Today's 5 Best Mid Caps For Jan. 6

I wanted to find the 5 Mid Cap stocks with the best current momentum so I screened the S&P 400 Mid Cap Index stocks first for the best technical buy signals.

My list today includes Orbital ATK (NYSE:OA), National Retail Properties (NYSE:NNN), Health Net (NYSE:HNT), Fairchild Semiconductor International (Nasdaq:FCS) and Extra Space Storage (NYSE:EXR).

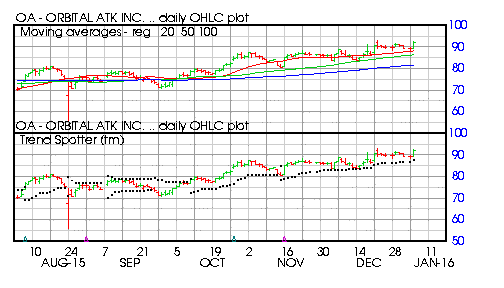

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 3 new highs and up 6.39% in the last month

- Relative Strength Index 64.00%

- Technical support level at 87.84

- Recently traded at 92.82 with a 50 day moving average of 86.58

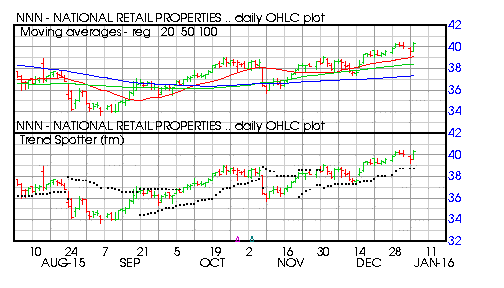

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 4.17% in the last month

- Relative Strength Index 64.75%

- Technical support level at 39.23

- Recently traded at 40.21 with a 50 day moving average of 38.42

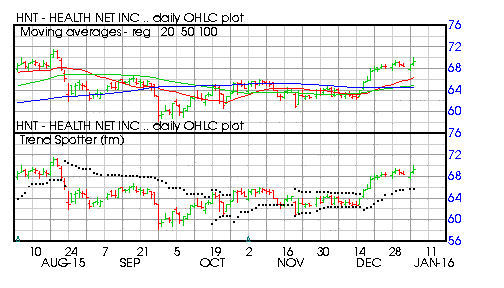

Barchart technical indicators:

- 88% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 7.48% in the last month

- Relative Strength Index 66.52%

- Technical support signals 67.77

- Recently traded at 6843 with a 50 day moving average of 65.03

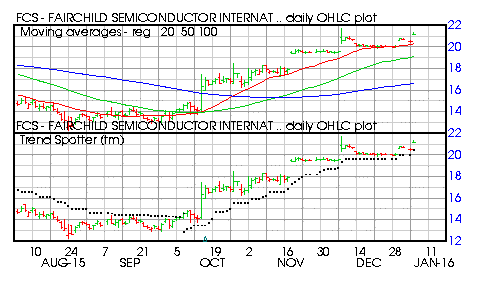

Fairchild Semiconductor International

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 2 new highs and up 8.31% in the last month

- Relative Strength Index 70.32%

- Technical support level at 21.00

- Relative Strength Index 70.32%

- Recently traded at 21.15 with a 50 day moving average of 19.19

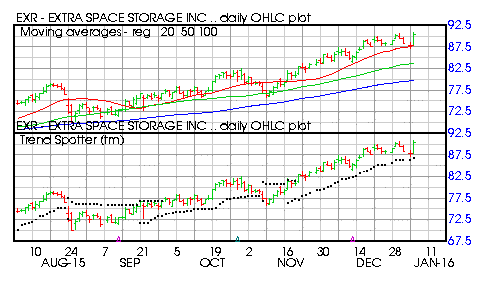

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 5.37% in the last month

- Relative Strength Index 65.63%

- Technical support level at 86.99

- Recently traded at 90.70 with a 50 day moving average of 83.95

Disclosure: None.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!