Why Apple Has A Shot In The Electrical Vehicle Market But It Won't Be Overnight

Long term stock picking is not about being right about the next line of products for a given company. In my view, it is about understanding how an organization works and thinks. This way we can measure the organization's ability to build great products and services. When you look from this perspective, you can understand why the "father" of growth investing, Mr. Philip Fisher, was able to successfully keep Motorola in his portfolio for more than 4 decades which, coincidentally, were the best 4 decades of the company.

Basically, I avoid focusing too much on the next line of products and try to focus on what led the concept team to design that product. What needs were they answering? Who are they targeting? Often, the answer is the company needs to ship X million units this quarter. This is the recipe for long term failure.

Hedgehog concept

I will never forget how former Nokia (NYSE:NOK) execs used to start their quarterly presentations by stating how they had shipped millions of devices during the prior quarter. Obviously the company was focused on the production, not on the consumer's needs, and therefore they've lost their hedgehog concept. Apple (NASDAQ:AAPL) on the other hand, has been focused on removing usability obstacles in its products and services. That has been the hedgehog concept for Apple. Remember the Apple II? Computers used to be complicated boards and wires mounted together by hobbyists in a process that took long hours, was expensive and lacked a standard operating system. Apple solved this problem by putting together a machine that was already built with a ready-to-use OS. This was all about removing user obstacles in order to target the mass market. The Macintosh was an even greater step by bringing the graphical user interface to the computer and reducing even more the learning curve. All this has been Apple's trademark.

There is one more ingredient, a gift that Steve Jobs left during his 2nd stint at the company: He recruited the best and influenced his staff to do the same. Steve Jobs left Apple with a top notch staff team and that is why 3 years after Steve Jobs has left us, Apple presented the best quarterly earnings that any company has ever been able to deliver.

All in all, these are the reasons why Apple is likely to have a real shot in the car market: Focus on removing usability obstacles and having the best staff to do it properly.

Potential for improvement in the Auto Industry

"Always listen to experts. They'll tell you what can't be done, and why. Then do it." - Robert Heinlein

Where is there room to improve in the auto industry and particularly in the EV marketplace? The obvious answer is mileage. This is a good starting point. A recurrent problem when companies are at the crossroads of different technologies aiming to achieve the same end is the struggle to get it right. And the ones who get it right can't really understand why they succeeded while others failed. This is something Apple has learned to do well. Apple never compromises on what matters: utility to the consumer. If a consumer feels he needs to do 400 miles on a single charge, then you can count on Apple to deliver 600 miles per charge. Just think about the MacBooks and how Apple turned battery life from 1-2 hours to 7-8 hours. Apple has exhibited a clear advantage at the moment of choosing the right technology for its products and services. Additionally, there is the charging time problem; here we are still at a crossroads between technologies. Tesla (NASDAQ:TSLA) has gone all-in with battery swap and fast charging posts, but there are alternatives (hydrogen and other fast charging tech) that might become industry standard, which leaves Tesla pretty much exposed to its current bet.

However, to reduce the whole matter to a proper choice of technology would be an underanalysis of Apple's potential in the auto industry. Let us think for a second about the "driving interface" of a car. Looking at the way we've been driving cars since the first decades of the 20th century, we can see it as a natural antecedent to the way we drive our current machines. Cars have evolved a lot during the last century, but they've mostly evolved within the current paradigm of drivability, which is hardly different from the paradigm 50 or 60 years ago. Therefore, it makes sense to talk about self-driving cars. Let me now pause just to say that I love driving: I am going to be one of those old school guys that is going to defend the right to drive until the end of my days. However, I wouldn't mind the occasional "self-lift" home after a party. Self-driving cars are the answer to huge problems in our day-to-day life; we shouldn't neglect the potential to have cars wired in smart networks that help to avoid traffic and save energy in the process. Daily problems like finding a parking space could be solved with integration with current Apple services like maps.

