Why This World-Class Economist Is Dead Wrong About Dividends

I had just finished my oatmeal when the economist told me why he didn’t like dividends.

“Shouldn’t a company use its capital to earn a greater rate of return rather than pay shareholders dividends?” he asked incredulously.

Now, it’s easy to bash economists and say they’re nothing but academics with no real-world experience. But this one manages money, consults with companies and, I have to admit, is very smart.

But he was dead wrong about dividends…

And I was going to have to prove it the next day in front of about 200 people.

We were in Las Vegas having breakfast prior to our panel discussion at FreedomFest, a Libertarian conference that celebrates “great books, great ideas and great thinkers.” There are many investment-related sessions and presentations during the four-day event.

When the session started, the three other panel members, including Oxford Club Chief Investment Strategist Alexander Green, each gave an eight-minute talk about their investing style.

Then it was my turn.

Within minutes, the economist interrupted me with the question he asked at breakfast…

Shouldn’t a company use its capital to earn a greater rate of return rather than pay shareholders dividends?

“That assumes there are infinite possibilities to invest the money at a high rate of return,” I answered. “Look at Apple, it’s sitting on $250 billion in cash.”

There are plenty of companies that invest in new technology, acquire other companies to grow their businesses and pay strong dividends as well. Cisco Systems (Nasdaq: CSCO) and Qualcomm (Nasdaq: QCOM) are a couple that come to mind.

I continued with my presentation, only to be stopped short again.

“I don’t mean to interrupt,” he interrupted. He then went on to tell a story about advising a company to invest in its business to achieve a higher rate of return rather than pay shareholders a dividend.

He said Warren Buffett was interested in investing in the company and met with him to discuss it.

“And you know, Warren Buffett probably agrees with me. After all, in all its years, Berkshire Hathaway has never paid a dividend,” he smugly declared.

I waited a beat.

“Yes, but Warren Buffett sure as heck loves receiving them,” I countered. “If the greatest investor in the world likes collecting dividends, then I’m in good company.”

To be clear, I don’t like owning dividend payers simply because Warren Buffett does. They outperform the market and have done so for decades.

And the kind of dividend payers that I recommend – Perpetual Dividend Raisers, companies that raise their dividends every year – crush the broad market.

Dividend Aristocrats are Perpetual Dividend Raisers that have raised their dividends every year for 25 years or more. They also must be members of the S&P 500 to be included in the Aristocrat index.

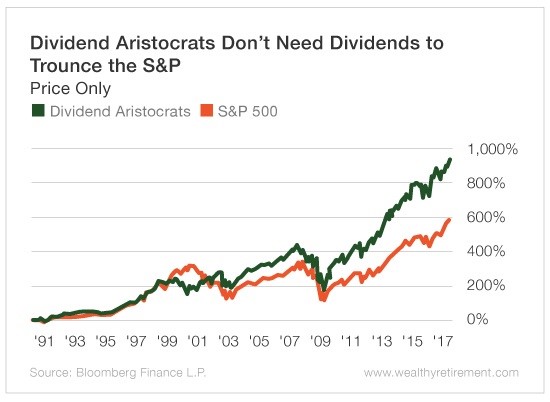

And look at the staggering outperformance of the Dividend Aristocrats.

Since the index was created, the Dividend Aristocrats index’s total return (including dividends) is 2,116%. The S&P’s total return is 1,162%.

(Click on image to enlarge)

That means that $10,000 invested in the Aristocrats created a nest egg of $221,600. Meanwhile, investing $10,000 in the S&P 500 totaled $126,200. That’s some difference.

I can hear the economist’s response now: Much of that had to do with the dividend, and if that money had only been invested in higher returning investments…

But that argument doesn’t hold up, because the Aristocrats outperformed on just price as well.

Since 1990, the Aristocrat index has appreciated 933%, while the S&P is up 601%. Again, this does not include any dividend payments.

On price only, the Aristocrats beat the broad market by 332 percentage points.

(Click on image to enlarge)

While the economist blathered on to show everyone how smart he was, I let the numbers do the talking.

He can have all of the theories he wants and advise household-name companies, but I’m sticking with what has worked for decades.

Investing in stocks that pay and raise their dividends is the best way to generate outstanding long-term returns that soundly beat the market.

Disclaimer: Nothing published by Wealthy Retirement should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not ...

more