Top Buyouts To Watch For In 2015

2014 has been the best year for M&A since the financial crisis, but we think 2015 could be even better. The market is flush with easy financing and cheap debt which has large companies looking to acquisitions for growth. Here are our top candidates to be bought out in this new year.

There’s a perfect storm brewing in the M&A industry for 2015.

Growth prospects for certain industries are quickly declining due to increased competition, making acquisitions a quick and easy way to grow. And sellers are becoming more and more motivated in a variety of industries (most notably the oil and gas space).

With that in mind, let’s take a look at what 2014 brought us and the companies that could be buyout targets in 2015.

M&A Buyouts For 2015 No. 1: Media

The media industry has been a hotbed for M&A deals this year. And 2014 was a year of megadeals in media.

We have the pending $71 billion acquisition of Time Warner Cable (NYSE: TWC) by Comcast (NASDAQ: CMCSA). AT&T (NYSE: T) is trying to spend over $67 billion to buy DirecTV (NYSE: DTV). And 21st Century Fox (NASDAQ: FOXA) even made a $80 billion play for Time Warner (NYSE: TWX), but that was ultimately abandoned.

Notice that the big trend in media M&A is focused on the TV industry. 2015 should bring even more TV M&A as competition forces companies to find new ways to save on costs and drive earnings growth.

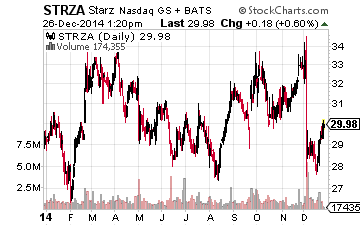

Along those lines, will Starz (NASDAQ: STRZA) finally see a buyout? It’s the only remaining independent premium pay-TV channel left. CBS Corp. (NYSE: CBS), owner of Showtime, has been a speculated buyer. And the move could give CBS a stronger hand in competing with Time Warner’s HBO in the premium channel space.

Famed deal maker John Malone, who owns roughly 49% of Starz, has noted that the pay-TV channel would be much better off as part of a larger cable company. 21st Century Fox also recently met with Starz about a buyout or possible strategic alliance.

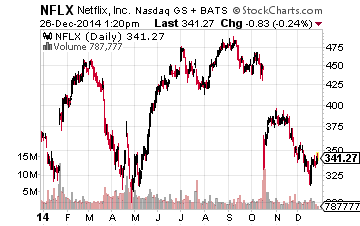

Netflix (NASDAQ: NFLX) is another interesting story in the TV space.

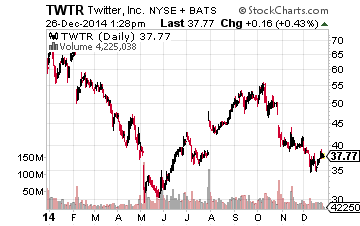

After the major selloff of Netflix shares back in October, Mark Cuban — the billionaire and owner of the NBA’s Dallas Mavericks — tweeted “I’m buying NFLX stock. At half of YHOO, 10B < Twitter (TWTR) and small pct of major media companies, someone will try to buy them.”

There’s been previous speculation of Apple (NASDAQ: AAPL) as a buyer, but such a move could make more sense for Amazon (NASDAQ: AMZN). The e-commerce site already has a presence in the streaming video industry. A buyout of Netflix would save on content costs and allow it to upsell Netflix’s 50 million users to its other services (think: Prime) and products.

Along the content creation lines, there’s AMC Networks (NASDAQ: AMCX). The cable company has effectively moved away from its American Movie Classics name and become a serial creator of successful shows. Think: Mad Men, Breaking Bad and The Walking Dead.

And with an enterprise value of less than $7 billion, it’s also small enough to be a buyout target for a variety of companies in the media industry. Netflix could become the acquirer in this case; it already spends a lot of money on purchasing content and might find a content creator like AMC Networks interesting.

M&A Buyouts For 2015 No. 2: Oil

With oil prices below $60 a barrel, a number of companies could be looking to merge in an effort to save on costs. Cf. the recent M&A deal where Halliburton (NYSE: HAL) is buying Baker Hughes (NYSE: BHI) for $38.5 billion. The deal will create the world’s largest oil-field services company. The catalyst is that together the two could save over $2 billion a year in costs.

The other M&A catalyst in the oil and gas industry will be that bigger players will find the stock price declines of smaller players enticing.

Spain-based Respoil is buying up the Canadian oil company Talisman (NYSE: TLM) for $8.3 billion after shares of Talisman tanked due to the oil price gutting. Other small and leveraged oil and gas names could see larger players come calling.

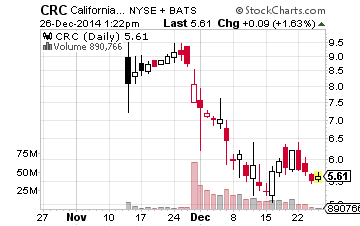

For example, the Occidental Petroleum (NYSE: OXY) spinoff of California Resources Corporation (NYSE: CRC) has left California Resources with a lot of debt and shares are down more than 30% in the two months since its spinoff.

Chevron (NYSE: CVX) is a major player in California and could find the fact that California Resources has been operating in the state of California for well over 50 years and is generating cash flow enticing.

