VBI Vaccines – An Idea For Investors Who Want To Avoid The Index Fund Bubble

TM Editors' Note: This article discusses a penny stock or microcap. Such stocks are easily manipulated; do your own careful due diligence.

I believe that investors need to start paying attention to what some very experienced and successful investors are doing and saying. Today many of the world’s greatest investors are warning that the S&P 500 is not attractively priced. Massive inflows to index funds and ETFs have pushed the share price of the companies including in the major indices to lofty valuations.

The time for blindly pumping money into the index is over. It is time to either start building up some cash or digging a little deeper for bargain opportunities.

The chart below clearly shows the incredible run that the market has had since the bottom in 2009.

Source: Nasdaq.com

This is a very unusual length of time for a bull market to go on uninterrupted.

How unusual? This bull market that dates back to March 2009 is now the second longest in the history of the S&P 500.

Image Source: Bloomberg.

As the image above shows, there are only a handful of bull markets that rival this one in length.

Included are the bull markets that ended in 2007, 1987 and 2000. For those of us who have been around long enough to have experienced the ends of those bull markets, we can tell you that what came next was not a pleasant experience.

Fear Of A Clinton Presidency Has Created A Market Overreaction In This Sector

If it is time to stop blindly pumping money into S&P 500 index funds then is it time to stop investing in stocks completely?

While I have no problem with investors letting cash build at points where the market is expensive I do think that there is an opportunity to pick stocks today.

One sector that does seem to present opportunity is biotech/pharma which has sold off with the prospect of a Clinton win in the election.

iShares Nasdaq Biotechnology Index Fund Stock Chart (IBB)

Source: Nasdaq.com

Within that sector, I believe that a company named VBI Vaccines (VBIV) is worth a closer look. While the company’s share price has come down in recent weeks along with the other companies in its sector the company’s business prospects have improved and perhaps significantly so.

Source: Nasdaq.com

For VBI the good news has been both from inside the company and outside of it.The positive external news relates to the struggles of its Hepatitis-B vaccine competitor Dynavax Technologies Corp (DVAX). Dynavax had the FDA cancel a crucial meeting for the company’s Hepatitis-B vaccine.That is good news fo

The meeting canceled by the FDA with Dynavax had been scheduled to evaluate the company’s hepatitis B vaccine called Heplisav-B.The reason given for the cancellation by the FDA was to “review and resolve” several outstanding issues. The FDA indicated that it intends to keep evaluating and will schedule a future Advisory Committee meeting “as needed”.There are no guarantees that a future meeting will ever be scheduled.

Dynavax shareholders had previously been dealt a blow by the FDA back in April when the FDA decided to delay an approval decision on Heplisav-B.

The Advisory Meeting that was just canceled had been just scheduled in August for November 16, 2016. The cancellation news was completely unexpected. The intent of the meeting was to consider Heplisav-B’s pros and cons. The FDA had previously rejected Heplisav-B in 2013 over concerns that it could cause autoimmune disorders.

It has been a trying road for DVAX shareholders.

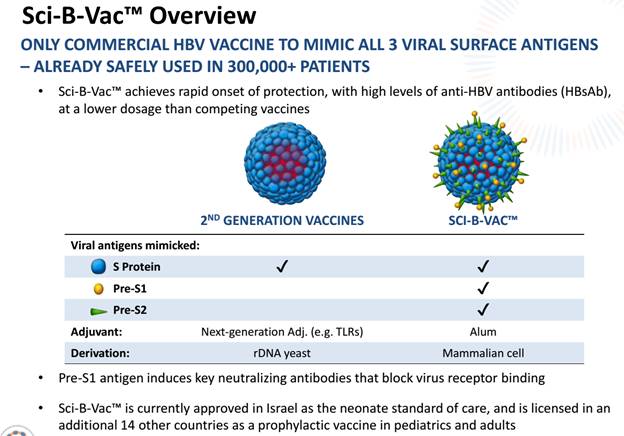

This eliminates or at least sidetracks a key competitor for VBI Vaccines which has a Hepatitis B vaccine of its own. VBI’s vaccine (Sci-B-Vac) is not just a pipeline vaccine, it is one that is already approved and in use in 15 different countries. That greatly reduces the risk involved with the vaccine.

Sci-B-Vac came to VBI as part of the merger with SciVac. The specific reason for this merger was to get the drug into the hands of a company with the financial means and infrastructure to get it approved for use in the huge markets of North America and Europe.

Source: VBI Corporate Presentation

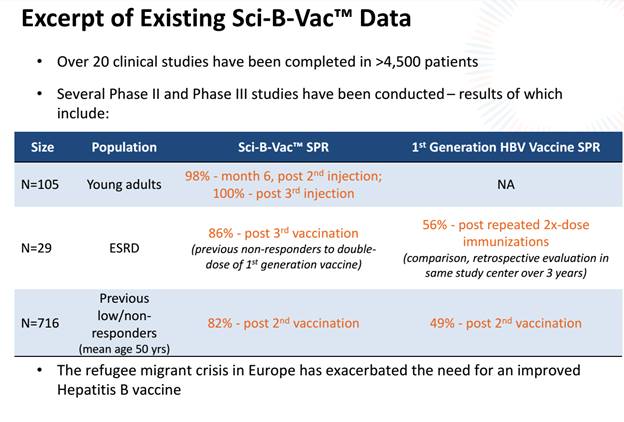

Sci-B-Vac is proven to be 100% effective and 100% safe.It has been used by over 300,000 individual patients in Israel.All that VBIV now has to do to tap into the markets of North American and Europe is compile the regulatory submissions for phase three trials.

