Weak Guidance Could Sink Nike

Nike (NKE) reports quarterly earnings after-hours Tuesday. Analysts expect revenue of $8.09 billion and eps of $0.43. The revenue estimate implies a double-digit decline sequentially. Investors should focus on the following key items:

Worries In North America

Nike is the undisputed leader in high-performance sports apparel and training apparel. The Nike Swoosh is one of the most recognizable logos in the world. Nike is also a leader globally, but certain regions could show signs cracking.

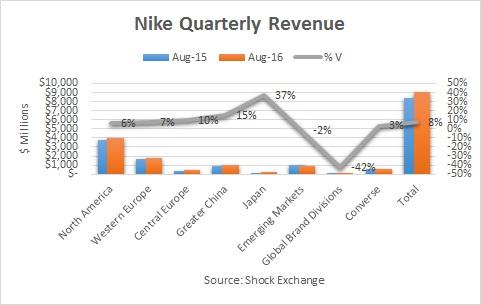

For the quarter-ended August, 2016 total revenue grew 8% Y/Y. Revenue for Nike North America (44% of total revenue) was up 6%, while revenue for Greater China and Japan was up 15% and 37%, respectively. Technology and investment in R&D has always been a part of Nike's culture. Its perception as being a "cool" brand and innovative has separated it from the competition, and allowed the company to charge premium prices.

Its "innovation" edge could be waning as consumers flock to Adidas (ADDDF), (ADDYY) and Under Armour (UA) who happen to be equally cool, at least for the moment. Its declining innovation can be measured by the single digit growth in North America. Gross margins declined to 46% last quarter, versus 47% in the year earlier period; I suspect the company is feeling pricing pressure.

Lastly, its futures orders for Nike brand footwear and apparel is nothing to get excited about. Last quarter futures orders for delivery from September 2016 through January 2017 were $12.3 billion, up 5% Y/Y. Orders were up 26% in Japan and 15% in Greater China -- Nike's engines of growth. They were only up 1% in North America which likely indicates competition from Under Armour and Adidas will not go away anytime soon.

Guidance

Nike could face global headwinds going forward. I am particularly concerned about the global economy. The effects of eight years of monetary policy from central banks appears to be waning. Of note is that 24% of Nike's revenue comes from Europe and 10% from emerging markets. The EU is under pressure after Britain decided to leave this summer. Italy could be next to buck the system; it is on the brink of nationalizing its banking system, in defiance of the EU. That said, the euro hit a 14-year low earlier this week.

Emerging countries like Venezuela, South Africa, Angola, and Brazil are dependent upon selling oil and other commodities to China. As China slows these emerging countries could also get hurt. Fed rate hikes could continue to pressure currencies of emerging countries. While Nike faces pressure at home, its sales in Europe and emerging countries could be worth less in dollars due to weakening currencies.

Conclusion

NKE is down 20% Y/Y versus a 12% appreciation for the S&P 500 (SPY). Its problems will not dissipate any time soon. What made it special -- its global presence and premium prices -- could haunt it this quarter.