Weekly Energy Roundup: Offshore Drilling Companies, June 25 To June 29

Overall, it was a relatively slow week for oil-related news, although President Trump did ask Saudi King Salman to endorse an increase in production totaling 2 million barrels per day in an attempt to punish Iran. Thus, it seems likely that most of the fluctuations in the stock prices of offshore drillers that we saw over the past week were due to general market action or company-specific factors.

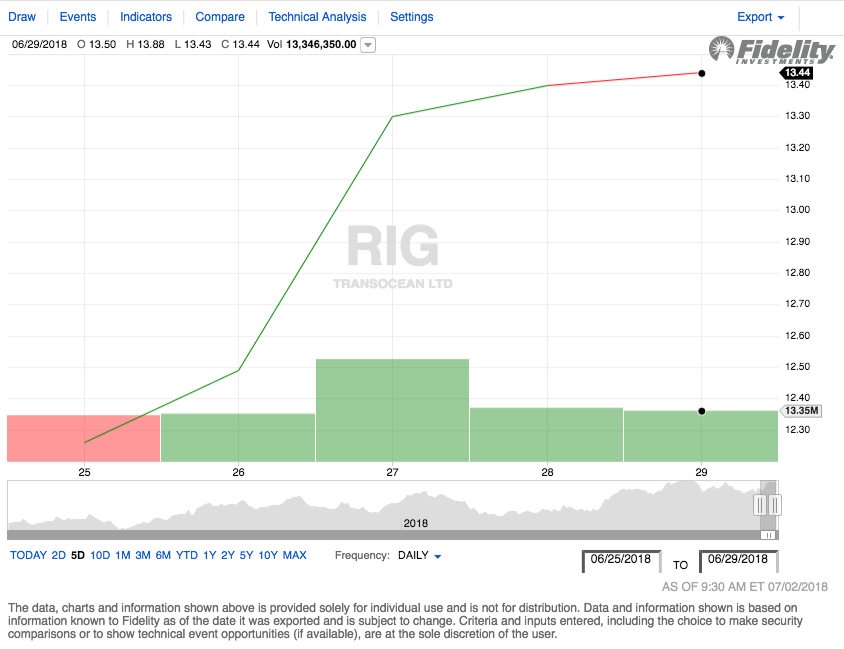

Transocean (RIG)

On Monday, June 25, 2018, Transocean opened at $12.70 per share. The stock climbed on every day over the course of the week, with its sharpest gain coming on Tuesday. Ultimately, Transocean closed out the week at $13.44. This gives the stock a 5.83% gain on the week, a rather respectable performance.

(Click on image to enlarge)

Source: Fidelity Investments

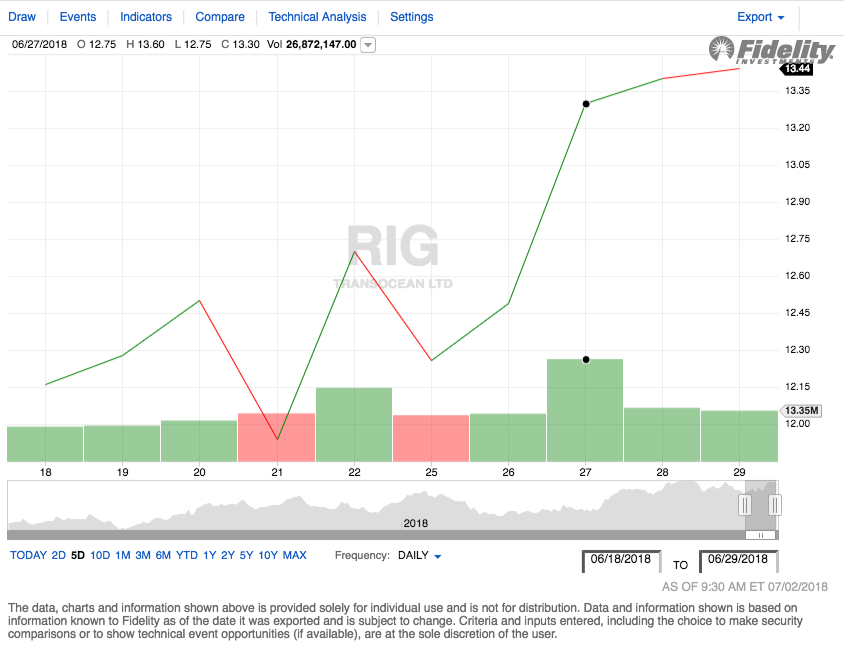

Transocean's stock performance was strongly positive over the trailing two-week period. While there were both up days and down days, the days with a positive return outnumbered those with a negative return and it returned an overall gain over the period. Transocean opened at $11.90 on Monday, June 18 and climbed to $13.44 by Friday, June 29. This gives the stock a two-week gain of 12.94%, which any investor should be able to appreciate. A trader would have had numerous opportunities to profit over the period as well.

