Wall Street’s Week Ahead: Tesla Motors Inc., Walt Disney Co., Yelp Inc., And Cisco Systems Inc.

Here’s what to watch for in much anticipated earnings this week from Tesla Motors Inc. (Nasdaq: TSLA), Walt Disney Co. (NYSE: DIS), Yelp Inc. (NYSE: YELP), and Cisco Systems, Inc. (Nasdaq: CSCO).

Tesla Motors Inc.

Tesla is set to release its Q4:2015 earnings on Wednesday, February 10 after market close. Analysts are expecting revenues of about $1.84 billion, compared to $1.1 billion from the same quarter of last year, and earnings of $0.09 per share, compared to a loss of ($0.13) from the same quarter of last year.

Ahead of earnings, investors and analysts alike have guidance concerns, questioning Model X and Model S demand as well as order concerns for the new Model 3. Investors are also watching for the company’s reaction to dwindling Model S and Model X production and the effect this will have on delivery. Last year, the company delivered vehicles on the lower end of its guidance, and investors are looking for the company to provide delivery guidance for 2016 in this report.

Analyst Adam Jonas of Morgan Stanley recently commented on the expected earnings, noting concern over past production delays for the model X, attributing this to “manufacturing and engineering challenges.” Most notably, he is unsure if Tesla can make its 2017 Model 3 launch, predicting a year delay, as “Tesla’s technical resources have been diverted from other projects to ensure proper execution of X.” Other reasons for his Model 3 delay predictions are “slower ramp,” including the “low demand for electric vehicles categorically and globally in a $30 oil environment.”

On February 2, 2016 the analyst reiterated his Overweight rating on Tesla and lowered his price target to $333 from $450.

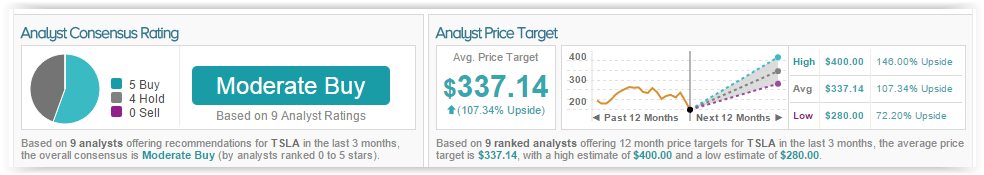

According to TipRanks’ statistics, out of the 9 analysts who have rated the company in the past 3 months, 5 gave a Buy rating while 4 remain on the sidelines. The average 12-month price target for the stock is $337.14, marking a 107% upside from where shares last closed.

Walt Disney Co.

Disney is set to release its Q1:2016 earnings on Tuesday, February 9 after market close. For this report, analysts are expecting revenues of $14.76 billion, compared to revenues of $13.39 billion for the same quarter of last year, and earnings of $1.45 per share, compared to earnings of $1.27 per share from the same quarter of last year.

Analysts will be watching for additional subscriber losses, specifically for Disney’s ESPN segment as it lost 3 million subscribers last year due to increased popularity in digital video platforms, which decreases the incentives to subscribe to cable services. Analysts are expecting massive gains from the release of Star Wars: The Force Awakens, which earned close to $2 billion, as well as merchandise sales from this segment over the holidays. However, analysts are also watching for the effect of global currency fluctuations. Another downside which could affect earnings is declining DVD sales as a result of online video growth. For its theme parks segment, analysts expect growth in both attendance and guest spending.

On February 1, 2016, analyst John Janedis of Jefferies weighed in on the company ahead of earnings with a Hold rating, reducing his price target from $112 to $92. While the company’s park segment experienced revenue and attendance growth, the analyst is not as excited, believing the parks segment reached peak levels with little flexibility to increase ticket prices. He specifically comments on the company’s domestic hotel business. Although occupancy levels rose in the past few years, the analyst believes “the majority of future revenue growth from the hotels will have to come from price going forward.”