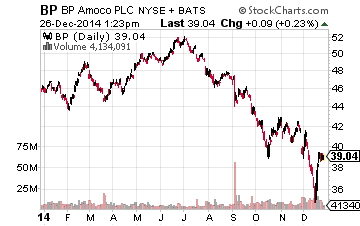

The days of $100 billion deals in the oil industry from 15 years ago, like the Chevron and Texaco merger, could also return. Of the oil Supermajors, BP (NYSE: BP) is one of the most interesting. Its market cap has been cut from over $250 billion to just $120 billion in a little over five years. The Gulf of Mexico oil spill from 2010 is largely behind the company, but the oil Supermajor still trades at a discount to its peers.

M&A Buyouts For 2015 No. 3: Pharma

Even with the allure of tax inversions, 2014 failed to deliver the megadeals we were looking for.

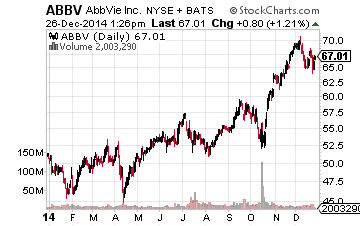

There were two megadeals in the making, but they eventually fell apart. Pfizer (NYSE: PFE) made a $120 billion offer for AstraZeneca (NYSE: AZN) that was ultimately rejected and AbbVie (NYSE: ABBV) eventually dropped its $54 billion deal for Shire (NASDAQ: SHPG).

Actavis was the most active in 2014, having bought up Forest Labs and then paying a hefty price for Allergan. But there were a number of pharma companies making partial buys; Eli Lilly (NYSE: LLY) bought the animal health business of Novartis (NYSE: NVS) and Bayer AG bought the consumer health business of Merck (NYSE: MRK).

Although the government has made the possibility of making acquisitions for tax inversions a little more uncertain, 2015 could be the year of megadeals for pharma. Competition is heating up and big pharma is finding it harder to grow.

And after the failure of two megadeals in 2014, it’s likely that we see at least one megadeal actually succeed in 2015.

We look for Pfizer to remain on the prowl for 2015, given sales growth is expected to be muted for the next couple years. Meanwhile, AbbVie is one of the few pharma companies that’s expected to grow earnings at nice click over the next half decade. Thus, AbbVie could become a buyout target. A possible Pfizer-AbbVie tie up isn’t out of the question.

M&A Buyouts For 2015 No. 4: Technology

There’s still lot of cash on the balance sheets at major tech companies. And so the technology sector will continue to be an M&A leader next year.

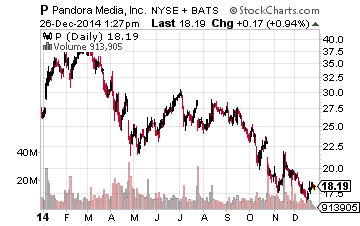

There seems to be a new buyout rumor every week surrounding Pandora (NASDAQ: P).

In part, because its sub $4 billion market cap makes it easy for a number of tech companies to swallow up. And there’s been plenty of interest in the music streaming space. Apple spent nearly $3 billion to buy up Beats and Google (NASDAQ: GOOGL) bought Songza earlier this year.

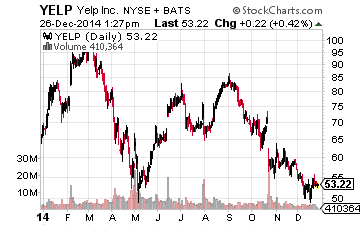

One thing to watch for is what will Yahoo (NASDAQ: YHOO) buy? Its business seems to be in decline and the tech company needs some reinvigoration. Names that could be on their radar, and the radar of other companies, include Yelp (NASDAQ: YELP) or Twitter (NASDAQ: TWTR). Both companies bring with them a lot of loyal users.

And loyal users are valuable. Recall that Facebook (NYSE: FB) bought WhatsApp for $22 billion, for which it got just $10 million in revenues. Meaning, it paid quite a premium for the 500 million users.

Bonus Buy: Beverages

As an added bonus, the beverage industry could also heat up in 2015. There’s been speculation that a merger could be a brewing between the two leading beer brewers, SABMiller (LSE:SAB) and Anheuser-Busch InBev NV (NYSE: BUD).

The catalyst being that SABMiller has a stronghold on the fast growing emerging markets, which could be attractive to a mega-cap like Anheuser-Busch. Note that SABMiller tried buying Heineken NV earlier this year, but failed.

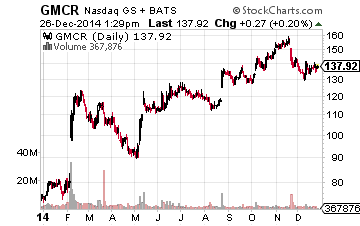

Coca-Cola (NYSE: KO) could also look to buy up the rest of Keurig Green Mountain (NASDAQ: GMCR). The baby formula business could also see some action. This includes the potential for Danone (DANOY) to try and catch Nestle (NSRGY) in the fast growing baby food business by buying up Mead Johnson (NYSE: MJN).

Whatever happens next year with Russia, oil and Japan’s impending recession, rest assured that more M&A deals are getting done and at higher prices.

Disclosure: None