(Click on image to enlarge)

Source: Fidelity Investments

Transocean did not have any news that significantly impacted the stock over the past week. On June 27, the company did announce a private offering of secured notes, but this is really just a refinancing of existing debt so will not have any major effect on the company except to push the maturity date of some $700 million in debt out to 2024.

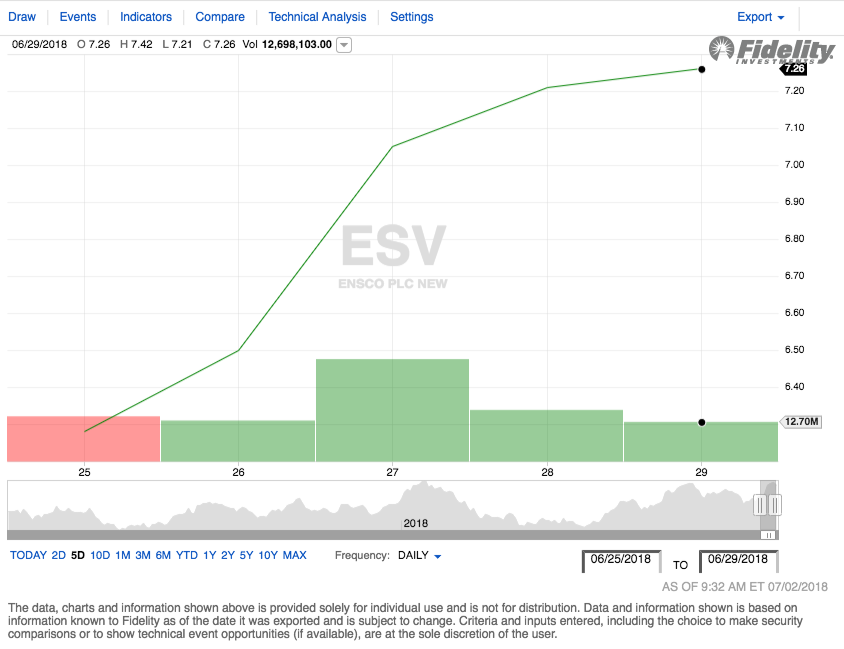

Ensco plc (ESV)

Ensco stock also increased over the week ending June 29, 2018 with almost no volatility. On June 25, the stock opened at $6.46 per share and closed out the week at $7.26 per share. Overall, the stock delivered a gain of 12.38% on the week.

(Click on image to enlarge)

Source: Fidelity Investments

The stock's performance over the trailing 10-day period was also quite strong, although the majority of the returns in the period did come during the second week. On June 18, 2018, Ensco’s stock opened at $5.80 and largely delivered daily gains over the following two-week period. The stock suffered from a surprisingly limited number of down days, delivering a 25.2% gain over the two-week period.

(Click on image to enlarge)

Source: Fidelity Investments

Ensco also had no news of any consequence over the past week. It was a quiet week overall for offshore drilling companies and the largest one in the world was no exception to that.