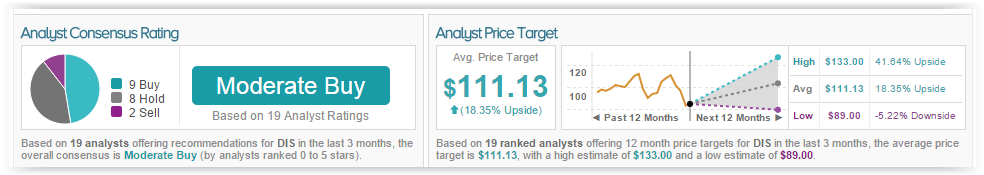

According to TipRanks’ statistics, out of the 19 analysts who have rated the company in the past 3 months, 9 gave a Buy rating, 2 gave a Sell rating, and 8 remain on the sidelines. The average 12-month price target for the stock is $111.13, marking an 18% upside from where shares last closed.

Yelp Inc.

Yelp is set to release its Q4 2015 earnings on Wednesday, February 10 after market close. Analysts are expecting revenues of $152.35 million, compared to revenues of $109.89 million for the same quarter of last year, and a loss per share of ($0.03), compared earnings of $0.08 per share for the same quarter of last year.

For this report, analysts are focusing on the company’s efforts to increase its user base, specifically marked by an increase in its mobile app adoption. Recently, the company has further expanded internationally and benefited from higher advertising revenues. However, some believe this expansion will cause SG&A and marking costs to increase, and as a result profitability for the quarter will decrease. Analysts expect Eat24, Yelp’s food delivery business and significant revenue driver, to display growth in the report. However, the segment faces competition from GrubHub, Uber, and OpenTable, as well as general competition from Facebook and Google.

Ahead of earnings, Brean Capital analyst Tom Forte reiterated a Buy rating and $40 price target on February 1, 2016. He stated, “We are looking for further indications that its Yelp Platform efforts (including its February 2015 acquisition of Eat24) are taking hold, with the potential to serve as a catalyst to both future transaction and advertising sales.”

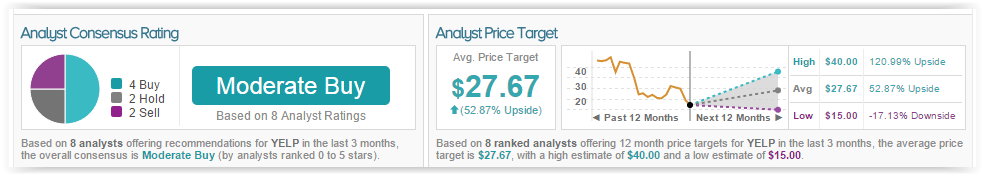

According to TipRanks’ statistics, out of the 8 analysts who have rated the company in the past 3 months, 4 gave a Buy rating, 2 gave a Sell rating, while 2 remain on the sidelines. The average 12-month price target for the stock is $27.67, marking a 53% upside from where shares last closed.

Cisco Systems, Inc.

Cisco is set to release its Q2 2016 earnings on Wednesday, February 10 after market close. Analysts are expecting revenues of $11.76 billion, compared to revenues of $11.94 billion for the same quarter of last year, and earnings of $0.54 per share, compared earnings of $0.53 for the same quarter of last year. Analysts are looking to see the effects of fewer orders and international enterprises on this earnings report, as well as international demand fluctuations due a strong dollar. Analysts are also watching for benefits resulting from switching upgrade cycles.

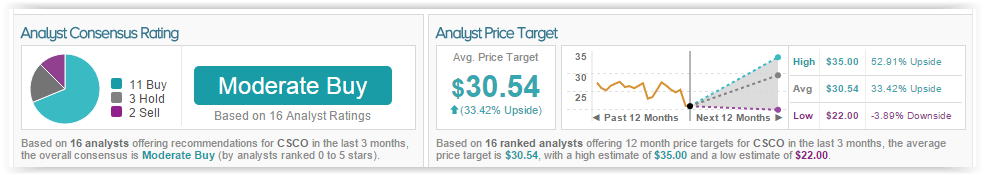

According to TipRanks’ statistics, out of the 16 analysts who have rated the company in the past 3 months, 11 gave a Buy rating, 2 gave a Sell rating, while 3 remain on the sidelines. The average 12-month price target for the stock is $30.54, marking a 33% upside from where shares last closed.

Disclaimer: Tip more