Waste Management (WM) Stock Analysis

Next time you take your trash out or see your neighbor’s cans on the side of the garage/house – I hope you now think of dividend investing. This dividend stock analysis proudly brings Waste Management (WM) to the forefront this summer. We performed a dividend stock analysis on this company and industry competition to see if they appear to be or appear not to be attractive for a stock purchase. Time to dumpster dive into the stock!

The Stock – Waste Management (WM)

I was driving around my neighborhood and was surrounded by a few waste disposal service trucks, massive trucks, that is. I though to myself, wow, my one neighborhood has a TON of trash sitting in their cans and bags outside of their home, what a business that is a complete annuity for the owners. Then it hit me – when would this business model slow down? If our consumption continues to increase and our waste per household continues to receive intense scrutiny (we waste a ton of food, products, etc., trust me), what a business to be an owner in! Yes, it was the green/white/yellow truck from Waste Management, that my eyes had seen. I was curious – how BIG is their business? Well… based on last quarter’s earnings release, they had $3.44B of top-line revenue, which on an annual basis is projected to be over $12B in annual revenue. Heck, free cash flow is almost $400M! Talk about a business model that is a pure cash cow. Are homes decreasing? No. Are we consuming less? Typically no, but I feel like I am, heck I only have one bag of trash every two weeks roughly, which I know I am a rarity and I do only live, currently, by myself; however, with the family next door – I typically see 4-6 bags of garbage, WOW.

You can tell, the intrigue really had my investment research blood boiling here. Who else is there? I wanted to find out the competition, the dividend metrics that we typically use and to see if it looks like an investment in an over-valued stock market place. I wanted to see if Waste Management, took the other competition to the curb and “disposed” of them with their financial metrics! It was time to take the trash through the Dividend Diplomat Stock screener to see the results that “spit” out.

About our Dividend Stock Screener

For those of you who are new followers, we run the Dividend Diplomat Stock Screener to identify potentially undervalued dividend growth stocks to analyze and potentially purchase. The Dividend Diplomats like to stick to 3 metrics when evaluating dividend stocks for considerations of a purchase. In our comparison, we will also compare the company we are analyzing to a competitor to gauge how the company performs in their respective industry, in addition to comparing them to the broader market. Here are the 3 metrics:

1. Price to Earnings (P/E) Ratio: We like to look for a P/E ratio that is below the S&P 500. The reason why we look for this is to show signs of undervaluation.

2. Payout Ratio: We further like to look for a company with a payout ratio of less than 60%. We choose 60% so the company has plenty of room to further expand their dividend in future years – it’s that simple.

3. Dividend Increase History: Additionally, we analyze companies that have a proven track record of increasing their dividend. We don’t go straight for the Dividend Aristocrats, but you have to have recent history, including the prior period, of increasing that yield.

With these dividend stock screening metrics, we may include additional items for consideration; however, these companies must break through the 3 barriers above. I like to compare against competition in the industry. That looks to be Republic Services, Inc. (RSG) & Waste Connections, Inc. (WCN).

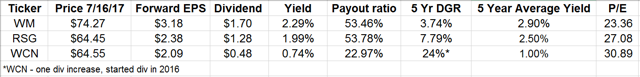

1.) Dividend Yield: Interesting. WM takes the pie here, but not by much over RSG. Further, they are a tad over the S&P 500 yield, which typically is a great bar to be over. WCN, though, is the laggard in this area. So far WM isn’t too bad. With a low yield, the question is, do they support a high dividend growth rate?

2.) Payout Ratio: I typically like to see that 40-60% range, and BAM! These garbage disposal service providers are definitely below 60% and the two critical companies in WM and RSG are both in the sweet spot at just over 50%. With WCN just starting their dividend in 2016, I would think there should be high dividend increases in the future. I like to be in the middle – as it shows their business is established, they want to maintain earnings in the business to continue to fuel growth prospects, but also to award shareholders. Solid job for WM and RSG here.

3.) Dividend Growth Rate: The punch to the gut! WM’s growth rate is SO small at 3.74%, even with a lower yield of 2.29%, as discussed earlier. This growth rate would need to be around/at least about 6% here to keep up with inflation and then some for me. RSG actually has a really strong yield to combine with a “decent” dividend yield. Given that WCN just instituted their dividend, it’s no surprise they have a HIGH growth rate. Hm… not sure what I think about here. On one hand – I don’t like their yield at WM, but they’ve done the dividend increase for 13, going on 14 years. I prefer higher here.

4.) 5-year Dividend Yield Average: This can be a sign of undervaluation if their current yield is greater than their 5 year average. One could state that the share price hasn’t kept up with the dividend growth or that the dividend growth has been that great. Worst case is that the stock has been pummeled with bad results lately. The case here for ALL THREE is that the stock prices have SURGED YTD at 4.74%, 12.90% and 23.20%, as listed in order of stocks in the chart. Therefore – the dividend increases are not keeping up with the share price appreciation. Need some more growth here! All three do not show signs of undervaluation.

5.) Price to Earnings (P/E) Ratio: Yes, another fun undervaluation metric. The S&P is around 26 at the moment, and surprise, surprise, WM is the only company that actually is below, but not by much. I typically like, for sure, below 20 and if I can – below 18. Not sure I like anything related to the P/E ratios on the board at the moment. WCN with the humongous appreciation right now has the highest P/E as well.

Dividend Stock Analysis Conclusion

Honestly, I love the business model, I TRULY do love it. It is a cash cow business, where, at times, it is difficult for a customer to switch if NO other companies are there in the area. Further, the entry to the market can be a “mediocre” fee – equipment in trucks and agreements for land/area to dispose. What throws me off is the low dividend growth mode with low yield – not a combination for a dividend investor preference when it comes to Waste Management. At having over $12B in projected revenue this year and such a history being build on dividend history, now, one would want a little more on the dividend growth – however – this could be due to the variable cost – more sales, more gas, more transportation, more salary cost, etc.. VERY interesting, when you think about it. Easy business model to understand, as well, partly why I like it.

For me to consider Waste Management further, since I do like the business model, I would like to see a correct (I know, “duh”), but if I could see a $65 range, this would be considered, as opposed to the almost $75 right now. Therefore, to conclude, I will be on the sidelines for this one.

Disclaimer: I do not recommend any decision to the reader or any user, please consult your own research. Thank you.