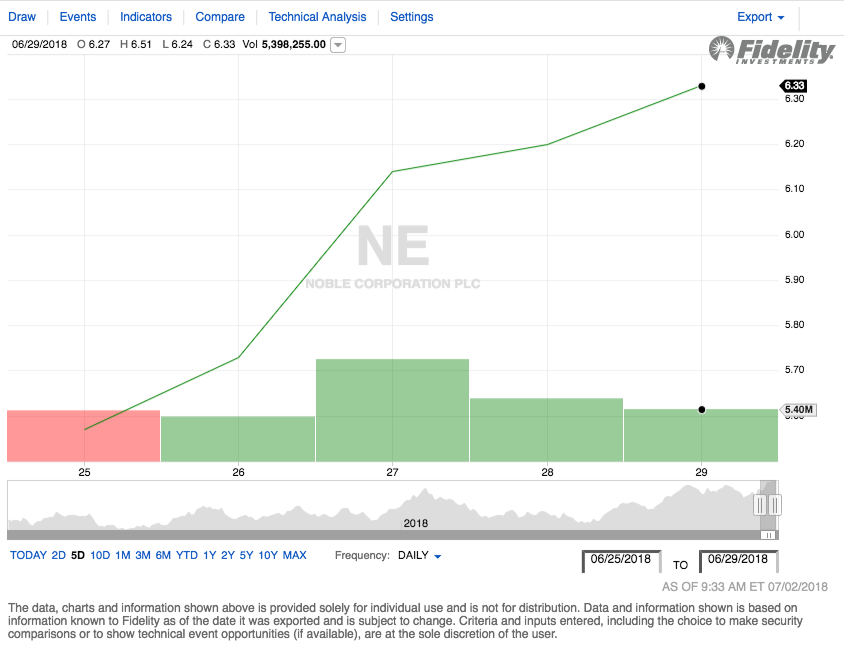

Noble Corp. (NE)

Noble’s stock also delivered strong gains to its holders over the past week. On June 18, 2018, Noble's stock opened at $5.72 per share. By the end of the week, the stock had gained $0.61 and closed at $6.33. This represents a gain of 10.66%.

(Click on image to enlarge)

Source: Fidelity Investments

Noble’s stock delivered solid gains with surprisingly little volatility over the trailing two-week period. In fact, it ended almost every single day in the black. The stock had only two down days in the period. On Monday, June 18, shares of Noble Corp. opened at $5.16. As they closed at $6.33 on June 29, the company’s stock delivered a total gain of 22.67% over the two-week period. This is certainly a performance that should be appealing to any investor.

(Click on image to enlarge)

Source: Fidelity Investments

As was the case with many of its peers, Noble had no news of any consequence over the past week. Jefferies did downgrade Noble on June 21, but that did not affect the company during the week of the 25th.

Diamond Offshore (DO)

Diamond Offshore had somewhat more volatility in its stock price over the past week than some of its peers, but it likewise delivered a gain to stockholders. However, unlike the other peer companies already discussed, the stock did not reach its highest level on Friday due to a loss that it suffered on Wednesday. Diamond Offshore’s stock opened the week at $19.74 per share. The stock closed out the week at $20.86 per share, giving the company a return of 5.67% over the week.

(Click on image to enlarge)

Source: Fidelity Investments

The stock exhibited considerable volatility over the past two weeks, at least when compared to its peers, giving traders plenty of opportunities to profit. On Monday, June 18, 2018, Diamond Offshore opened at $18.35 per share and proceeded to deliver a series of daily gains and losses. Overall, the stock delivered a gain of 13.68% over the two week period.

(Click on image to enlarge)

Source: Fidelity Investments

As was the case with many of the company's peers, Diamond Offshore had no notable news over the past week.

Rowan Companies (RDC)

