Wall Street's Week Ahead: Tesla Motors, Alibaba Group Holding, GoPro Inc And Fitbit

Analysts are weighing in on big-name stocks Tesla Motors Inc (NASDAQ:TSLA), Alibaba Group Holding Ltd (NYSE:BABA), GoPro Inc (NASDAQ:GPRO), and Fitbit Inc (NYSE:FIT) discussing upcoming earning report expectations and recent events influencing the success of these stocks.

Tesla Motors Inc

Tesla will report first quarter earnings on Wednesday, May 4 after market close. Analysts expect the automotive and energy storage company to post a loss of $(0.89) for the quarter and revenue of $1.6 billion. In the same quarter of last year, the company posted revenue of $1.1 billion. During the upcoming five years, analysts are forecasting that Tesla will grow earnings at an average rate of 30% per year.

Tesla revealed its Model 3 in late March, sending shares up 7% thanks to the warm reception of the new model, though consumers were only able to pre-order the vehicle. At this point, Tesla has two models available: the Model S and the Model X. Analysts will be looking to see how many cars Tesla sold in the quarter, as well as updated sales guidance for the year.

The company has been operating at a loss but analysts hope that an update on the Gigafactory will take the company one step closer to cost saving initiatives. Once the Gigafactory is complete, it will lower the cost to produce lithium batteries and enable Tesla to ramp up production. Many analysts, such as Ben Kallo of Baird, remain bearish on the company, noting that even though deposits made on the Model 3 will help cash needs in the short term, Tesla does not have sufficient near-term capital need. Through Model 3 reservations, Tesla raised over $400 million. According to Kallo, due to this capital combined with the company’s lines of credit, the company may not need to do a capital raise in the near term.

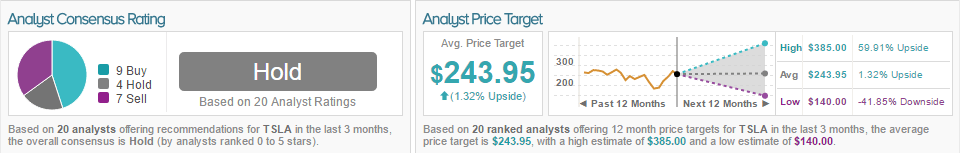

According to TipRanks, 45% of analysts recommend a Buy rating, 20% recommend a Hold rating, and 35% recommend a Buy rating on TSLA. The average price target for the stock is $243.95 with a 1.32% upside.

Alibaba Group Holding Ltd

Alibaba is expected to report earnings Thursday, May 5, before market open. Analysts expect the company to report earnings of $0.56 per share, marking a 22% year-over-year increase. Analysts also expect the company to post quarterly revenues of $3.5 billion, up from $2.8 billion posted in the same quarter of last year.

In the most recent quarter, the Chinese e-commerce giant posted 393 million monthly active users. Analysts will be looking to see an increase in the company’s user base as the company handles more business than other e-commerce company. Analysts will also be looking for an increase in the company’s gross merchandise volume; a key metric for all e-commerce platforms.

Recently, the online marketplace brought in quite some attention, due to the substantial capital raise by Ant Financial, an affiliate company of the Alibaba Group operating the Alipay payment platform. Ant Financial raised $4.5 billion, which led to be the largest fundraising round for an internet company.

Needham & Co. analyst Kerry Rice initiated a Buy rating on the stock with a price target of $95.00 on April 14, 2016. The analyst commented, “We view Alibaba as the best in class e-commerce marketplace that not only serves as a tollgate to merchants and brands that desire to reach the 1.4B Chinese consumers, but also extends their reach around the world.” Rice further elaborated, noting “The results of our survey suggest that Chinese consumers spend the most time and money on Alibaba sites and both are expected to increase over the next year.”

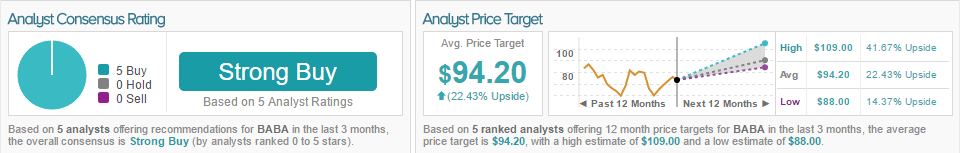

According to TipRanks, the average analyst consensus for BABA was Strong Buy, with 100% of analysts offering Buy recommendations on the stock. The average price target is $94.20 with a 22.43% upside.

