Why I Am Not Worrying About Warren Buffett’s Record Stash Of Cash

A recent Business Insider (BI) heading warned boldly: “Why Warren Buffett’s record-breaking cash stockpile should have investors very worried.”

The BI’s evidence comes in the form of a record stash of over $130 billion of idling cash combined with major indices, like the S&P 500 (SPY), at or near all-time highs. Putting the two observations together, Business Insider concluded that the market must be “overvalued and overly expensive.”

The logic is deceptively simple. If the market were cheap, Buffett would draw down on all that cash and buy the bargains. Since he is instead letting the cash pile ever higher, he must think assets are too expensive to buy. BI even references Buffett’s last annual report where the Oracle of Omaha complained that high prices prevented most deal-making in 2017. The S&P 500 gained 19% in 2017 while Berkshire Hathaway (BRK-A) out-performed with a 22% return. Not bad for a year devoid of deals.

Most importantly, the article includes a chart showing the amount of cash on-hand at Buffett’s Berkshire for each quarter since 1996 alongside a line graph of the S&P 500 (SPY). The chart visually demonstrates the correlation between Buffet’s cash and the stock market. Like the stock market, the stash of cash has risen impressively since the last trough in 2009 during the recession. Starting in 2011 and 2012 and then consistently from 2014 until now, Berkshire’s cash stash hit all-time highs. Despite these on-going string of all-time highs, the S&P 500 refused to top out. The jury is still out on January’s all-time high which the index almost matched this month. Still, the rationale linking 2018’s all-time highs to the imminence of the ultimate calamity is not as clear as the article implies:

“As you can see, Buffett held comparatively high levels of cash in the periods preceding the two most recent market crashes, in 1999 and 2007.”

What the chart shows is a cash pile that is coincident with the stock market and NOT a leading indicator. If all-time highs of cash predicted market tops, then the market should have topped out for at least the last 3 to 4 years. We also must wonder why and how Buffett was able to do deals during all the years when cash continued to grow; in other words, all-time highs in cash also fail to say enough about the amount of deal-making occurring. Finally, Buffett’s cash increases with the stock market and both tend to follow the fortunes of the economy: Buffett probably makes more money as the stock market and the economy strengthens. Of course then during the good times, he can find his fortunes increasing faster than he can spend them (the guy IS frugal, right?).

Buffett is legendary for buying assets on the cheap. So I have another problem with fearing BI’s spurious conclusion. I am relieved to see Buffett’s cash increase: history shows a decline in Buffett’s cash coincides with a poor and/or declining economy and stock market. Buffett’s cash hit big troughs during the last two recessions. Do I prefer a market in the toilet and cheap enough for a Buffett buying spree, or do I want a rising market where everyone participating is benefiting from wealth-creation? I prefer the latter. Maybe if I had spare billions lying around, I would not care much either way.

A market crash could indeed be around the corner. The market crash could be in 2019 or 2020 or later. I bet Buffett’s cash will be at new record levels just ahead of that crash – cash records will likely exist for EACH year until that crash happens. This kind of relationship does NOT provide a leading indicator. Following that lead keeps you trapped in fear for long portions of bull markets.

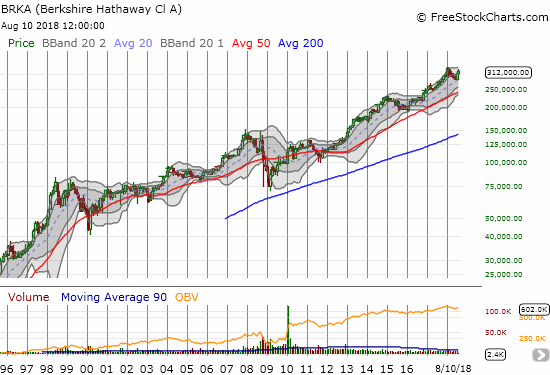

Along with its cash, the price of Berkshire Hathaway (BRKA) has a knack for making all-time highs over extended periods of time. Can you tell exactly where the sign of a top occurs…?

Disclosure: long SPY put option

Follow Dr. Duru’s commentary on financial markets via more