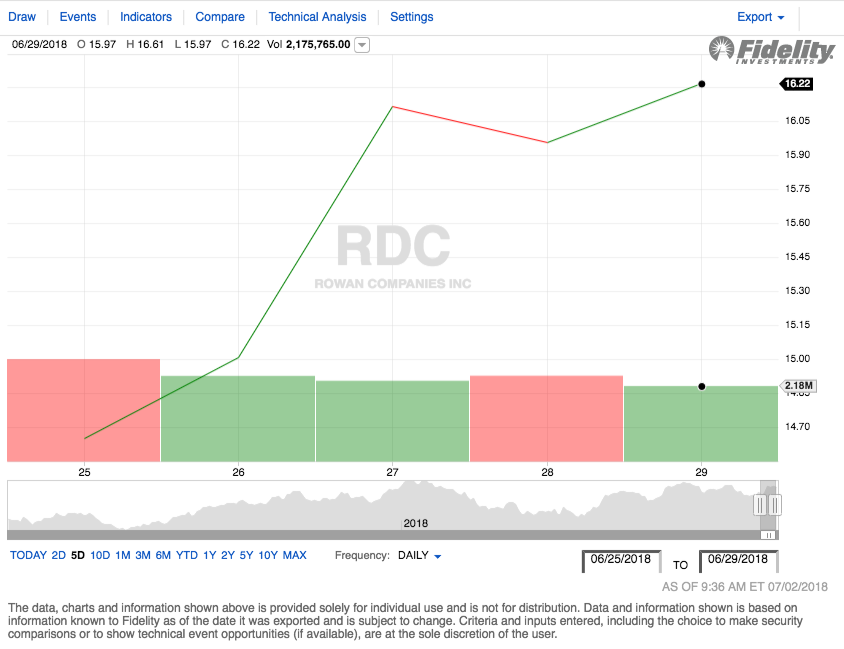

Rowan's performance over the past week was quite similar to Diamond Offshore. As with its peer, Rowan did hand investors an intra-day loss on Wednesday. In this case, though, the stock was able to recover and did close out the week at its highest point. Rowan opened at $15.19 per share on Monday, June 25, 2018 and closed out the week at $16.22. This represents a gain of 6.78% over the week.

(Click on image to enlarge)

Source: Fidelity Investments

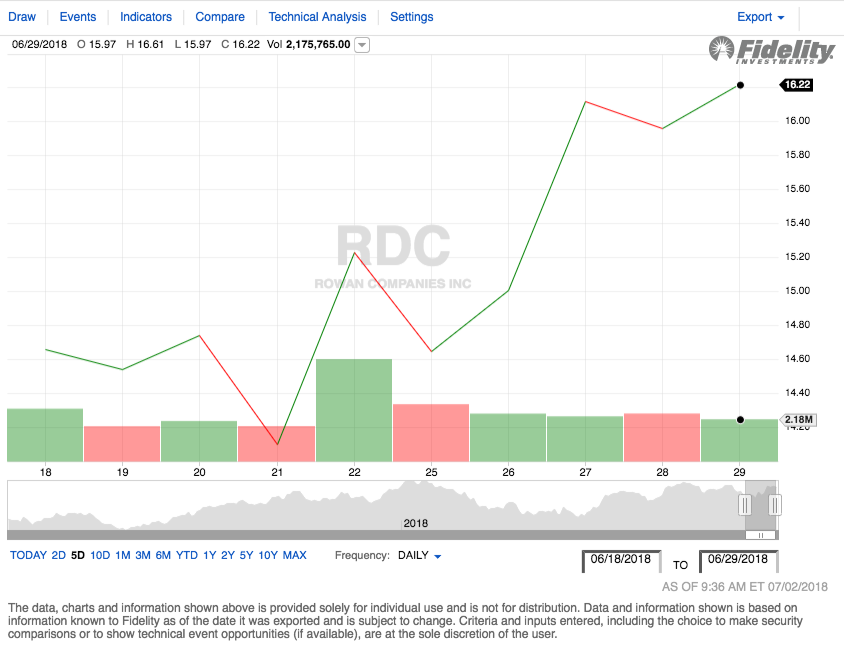

Rowan’s two-week stock price performance was overall very strong, although it did have a few down days. On Monday, June 18, 2018, Rowan shares opened at $14.56 and declined fairly quickly before recovering on the following day. Overall, the stock delivered a two-week gain of 11.40%.

(Click on image to enlarge)

Source: Fidelity Investments

As with many of its peers, Rowan had no notable news affecting the stock this week. It does seem to be less followed than some of the other companies discussed here by the American financial media as well so what impact that has could be anybody's guess, but that may have an impact on its overall performance.

Seadrill (SDRL)

