U.S. Weekly Stock Market Valuation Indicator - Substantial Downside Risk

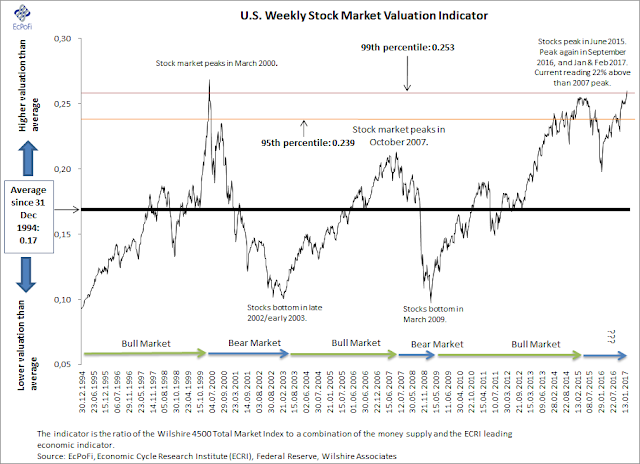

Yesterday, this simple stock market valuation indicator, calculated as the Wilshire 4500 stock market index divided by a combination of the money supply and the ECRI leading economic indicator, climbed into the 99th percentile based on data going back to 1987.

Only on one previous occasion has the reading been higher: March 2000, the peak of the dotcom bubble when it was only 3% higher than now.

The indicator is now 22% higher than the Q4 2007 peak and has now also surpassed the previous peak from March 2015. Though the stock market has since recouped from the losses that followed this peak, the market suffered large losses following the 2000 and 2007 indicator peaks.

Based on the losses inflicted after these previous peaks, the current reading does indicate substantial downside risk to stock market returns over the next twelve months if not longer.

Disclosure: None

Thanks for sharing

Thanks for sharing