GoPro Inc

GoPro is expected to release first quarter earnings on Thursday, May 5 after market close. Analysts expect the company to post a loss of ($0.06) per share and revenue of $169.08 million, which would mark a startling 53% year-over-year revenue decrease, fueling analysts’ fears that GoPro is a one-product wonder.

GoPro produces cameras and accessories that are easily mountable, wearable, and often used for extreme action videography. With all the hype regarding drones lately, it is not surprising that GoPro wants in on the trend in an effort to diversify its offerings. The company will be launching “Karma,” its own version of a drone expected to be released by the end of this year. In a further effort to diversify its offerings, GoPro has acquired a handful of startups to add to its video and editing technology. However, all eyes will be on GoPro sales as analyst brace themselves for falling sales after the holiday period.

Pacific Crest analyst Brad Erickson reiterated a Hold rating on the stock on April 25, 2016. Erickson commented on his expectations regarding the drone launch, noting, “We believe the stock has gotten some recent lift anticipating Karma, which could persist depending on how it is initially perceived by investors.” The analyst seems less than optimistic, however, explaining, “While the drone launch doubles the company’s TAM and could support shares in the near term, we still see downside longer term due to action camera softness, with drones likely only gaining modest traction over time.”

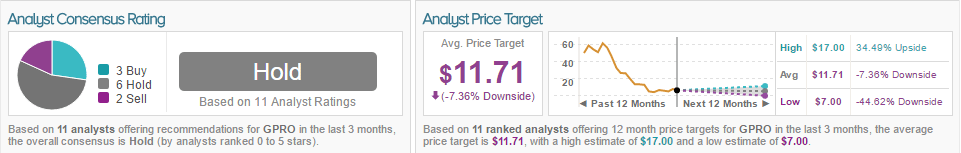

According to TipRanks, the overall analyst consensus on GPRO is Hold, with 27% of analysts bullish, 55% of analysts neutral, and 18% of analysts bearish. The average price target for the stock is $11.71 with a (-7.36%) downside.

Fitbit Inc

Fitbit is expected to report earnings on Wednesday, May 4, after market close. Analysts are expecting the company to post earnings of $0.02 per share on revenue of $440 million.

In light of major competitor Apple’s (AAPL) less than stellar earnings results last week, analysts are expecting Fitbit to benefit and post higher than consensus estimates. Analysts will also be watching for updates on enterprise sales. Although these customers make up less than 10% of revenues for the company, investors are hopeful on the long-term opportunity this market represents

In the recently conducted Teen Survey, Fitbit yet again was ranked first place as the most preferred fitness band among teens, with a whopping 72% choosing the Fitbit over completing fitness trackers.

In light of these positive results, Piper Jaffray analyst Erinn Murphy weighed in on the stock on April 21, 2016. Murphy raised her Q1 estimates due to the survey results noting, “Overall intent to purchase a fitness tracker moved up from 15% last spring to 22%. Moreover, overall upper-income ownership rose to 22% for females and 18% for males (vs. 14% and 12% Fall 2015).” However, the analyst claims she still needs to “see more consistent evidence of sell-through of the newer products,” and therefore reiterated her Hold rating on the stock, with a price target of $16.00.

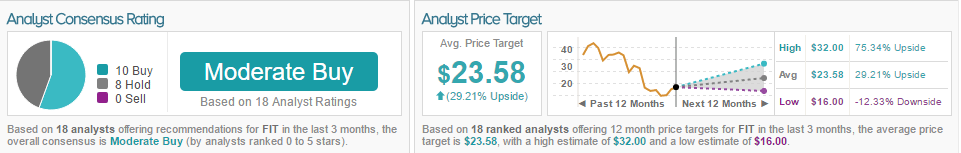

According to TipRanks, 56% of analysts recommended a Buy rating, and 44% recommended a Hold rating. The average price target for the stock is $23.58 with a 29.21% upside.

Disclaimer: Tip more