US Stocks Can Be Headed Lower

Today we will talk about US stock market. As you know, US stocks are more or less in positive correlation, so what we are tracking right now are Nasdaq 100 and S&P 500 counts, where we clearly see bearish patterns!

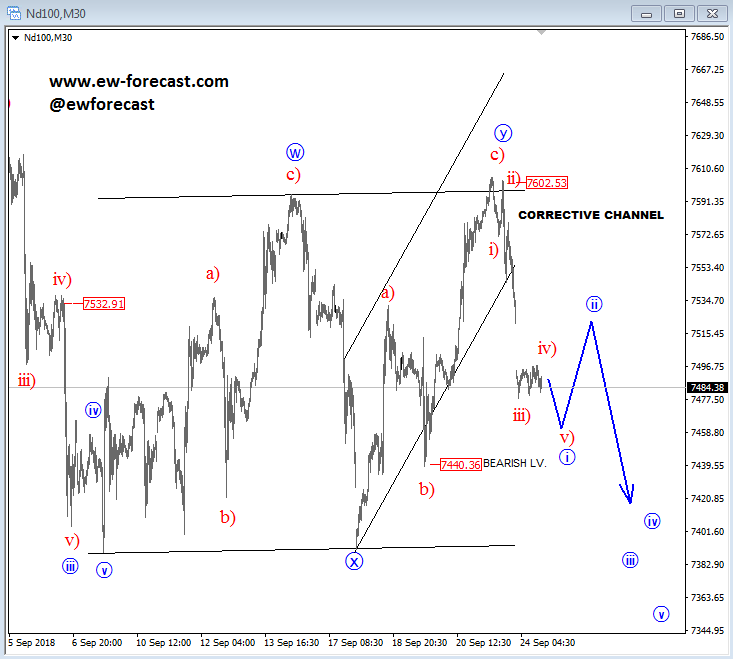

More interesting is actually Nasdaq 100, which has been trading sideways this month in a complex w-x-y corrective pattern after an impulsive five-wave drop from highs, which means that we have a perfect bearish setup. Current sharp drop away from 7600 projected resistance level suggests that NASDAQ remains bearish and we should be aware of more weakness, especially if we get those red five sub-waves followed by a break beneath 7440 region.

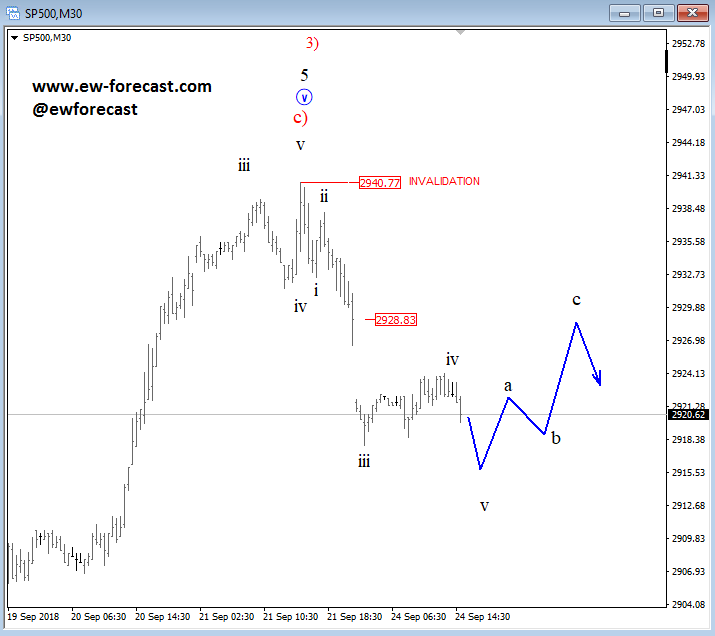

In the same time, we see a correlated stock market S&P500 turning bearish into a deeper correction. So, if we get a five-wave decline, then we should be aware of more weakness while it's below 2940 invalidation level, but after a three-wave a-b-c pullback.

That said, watch out for much lower levels on US stocks in upcoming days.