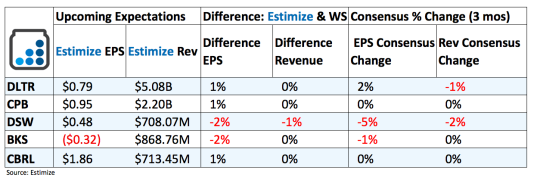

Top 5 Quarterly Results To Watch Tomorrow - Tuesday, November 22

(Click on image to enlarge)

Dollar Tree (DLTR): Dollar Tree had been outperforming the broader retail sector in recent years thanks to bargain basement prices and rapid expansion. That statement still holds true but shares have begun to slip after the dollar store missed its targets for the second quarter. Analysts had placed unrealistic expectations on the retailer that simply could not be met. This has sent shares plunging 15% in the 3 months following the print. Expectations for the third quarter are a bit tepid given its recent blunder but analysts still project sales to grow by 3% and earnings by 61%. Most of its growth will come on the back of its long term integration of the Family Dollar buyout and a foray into consumables/grocery type products. Dollar Tree still faces increasing costs and cannibalization from the Family Dollar incorporation which will likely continue throughout the integration process.

Campbell Soup (CPB): Shares of the soupmaker have started to tumble after consecutive quarters of failing to meet analysts estimates. Its portfolio of brands which largely consists of processed foods are simply not resonating with modern consumers and thereby dragging down financial performance. Shares are virtually flat this year but could plummet if tomorrow’s report does not meet its marks.

DSW Inc. (DSW): The broader rebound in the retail sector has come to bite discounters in recent quarters. DSW has been hit hard this year despite topping expectations in 2 of its past 3 quarters. Shares are down 7% since the company’s second quarter report with expectations that the stock will drop further following tomorrow’s results. Analysts are forecasting a 4% decline on the bottom line but a 7% increase on the top. Comparable sales are expected to decline 0.6% compared to a 3.9% decline in the previous quarter. Management has refrained from offering deeper discounts than it has in the past which will likely result in lower traffic trends and sales volume.

Barnes & Noble (BKS): Barnes & Noble is still feeling the effects from Amazon competition over the past decade. BKS was the first of Amazon’s many victims, making physical bookstores nearly obsolete. Today’s consumers liken a bookstore to a showroom which they only look and last purchase online. Needless to say Barnes & Noble’s performance has suffered in recent years. Some of these losses however have been offset by ecommerce and NOOK sales. Efforts to reduce expenses could provide some support to the bottom line. Management still expects comparable sales to decline in the low single digits for the fiscal 2017, a slight decline from its previous forecast.

Cracker Barrel (CBRL ): The restaurant industry has had its shares of ups and downs this year with fast casual, quick service and casual dining in a dead heat for restaurant supremacy. Cracker Barrel has been amongst the leaders in the casual dining segment following a string of better than expected results. Comparable store sales continue to outperform the overall industry despite no alcohol offerings. Management indicated in its Q4 2016 report that comparable sales would fall in the range of 1 to 2% for fiscal 2017. The company also expects to open 7 to 8 new Cracker Barrel stores which will help support top line growth.

Disclosure: None.