Upside With United Insurance

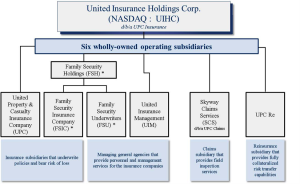

United Insurance Holdings Corp (UIHC) is a property and casualty insurance holding company. Its primary insurance subsidiary is United Property & Casualty Insurance Company, which sources, writes, and services residential and commercial property and casualty insurance policies using a network of agents and a group of wholly owned insurance subsidiaries. United Property & Casualty Insurance Company was formed in Florida in 1999.

Other subsidiaries include United Insurance Management, L.C., the managing general agent that manages all aspects of United Property & Casualty Insurance Company's business; Skyway Claims Services, LLC, which provides services to its insurance affiliates; and UPC Re, which provides a portion of the reinsurance protection purchased by United Insurance affiliates. Recently United Insurance acquired Family Security Holdings, LLC (FSH) and its two wholly owned subsidiaries, Family Security Insurance Company and Family Security Underwriters.

United Insurance’s primary product is homeowners' insurance, which it offers in Florida, Louisiana, Massachusetts, New Jersey, North Carolina, Rhode Island, South Carolina and Texas. United Insurance is licensed to write insurance in Alabama, Connecticut, Delaware, Georgia, Hawaii, Maryland, Mississippi, New Hampshire, New York and Virginia.

Homeowners insurance is major portion of United Insurance’s revenue. Last year in 2014 Homeowners insurance policies accounted 96% of its total revenue, flood insurance accounts for 3% of its revenue and remaining 1% for of the revenue generated from commercial insurance.

Growth with Value

Until year 2010, United Insurance primarily focused its business operations in the state of Florida, then started expanding into other states. Last year 69% of its total policies in force were in the state of Florida, the rest from seven other states. However as of the end of 2013 81% of the policies were concentrated in Florida.

At the end of 2014 total insured value of the policies in force increased 26.8% from the prior year; outside-Florida represented 60% of the total insured value compared to 74.3% at the end of the prior year.

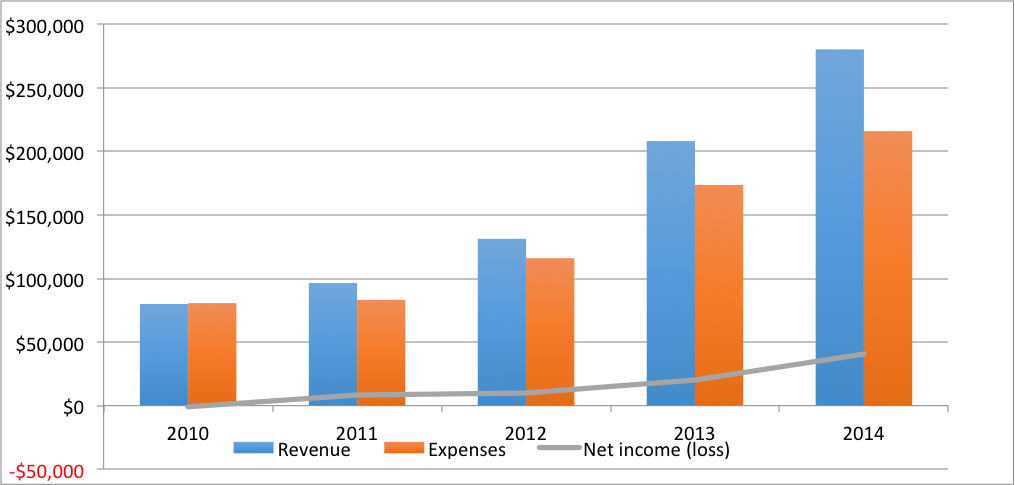

As United Insurance has been growing impressively, so has its net income from the business. In the year 2010 its net revenue including investment gains was close to $80 million, with net loss close to a million. As you can see in the following graph, net revenue increased to $280 million and net income grew to $41 million, or $2.05 a share.

| 2010 | 2011 | 2012 | 2013 | 2014 | |

| Revenue | $79,991 | $96,418 | $131,234 | $208,080 | $280,230 |

| Expenses | $80,673 | $83,227 | $116,005 | $173,594 | $215,897 |

| Net income (loss) | -$925 | $8,088 | $9,705 | $20,342 |

$41,013

|

Balance Sheet Rich

As of the end of the first quarter, United Insurance's balance sheet has $604 million in assets and $386 million in liabilities. With approximately 21 million outstanding shares, United Insurance’s book value is at $10.25. With stock price at around $16, it is trading at just 1.6 times the book value. Relative to its insurance peers United Insurance appears cheap by book value. Since United Insurance’s assets are mostly liquid assets, there is little room for error on this valuation.

