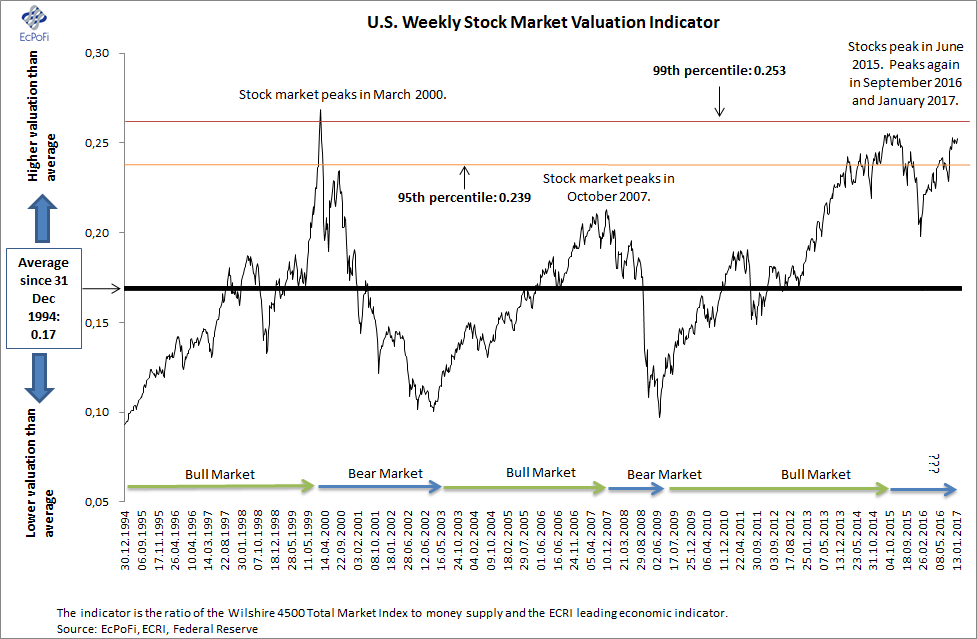

U.S. Weekly Stock Market Valuation Indicator: Near All-Time Highs, But Declining Credit Growth Could End The Party

This simple stock market valuation indicator comparing a broad U.S. stock market index with a leading economic indicator and the money supply is still hovering near all-time highs.

Though short of the peak hit in Q1 2000, the current reading is substantially higher than October 2007 and is now back to the mid-2015 levels. The indicators suggests current market valuations are extremely bullish, that a setback is very likely, and that future returns from long positions are likely to be poor.

The current high reading is especially worrying since bank credit growth, the major driver of money supply growth these days, has tanked in recent weeks. This decline in credit growth will negatively impact the money supply if it continues which again will have a negative impact on both stock market valuations and earnings.

Disclosure: None