Weak Post-2008 Crisis Economic Recovery Puts Capitalism At Risk

There Hasn’t Been an Economic Recovery After the 2008 Crisis: Now Capitalism Itself Is at Risk

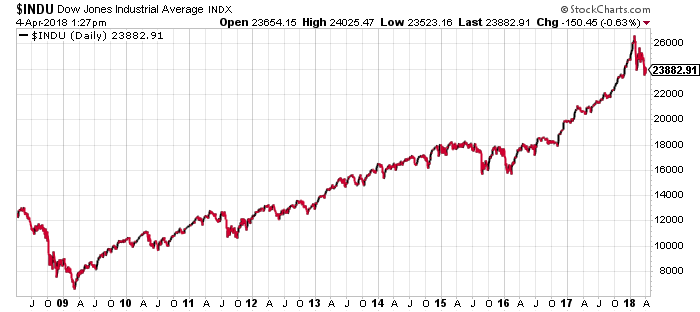

There are signs the so-called economic recovery is heading for a re-evaluation of its ambitious pretense. At first glance, the stock market suggests otherwise—you might, with reason, be wondering which of the newly legalized herbal treats I have been inhaling. And you’d be right to entertain such qualms. After all, the Dow Jones speaks the clear language of numbers. The chart below leaves little room for doubt.

Chart courtesy of StockCharts.com

The Dow has risen from 6,620 points, the bottom of the 2008 financial crisis, to over 26,000 points on January 26, 2018. As the chart above shows, this is one of the sharpest recoveries in the history of the Dow index. Some investors have certainly increased their net worth in the past decade. But there’s something different and dangerous about the past decade’s market performance. As much as stocks have beaten all performance records on Wall Street, there has been no corresponding economic recovery.

By older standards, say before 1990, the media and Wall Street establishments might describe the recession that started in 2008 after the second-worst financial crash in history as entering its 10th year, as economist Richard Wolff suggests. Wolff charges that banks have been the ultimate winners and arbiters of capitalism over the past 50 years.

iStock.comboggy22

The Economy Is a Slave to Finance

Everything that individuals do to live in the modern world, from shelter to education, requires the intermediation of a bank. Student loans, mortgages, credit card applications, car loans, and countless other activities need you to visit or interact with a bank. (Source: “Wall Street Bankers’ Executive Bonuses Highlight Worsening Inequality,” The Real News, April 3, 2018.)

The problem is not that banks offer these services. Rather, it’s that the banks which triggered the 2008 financial crisis have been the only ones to really recover. After all, how else could Wall Street afford to pay the highest bonuses in a decade if they hadn’t? The banks secured almost a $1.0-trillion bailout—for their mistakes—and then caused a credit crunch, grinding the economy to a halt.

The 2008 financial crisis, preferably, should have triggered an examination of what capitalism itself means nowadays. The capitalism of Adam Smith was as much a utopian idea as Marx’s scientific communism about 75 years later. Both systems involve the achievement of a just society, even if they propose different routes to get there.

Yet, as Lehman Brothers collapsed and the misuse of finance created such toxic tools as “subprime mortgage-backed derivatives,” governments, academics, practitioners of finance, and citizens should have been asking the big questions about capitalism.

The Arrogance of Post-“Iron Curtain” Capitalism

Having emerged as the victor in the “cold war” against communism, capitalism became arrogant. Instead, the winners in the West should have examined the causes of its victory and the aspects needing improvement. After all, the Soviet Union collapsed, less because of the contest with the West, and more because a principled leader, Mikhail Gorbachev, ultimately decided that upholding communism was not worth the price of a nuclear Armageddon.

Instead, capitalism performed an arrogant victory dance, which spun out of control after a grotesque step, as the dancers stepped on their own sub-prime hubris.

The tech bubble that inflated during the 1990s crashed and burst in 2000. It was a warning like the earthquakes that tend to announce a disastrous volcanic eruption. But, by then, the so-called “liberal” Bill Clinton administration had deregulated banks, allowing commercial and investment institutions to combine forces and take more risks.

Unhinged Finance Has Made Capitalism Into a Monster

Unlike millions of individuals and thousands of productive businesses facing risks, the de-regulated banks counted on being bailed out like some spoiled millionaire brat after a misdemeanor.

The post-Cold War capitalism, therefore, turned into an uncontrollable monster, oblivious to risks, because it deflected these onto unsuspecting citizens and business victims. They paid the price, but unbridled capitalism did not. The bankers of Wall Street enjoyed bonuses during Christmas 2008, while the real economy was confronting the fallout of their irresponsibility. (Source: “Bankers Reaped Lavish Bonuses During Bailouts,” The New York Times, July 30, 2009.)