The company is currently in the process of doing that.

The big advantage that Sci-B-Vac has over the current standard of care Hep-B vaccine is how well it works for patients over 40.The efficacy of the current standard of care for older patients is dramatically reduced.Sci-B-Vac has a unique solution for these over 40-year-olds as well as individuals with compromised immune systems (think heavy drinkers and smokers, pre-diabetics).

A key differentiating factor for Sci-B-Vac is that it boosts immunological response which helps alleviate concerns that some have with vaccine safety.Sci-B-Vac has been shown to create a stronger and more rapid antibody response that competitor drug Engerix-B while using 25%-50% less antigen.It also has the advantage of improving immunogenicity which is something that can’t be created in the yeast-derived process that competing products go through.

Source: VBI Corporate Presentation

There Is A Big Market Here To Be Addressed

Hepatitis B kills more people than any other infectious disease (including HIV/AIDS and malaria) so this is a big and very important market to address.

Hepatitis B is usually spread when blood, semen or other body fluids from an HBV-infected person enter the body of someone who is not infected. HBV attacks the liver, causing both acute and chronic disease.

In its early stages, chronic hepatitis B infection is largely asymptomatic, and many patients who may benefit from treatment go undiagnosed. Research has shown that treatment can have a major preventive effect on liver-related mortality and morbidity in persons with chronic hepatitis B infection. Efforts are needed to detect those infected who would benefit from treatment so the costly long-term side effects of HBV can be better managed.

According to the World Health Organization, globally, 240 million people are chronically infected with HBV and more than 780,000 people die every year due to complications related to HBV, including cirrhosis and liver cancer. In sub-Saharan Africa and East Asia, 5% to 10% of the adult population suffers from chronic hepatitis B infection. High rates of chronic infections are also found in central and eastern Europe, the Middle East and the Indian subcontinent.

The vaccine was initially developed at the Weizmann Institute of Science in Israel. The 15 countries that it is currently marketed in include Chile, Gabon, Central Africa, Georgia, Hong Kong, Moldova, Niger, Philippines, Central Africa, Equatorial Guinea, Ghana, Israel, Ivory Coast, Moldova, Nigeria, Senegal, and Vietnam.

Total sales in 2015 of Sci-B-Vac were $600,000 with the bulk of that taking place in Israel where it splits the market with Engerix-B.Getting into Europe and North America opens up markets that are exponentially larger than the 15 that Sci-B-Vac is currently being used in. When I say exponentially I mean it.

The analysts at Ladenburg Thalmann believe that Sci-B-Vac can reach $186 million of sales globally by 2025 (split $81 million Europe, $86 million The United States, $18.5 million rest of the world) if it gets approved for use in these markets.That assumes success only with high-risk adult population with compromised immune functions.Very little uptake of Sci-B-Vac has been assumed by Ladenbur for healthy adult populations.

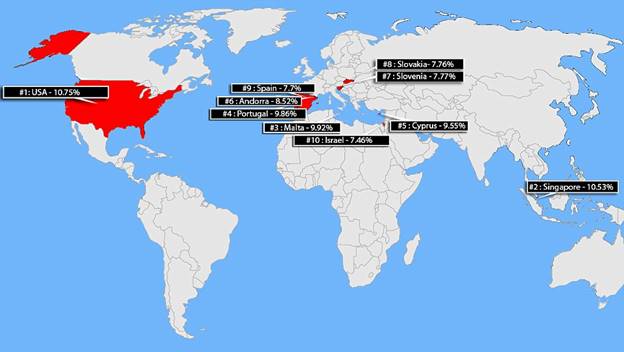

These revenue numbers may seem a bit “pie in the sky” but remember that almost 11 percent of the people in the United States has diabetes and would be natural candidates for Sci-B-Vac.

America has the HIGHEST rate of diabetes in the developing world

Risks And Share Price Movement

The recent decline in VBIV’s share price is certainly not justified in any way by the underlying business results.The reality is that VBI’s competitive position has improved significantly in recent weeks.

The appeal to me here is that Sci-B-Vac is already a proven solution to a problem that exists in a big market.The fact that there will be revenue and cash flow growth from bringing this market into Europe and North America seems very likely. The potential for this growth to be very significant also seems like a distinct possibility. The risk here is much lower than it is for a typical drug not yet approved for use.

Investors do need to keep in mind that this business is by its nature which involves rapidly evolving technologies very unpredictable.Any investment in a company in this sector should be a small part of a diversified portfolio. That includes VBI Vaccines.

Disclosure: We/I have no position in this company.