Why Hormel Foods Investors Can Expect At Least A 15% Dividend Increase Soon

Hormel Foods (HRL) is a legendary dividend stock. It has paid 353 consecutive dividends to shareholders. The company has paid a dividend consistently going all the way back to its IPO in 1928.

And, Hormel has increased its dividend each year for the past 50 years in a row. It is a Dividend Aristocrat. You can see the entire list of Dividend Aristocrats by clicking here.

One of the rules for being a Dividend Aristocrat is that a company must have raised its dividend for at least the past 25 years. This means Hormel would qualify as a Dividend Aristocrat twice over.

Hormel typically raises its dividend in November, in time for its first-quarter payout. Consequently, it is due for another hike.

Here’s why investors can expect a very strong raise from Hormel this year.

Business Overview

Hormel traces its roots all the way back to 1891, when George A. Hormel formed the Geo. A. Hormel & Co.

Today, Hormel generates more than $9 billion of annual sales. Hormel manufactures consumer-branded food and meat products. It operates five operating segments:

- Refrigerated Foods (50% of sales)

- Jennie-O Turkey (18% of sales)

- Grocery Products (17% of sales)

- Specialty Foods (9% of sales)

- International & Other (6% of sales)

It has a large portfolio of brands, spread across product categories.

Source: Company website

The reason Hormel has been such an outstanding dividend growth stock over time is its steady growth. For example, over the past decade, the company grew earnings-per-share by 10% per year. It achieved earnings growth in 27 out of the past 30 years.

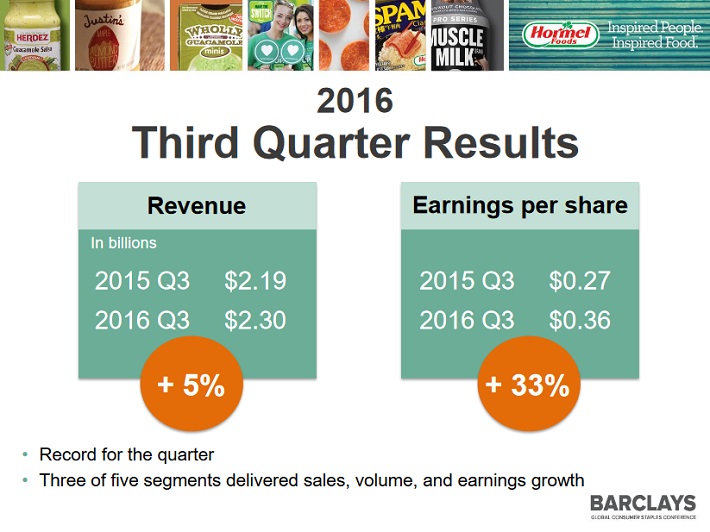

Hormel is off to an even more impressive start in 2016. The company generated record earnings-per-share last quarter.

Source: Barclays 2016 Consumer Staples Conference, page 4

The best-performing segment last quarter was Jennie-O. This business increased earnings-per-share by 59%, thanks to 20% sales growth during the quarter.

Hormel acquired Jennie-O in 2001, for $334 million. This deal has worked out tremendously well for Hormel, and demonstrates the company’s skill at making successful acquisitions.

Jennie-O generated $237 million of operating profit over the first three quarters of 2016 alone.

Future earnings growth could easily surpass 10% each year, based on Hormel’s many growth catalysts.

Growth Prospects

Hormel plans to continue growing sales through internal investments as well as acquisitions. A relatively recent acquisition that has very high potential for the company is its $775 million acquisition of Applegate Farms last year.

Applegate Farms owns the Applegate brand, which markets natural and organic prepared meats, such as deli meat, bacon, and hot dogs. It is the number one brand in natural and organic meats.

This is a very attractive acquisition for Hormel. First, is because it diversifies Hormel’s product offerings into organics. Natural and organic food is an emerging, high-growth category because it appeals to health-conscious consumers.

And, the acquisition fits perfectly into Hormel’s existing portfolio, which means there are significant cost synergies to drive margin expansion.

Last quarter, the Applegate business helped sales in the Refrigerated Foods segment increase 9%. Meanwhile, cost synergies resulted in 24% growth in segment profit, year over year.

In addition, the 2014 acquisition of CytoSport Holdings gives the company further entry into nutritional products. CytoSport is the maker of MuscleMilk protein products. MuscleMilk is a leading brand in its category, and is another way for Hormel to capitalize on the health and wellness trends.

Source: Barclays 2016 Consumer Staples Conference, page 14

Hormel is adept at cutting costs to improve efficiency. It keeps constant focus on cost controls, in administrative functions, capacity optimization, yield improvements, and maximizing utilization of raw materials.

These initiatives allow Hormel to be near the top of its peer group in return on invested capital.

Source: Barclays 2016 Consumer Staples Conference, page 7

This is why Hormel expects 2016 to be a great year. The company expects earnings-per-share to grow 21%-24% for the year.

Growth will be based on a combination of factors, including organic revenue growth, growth through acquisitions, margin expansion, and share repurchases.

Source: Barclays 2016 Consumer Staples Conference, page 11

Hormel’s aggressive acquisition strategy has been a key contributor to its earnings-per-share growth. From 2010 through the third quarter 2016, it has generated $2.3 billion of sales growth from acquisitions.

Dividend Analysis

It is not an exaggeration to suggest that Hormel may raise its dividend by 15%-20%. This would be a very high rate of growth, but Hormel’s fundamentals support such a generous raise.

The company enjoys strong brands, economies of scale, and several future growth catalysts working in its favor. Not only that, but it also has sound dividend metrics.

For example, Hormel’s current annualized dividend of $0.58 per share represents 36% of its projected 2016 earnings-per-share. That is a very comfortable payout ratio that leaves plenty of room for dividend growth.

Given Hormel’s earnings-per-share growth rate, it could pass along a 15%-20% dividend increase this year and barely raise the payout ratio.

Hormel is no stranger to high dividend growth. Its 2015 dividend raise was 16%. Such high dividend growth rates help compensate investors for the stock’s relatively low dividend yield. Hormel stock has a 1.5% dividend yield.

A 15% raise would lift Hormel’s forward annualized dividend payout to approximately $0.67 per share. This would boost the stock’s dividend yield to 1.9%.

Final Thoughts

Hormel has a below-average dividend yield compared with the S&P 500. But investors are treated to high dividend growth rates each year.

Over time, an investor’s yield on cost can rise rapidly with Hormel’s double-digit dividend growth each year.

Hormel has raised its dividend by 10% or more for several years. Based on its strong fundamentals and growth catalysts, it is likely the company will pass along another generous dividend raise in 2016.

Investors should expect a 15% dividend increase from Hormel by the end of November.

Disclosure:

more