The Economics of the Industry

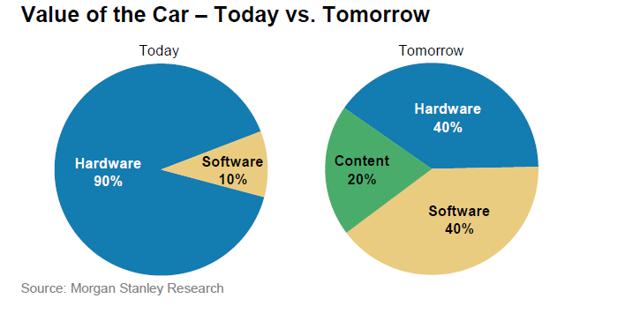

Many things have been written about the fact that the auto industry is thin on margins. I believe this is conventional wisdom getting in the way of seeing the potential ahead. Nowadays, if we use computer industry terms, we would be talking about cars being 90% hardware and 10% software (Source: Morgan Stanley Blue Paper). Apple could change that relationship a lot. This is the critical factor to achieve fatter margins and possibly even cross-sell other Apple content-rich products and services.

Graph 1 - Hardware vs Software in cars in the present and in the future

Additionally, in the near future, the production technology is also going to be under fire. 3D printing might end up being a game changer for many industries, including the auto industry. There are some examples of cars built through 3D printing, and results are encouraging. I am not aware of Apple's projects in this area, but we may end up seeing Apple developing new production technologies and then licensing it to outsourcers that will do the hard work.

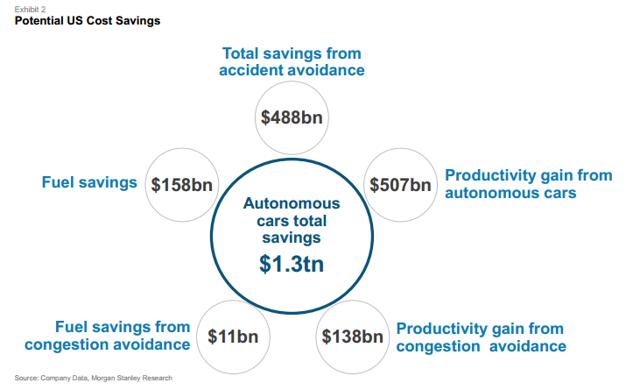

Finally, there is the impact of a revolution this size on the whole US economy:

Graph 2 - Potential impact in the US economy of autonomous cars

These numbers could be a big encouragement for policy makers in order to hasten the pace of regulation in the sector.

Let's not get ahead of ourselves

Yes, I have just taken a stand defending how Apple has the chance to be a relevant player in the auto industry. EVs are the new hype since companies like Apple and Google joined the new kid in town, Tesla, in the EV race. Obviously, these companies bring much-needed new perspectives to this old fashioned business. However, let's not get ahead of ourselves. There is one thing they won't change in the following years: the need to keep researching and developing prototypes. And this is a traditional time consuming activity for the auto producers; each new car model needs on average 5 years to go to market. Tesla took 5 years to bring its Roadster to market and took a further 4 to bring the Model S. More than this, Morgan Stanley Blue Paper estimates 5 to 10 years for complete autonomous capability and up to 2 decades to have close to 100% penetration of the technology (utopic scenario).

Furthermore, since the time to market is very different from smartphones, 5 years against 1.5 years, we are talking about slower changes in consumers' habits. Folks do not change cars like they change mobile devices or even computers. If we add the fact that there are liability issues regarding accidents involving autonomous cars, we can see that there are many issues to solve before we can have a consolidated industry.

This said, my point with this article is to argue that of all companies outside the auto sector, Apple has the best track record in terms of understanding consumers, developing products and services with a great feel, and revolutionizing business models. If the company keeps being well organized and ambitious, it may very well succeed in this wonderful old business. Just don't expect it to add much to the bottom line in the next 5 years.