mills (GIS) have paid dividends to shareholders for over 100 years.

Even companies that were very reluctant to pay dividends have joined in the dividend parade. Shareholders of traditionally non-dividend paying sectors, such as technology, have embraced dividends as part of their capital allocation programs. Companies such as Apple (AAPL) have initiated dividends over the past decade, due in large part to rising shareholder demands for them.

The appeal of dividends is clear. In times of recessions or stock market downturns, dividends represent a cushion against falling stock prices. When the markets are rising, dividends only add to shareholder returns. In any case, dividends provide shareholders with a real return—dividends are cash payments that shareholders can spend on anything they want.

For income investors such as retirees, dividends can help replace lost income from no longer working. The working-age eventually stops for everyone, but life’s expenses never do. That is why dividend stocks can be such a valuable component of a retirement strategy.

But growth stocks like Netflix are much different than dividend stocks like Walmart or Johnson & Johnson. Netflix still has to spend huge amounts of capital on content, which is a necessary expense to retain subscribers and continue to grow its subscriber base.

In 2017, Netflix spent $9.8 billion on additions to its streaming content assets. Realistically, Netflix may always have very high content costs, a necessary evil to maintain its competitive edge. There are many competitors in the streaming space, which casts doubt on whether Netflix will ever pay a dividend to shareholders.

Will Netflix Ever Pay A Dividend?

While there are many good reasons for paying a dividend, there are also valid reasons not to. Ultimately, in order for a company to pay a dividend to shareholders, it has to generate the necessary cash flow to do so. Companies that are not consistently profitable, such as Netflix, simply do not have the profitability to return cash to shareholders.

According to Netflix’s 2017 annual report, the company generated earnings-per-share of $1.25 in 2017. This was its highest earnings-per-share recorded in the past five years. While the company theoretically could pay a dividend, it chooses not to, instead preferring to reinvest all of its earnings back into the business.

Netflix has generated negative free cash flow in each of the past five years, with accelerating negative cash flow in that time. In 2013, the company recorded negative free cash flow of $16.3 million; in 2017, Netflix was free cash flow negative to the tune of $2.1 billion. This means the company must continue to raise capital—primarily through selling shares and raising debt—to continue funding growth initiatives.

Clearly, a dividend is simply not on the map for Netflix management, perhaps rightfully so. Netflix stock has massively outperformed the broader market in the past several years.

Final Thoughts

A company’s capital allocation strategy is never set in stone. It is possible that Netflix one day will pay a dividend. If the company successfully vanquishes competitors and becomes so large that it is highly profitable, the company could choose to pay a dividend at that point.

However, that seems to be years away, if ever. Until then, Netflix management appears content to use all available cash to reinvest in the business. The company has plowed billions of dollars into producing original content, which will most likely continue to be its biggest strategic priority for many years.

There are good reasons to invest in Netflix, including its incredible growth rate, but a dividend is not one of them. Netflix stock could continue to richly reward shareholders, as it has for the past several years, but risk-averse investors looking for dividend income should look elsewhere.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

While I agree that the above reasoning explains the lack of dividend, it's also important to point out that dividends should logically be paid out when a company cannot reinvest earnings at higher rates of growth. In the case of Netflix, its entire progression defies basic economics, since the stock price does not reflect the economic reality of the company. Netflix is questionably profitable, and has deepening debt. It is true that it shouldn't pay dividends, since it doesn't have earnings to pay out. More to the point, however, is that the valuation of Netflix is way beyond any economic/business justification. It's simply a popular stock, who's share price is driven by popularity, and not by fundamental economics. This makes it a speculation, and a potentially dangerous one.

It is easy to see why they don't. They are cash flow negative. they also have a boat load of debt. Also, in a rising interest environment their financing costs go up. If they want to stick around as a viable entity they better not pay dividends.

The last issue is competition. It is heating up and chock full of heavyweights who can burn cash and don't need their services to be profitable for years. This industry is increasingly becoming a game of monetary chicken.

I had wondered about why there were no dividends, so thanks for the clear explanation. and the explanation makes complete sense.