Cash Flow

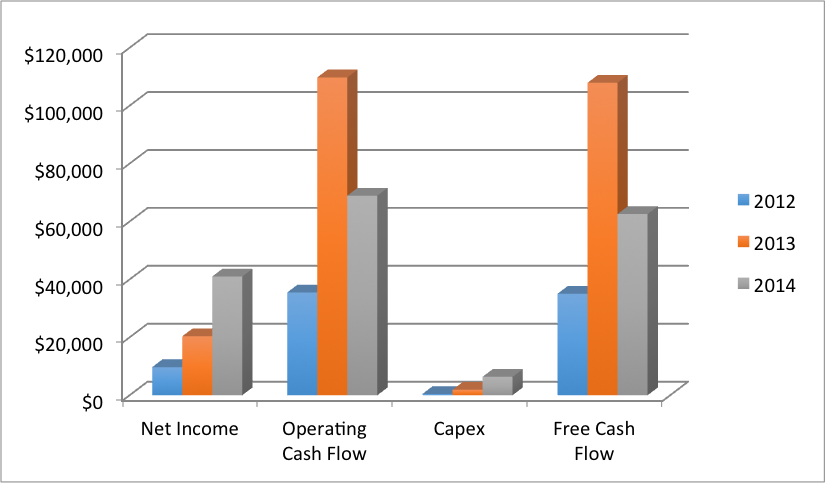

For the past few years Operating cash flow for United Insurance has been growing at an impressive rate. Last year free cash flow to the firm was at $62.5 million, or $3 of free cash per share; United Insurance trading 5.33 times free cash flow.

| 2012 | 2013 | 2014 | |

| Net Income | $9,705 | $20,342 | $41,013 |

| Operating Cash Flow | $35,515 | $109,766 | $68,918 |

| Capital Expenses | $452 | $1,867 | $6,346 |

| Free Cash Flow | $35,063 | $107,899 | $62,572 |

United Insurance trailing twelve-month profit margin is at 14.64% and operating margin is 23%; both are better than industry normal ratios. ROE is 19% and paid $0.17 in the last twelve months.

If every thing looks good, why it is trading lower?

Last quarter United Insurance's net revenue was $82 million, compared with $67.5 million in the first quarter of the prior year, but it had unusual expenses, almost double that of the previous year, and barely made penny a share in net profit. The primary reason for the losses was due to winter storm affecting the Northeastern United States during the first quarter. As per the company quarterly meeting this is an abnormal and unusual event. As per their statistics it is a fifth sigma event from the normal. Black swan events do happen, they don’t have anything to do with statistics but it is part of the insurance business. Assuming this is an unusual event, the normal business process should pick up in the later part of the year. The operating cash flow in the first quarter was $18.8 million versus $17.1 million during first quarter of the prior year. Management has been very effective in growing sales and expanding business beyond their Florida base. Judging by their past history United Insurance should come back to normal earnings second quarter onwards since no warnings were posted by the business since last quarter.

Other Risks

As an investor one should look into United Insurance's asset base. United Insurance declares in assets as available for sale. These securities neither belong to held-for-trading nor held-to-maturity. These securities are reported at fair value on the balance. Realized gains or losses are reported on income statement along with dividend and interest income. Unrealized gains/losses are excluded from income statement and included in shareholders' equity.

As of end of the first quarter, $409 million of assets were held under available for sale; out of that, $370 million assets were invested in fixed income. This will have impact on shareholders equity if interest rates start creeping up from the zero interest rate environment. As interest rates go up, fixed income securities decline in value. The longer the duration in the bonds, the more they could lose. As per the company's annual statement, 90 percent of its fixed income securities are due in less than 10 years. So 100 basis points increase in interest rates could potentially reduce United Insurance asset value to $13.5 million, and a 300 basis point rate hike could damage $41 million in asset values.

Final thoughts

We believe United Insurance is one of the fast growing companies under efficient management trading its fair value. We believe there is much upside potential for this equity given the lower valuation.

Disclosure : Long on United Insurance (UIHC). Owned in personal and client portfolios.