What To Expect From Skyworks Solutions' Earnings Report

As a supplier of multiple chips for Apple (AAPL) mobile devices, Skyworks Solutions (SWKS) will benefit from the increasing demand for Apple's iPhones.

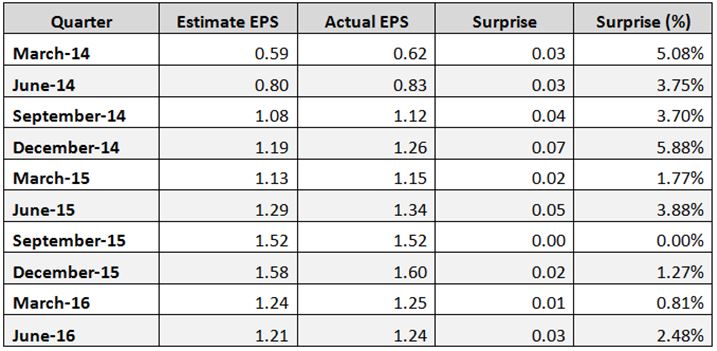

Skyworks Solutions is scheduled to report its fourth-quarter fiscal 2016 financial results on Thursday, November 03, after market close. According to 22 analysts' average estimate, SWKS is expected to post a profit of $1.43 a share, a 5.9% decline from its actual earnings for the same quarter a year ago. The highest estimate is for a profit of $1.44 a share while the lowest is for a profit of $1.40 a share, not a big difference. Revenue for the fourth quarter is expected to decrease 5.7% year over year to $831 million, according to 19 analysts' average estimate. There was one up earnings per share revision during the last seven days and one EPS up revision during the last 30 days. Since SWKS has shown earnings per share surprise in nine of its last ten quarters, as shown in the table below, there is a good chance that the company will beat estimates also in the fourth quarter.

SWKS Stock Performance

Since the beginning of the year, SWKS stock is up 2.4% while the S&P 500 Index has increased 5.1%, and the Nasdaq Composite Index has gained 4.9%. However, since the beginning of 2012, SWKS stock has gained an impressive 385%. In this period, the S&P 500 Index has increased 70.8%, and the Nasdaq Composite Index has risen 101.7%. According to TipRanks, the average target price of the top analysts is at $83.36, which indicates an upside of 5.9% from its October 14 price, however, in my opinion, shares could go even higher.

SWKS Daily Chart

SWKS Weekly Chart

Chart: TradeStation Group, Inc.

Valuation

Considering its compelling valuation metrics, SWKS stock, in my opinion, is significantly undervalued. The company has no debt at all, its trailing P/E is at 15.35, and its forward P/E is very low at 12.63. The quick ratio is very high at 6.00, the Enterprise Value/EBITDA ratio is low at 9.88, and the PEG ratio is very low at 0.90.

Ranking

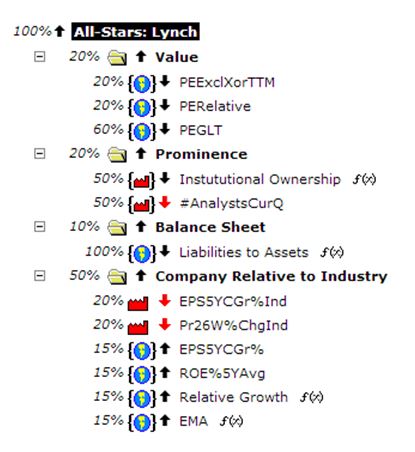

According to Portfolio123’s “All-Stars: Lynch” ranking system, SWKS stock is ranked first among all S&P 500 stocks. The ranking system is based on investing principles of the well-known investor Peter Lynch. The twenty top-ranked S&P 500 companies according to the ranking system are shown in the table below.

The “All-Stars: Lynch” ranking system is quite complex, and it is taking into account many factors like; trailing P/E, relative P/E, PEG ratio, institutional ownership, liabilities, sales growth and EPS growth, as shown in the chart below.

Back-testing over seventeen years has proved that this ranking system is very useful.

Summary

As a supplier of multiple chips for Apple mobile devices, Skyworks Solutions will benefit from the increasing demand for Apple's iPhones. Skyworks is scheduled to report its fourth-quarter fiscal 2016 financial results on Thursday, November 03, after market close. According to 22 analysts' average estimate, SWKS is expected to post a profit of $1.43 a share, a 5.9% decline from its actual earnings for the same quarter a year ago. Since SWKS has shown earnings per share surprise in nine of its last ten quarters, there is a good chance that the company will beat estimates also in the fourth quarter. Considering its compelling valuation metrics, SWKS stock, in my opinion, is significantly undervalued. The average target price of the top analysts is at $83.36, which indicates an upside of 5.9% from its October 14 price, however, in my opinion, shares could go even higher.

I am long AAPL stock