Valeant: Kicking The Can Down The Road?

The drama continued for Valeant (VRX) last week after it sought to restructure $3 billion in debt, and remove or modify certain of its interest maintenance covenants. The company got the refinancing done and the covenant relief it requested:

Valeant announced today that it has priced its previously announced offering of $1.25 billion aggregate principal amount of 6.50% senior secure notes due 2022 (the "2022 Notes") and $2 billion aggregate principal amount of 7.00% senior secured notes due 2024 (the "2024 Notes" and, together with the 2022 Notes, the "Notes"). The aggregate size of the offering reflects an increase of $750 million from the previously announced offering size.

Valeant was able to remove the maintenance covenants of Term B loans due 2022 and modify maintenance covenants under its revolving credit facility. It was also able to push back near-term maturities another five to seven years. The likely risked breaching debt covenants this year. I felt its bankers were lenders of last resort and should have extracted high rates and warrants.

Kicking The Can Down The Road?

The debt deal is in stark contrast to the company's posture in Q4 2015 when it vowed to pare debt and focus on maintaining cash flow. Its acquisition of Addyi has been a $1 billion headache, and the loss of pricing power in key drugs has hurt sales and cash flow. In my opinion, the debt deal is nothing more than "kicking the can down the road." SA author Orange Peel had this to say:

We know there are real businesses at the core of the company, and with the new CEO and a new business model, we can't help but feel like things can't get worse forever. We are not saying that the company definitely isn't going to go bankrupt. What we are saying is that we do believe the fundamentals of the business should eventually level off as the company finds its bottom.

However, I estimate the company's' sum-of-the parts is $0. Secondly, the company's fundamentals will worsen in the near term; its debt/EBITDA, currently above 8x, could become untenable by the time it "finds its bottom."

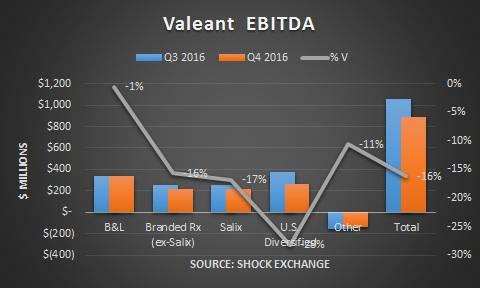

Q4 revenue fell 3% sequentially, yet EBITDA was off 16%. Bausch & Lomb's EBITDA fell 1%. Assuming its EBITDA margins are consistent with the rest of Branded Rx, then Salix's experienced an EBITDA decline of about 17%. We know for a fact that its revenue fell 5%. Management claims that its attempt to sell the company might have caused a minor disruption. Now that it has thrown more salespeople at the problem, Salix should grow again.

Valeant's other two business segments -- U.S. Diversified and Branded Rx (ex-Salix) -- are in free fall. The lost of Philidor's distribution muscle has hurt pricing and revenue for Branded Rx's dermatology products. Meanwhile, U.S. Diversified's neurology products are facing pricing pressure and competition from generics. Analysts expect the company to deliver Q1 2017 revenue of $2.17 billion -- implying a 10% sequentially decline. Given margin compression, the decline in EBITDA could be even more pronounced.

Time To Cover

I have been short VRX due to its declining earnings fundamentals. The stock is off over 25% since earnings were released. The debt deal means a covenant breach is likely no longer imminent and Valeant will live to fight another day. Short covering and speculation in the shares could drive the stock closer to its pre-earnings value. I have purchased calls to partially cover my short position ... just in case. Additional noise from proposed asset sales could also spur the stock higher. However, after a few more quarters of double-digit EBITDA declines, I believe VRX will trade closer to its intrinsic value of $0.

Conclusion

Valeant's recent debt deal will allow the company to kick the can down the road, and allow day traders to continue to speculate in the stock. The drama over a potential covenant breach is over for now. VRX could bounce from here. In the second half of 2017 I expect it to continue its descent lower on falling revenue and EBITDA.

Disclosure: I am/we are short VRX.