Politics should have stepped in—if only because the leaders of the mainstream media and academia did not. Capitalism had shown its weakness.

It did not win the Cold War. It needed to reach an apex to highlight the folly of the triumphalist attitudes that allowed it to morph into a monster with the repeal of the Glass-Steagall Act in 1999.

In 2008, as the sub-prime crisis unfolded, many noticed the need for a rethinking of the way capitalism worked, both in theory and practice. Several economists and finance practitioners—Nicholas Nassim Taleb comes to mind—noted that since the early 1990s, regulators unleashed a financial orgy, opening the economic system to “engineering.” The results were instruments lacking limits and controls.

The Financial Markets Serve Short-Term Gains

Experts like Taleb—whose Black Swan became a bestseller and opened up a whole new understanding of risk—agreed that financial markets had become good only for short-term gains. They had become, in many ways, toxic for the economy in general.

The economy—that is, the sum of non-financial productive activities in which most Americans engage—rather than Wall Street is what serves the needs of society at large. It almost seemed as if the financial system would be reformed. Public opinion demanded it. Instead, identity politics took over—as seen in the 2016 presidential campaign—and the subject of financial reform has left the building.

Ten years after the crisis of 2008, the gap between the rich and the poor has increased and economic injustice has spread while the world economy has remained (and still is) exposed to the vagaries of capital and, above all, finance. On the contrary, the importance and salaries of the merchants of finance have increased. The paradox is that despite the abundance of widespread liquidity made possible by low-interest rates and quantitative easing, many individuals and businesses have been forced to pay exorbitant fees for their credit.

Finance Has Little to Do With the Economy Anymore

There is a difference between finance and the economy; the two concepts are almost entirely divorced from each other. Finance used to be a tool of the economy. But since the collapse of the Iron Curtain and the demise of communism (even China is only communist in name), finance has become an end in and of itself.

Stocks can perform well—often spectacularly so—even when factors such as wealth distribution, the real unemployment rate, the cost of living, college tuition affordability, and the health of the middle class are lagging.

To make the concept clearer, finance is what brought you the Great Recession in 2008 and the Great Depression in 1929. A one-sentence summary of the causes of the 2008 crash and subsequent recession might read: “A largely deregulated financial system was allowed to wreak havoc on the real economy.” That same explanation works to account for October 1929.

It’s important to stress the “unregulated” appellation in blaming finance. It’s not finance itself that’s the problem, but what it can destroy when it becomes “creative.” Creative finance is almost inevitable in an unregulated environment. And it causes the kind of damage that holds real growth back.

That’s why there has not been a real economic recovery. Eventually, of course, either society fights back to correct this discrepancy or creative finance will destroy itself, triggering an economic collapse.

Marx Is Popular Once More, 2008 Was Like 1848

Many have not noticed, but ever since 2008, sales of Karl Marx’s Das Kapital have risen. Far from being over, communism, or some interpretation of it, continues to offer hope to those—the numbers of whom are selling—seek answers about how to improve our economies if not the world even 150 years after its first edition was published. (Source: “150 years of ‘Das Kapital’: How relevant is Marx today?,” al-Jazeera, August 22, 2017.)

Ironically, it was the economic crisis of 1848—and the related revolts that erupted all over Europe—that prompted Marx to publish his perceptions. President Franklin Delano Roosevelt (FDR), who served in the period when communism was surfing its biggest wave, understood that capitalism and democracy—as America understood it—could not function without some controls.

The USSR had been the only country to remain unaffected by the 1929 crash. It thrived during that period. Thus, FDR worked with the unions and with citizens to create a series of social “shock-absorbers,” known as the New Deal. In many ways, it can be argued that the New Deal saved capitalism from itself—and it saved the “American Dream.”

In 2009, President Obama did not have the ability—or perhaps the authority—to engage in a similar exercise. Thus, the real economy was left to fend for itself, while the world of finance—on Wall Street and in London—was allowed to survive to speculate another day.

Few would advocate a return to communism. But there’s no question that considerable anger has built up deep in society. And it affects many people, who once considered themselves to be middle class or even upper-middle class. If Marxism isn’t the solution, people are returning to the old “classics of socialism” library to vent their anger. They may not have reached a breaking point yet, but the Arab world has already shown what happens when anger has no more peaceful channels through which to diffuse.

It spills over to the streets. One more major stock market crash that leaves those responsible—the major banks like the Goldman Sachs Group Inc (NYSE: GS) and JPMorgan Chase & Co. (NYSE: JPM) of this world unscathed—alive and thriving, could trigger a social revolt, which targets Wall Street even before it does Congress.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more