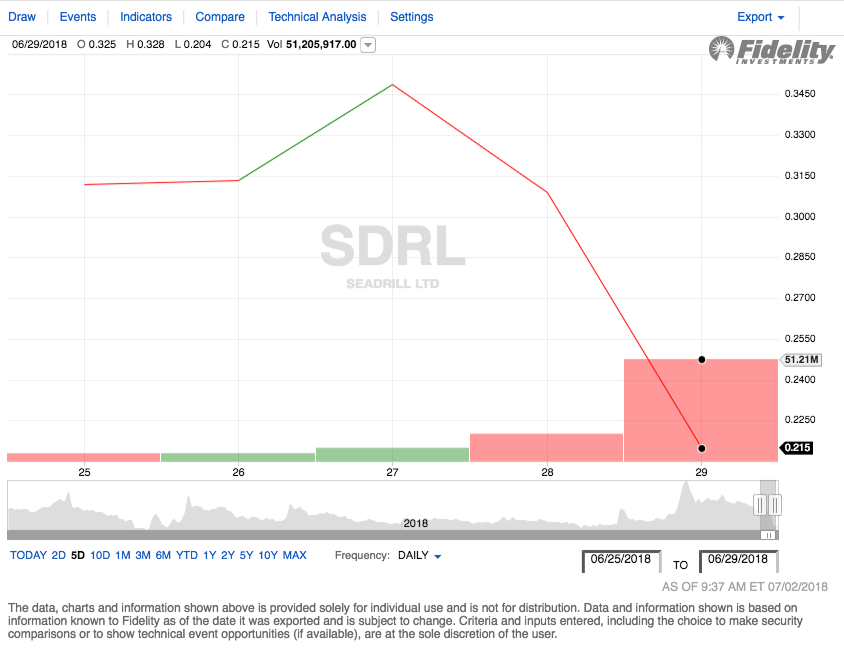

Seadrill remains the most troubled firm on this list despite having some success forging a restructuring plan several weeks ago. Unlike its peers, however, Seadrill's stock delivered a very solid loss over the past week. On June 25, shares of Seadrill opened at $0.3536 and saw some very weak positive performance early in the week before dropping like a rock. The shares closed out the week at $0.215, representing a loss of 39.20%.

(Click on image to enlarge)

Source: Fidelity Investments

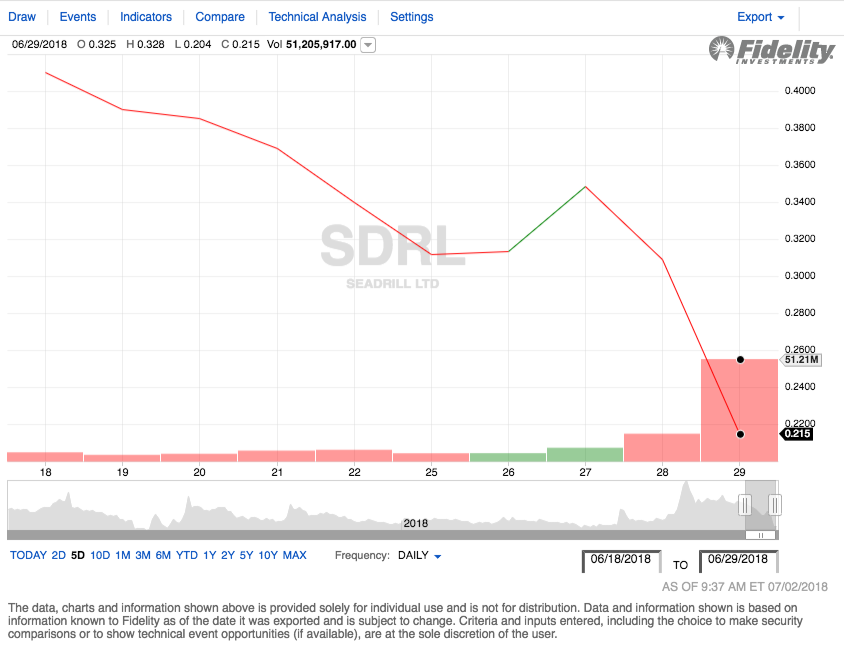

The company had surprisingly little volatility over the past two weeks, although it did show pretty much consistent declines. For that reason, companies that are under Chapter 11 protection are typically not appropriate for most investors. With that said, the stock opened at $0.41 per share on Monday, June 18, 2018 and closed at $0.215 on June 29, 2018, which gives it a two-week loss of 47.56%.

(Click on image to enlarge)

Source: Fidelity Investments

Seadrill had no significant news affecting it over the past week, so the stock’s performance is entirely due to the uncertainty surrounding the company as it attempts to restructure itself. Long-term investors may wish to avoid it in general until more certainty is available, while traders may appreciate the volatility and wish to take advantage of the sharp swings to earn some money. With that said though, Seadrill does plan to emerge from Chapter 11 protection in the first half of July, so it could pose an opportunity for someone looking to make a bet on its long-term future.

Disclosure: I have no positions in any stocks mentioned in this article.