Tintri: Cloudy Financials Ahead Of IPO

Tintri (TNTR) has updated its S-1 registration statement, maintaining that it aims to raise $100 million by selling 8.7 million shares at a midpoint price of $11.50 per share.

Although the company indicates rapidly growing revenues, it is at a decreasing rate, and Tintri is burning through cash to do so.

If TNTR prices its IPO at the midpoint of its proposed range, the company will have a market capitalization of $372M.

Underwriters include: BofA, Morgan Stanley, Pacific Crest; Needham, Piper Jaffray, Raymond James, William Blair

Company Overview

Founded in 2008 by Chief Architect Mark Gritter and CTO Kieran Harty, Tintri provides businesses with a flash-based platform to more easily automate and manage their cloud-native applications and infrastructure. Its list of partners includes a number of large providers of cloud technology. The platform helps businesses in their data center operations by allowing companies to isolate their cloud applications and set service automation parameters.

The Mountain View, California-based company has raised more than $262 million in several rounds of private financing from top-tier private equity and venture capital investors, including Silver Lake Kraftwerk, Insight Venture Partners, Lightspeed Venture Partners, Menlo Ventures and New Enterprise Associates.

Tintri is managed by CEO and Chairman Ken Klein, who started with the company in October 2013. Previously, Mr. Klein served as president of Wind River Systems.

IPO Details & Use of Proceeds

Tintri aims to earn ~$100 million in gross proceeds from its IPO. Existing shareholders will not sell shares as part of the offering, and the company plans to use the net proceeds for general corporate purposes such as marketing, sales and working capital activities, administrative and general expenses, capital expenditures and engineering initiatives.

Financials

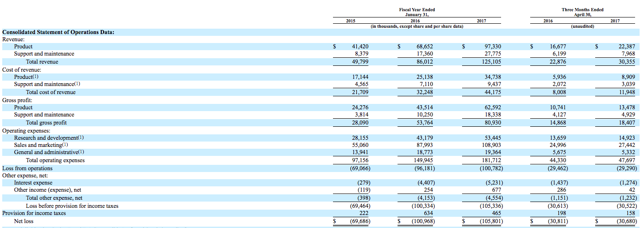

According to the company’s S-1/A filing, Tintri indicates growing topline revenue but at decreasing growth rates. The company is dramatically increasing use of cash in operations, and it maintains an uneven but generally increasing gross margin.

For the fiscal year ending the first quarter of 2018, Tintri reports total revenue of $30.4 million, a 33% increase from the prior year. For the fiscal year ending 2017, Tintri reported revenue of $125.1 million, a 45% increase from 2016, in which it brought in $86 million.

(Click on image to enlarge)

(Source: S-1/A Filings)

The company reported $70.4 million, $62.1 million and $51.1 million cash used in operations for 2017, 2016 and 2015, respectively. As of April 30, 2017, Tintri had $165.6 million in total liabilities and $48.7 million in cash.

Hot Competition

The cloud systems management market is expected to increase from $3.95 billion in 2016 to $15.29 billion in 2021, according to a 2016 report by Markets and Markets. This increase indicates an extremely high compound annual growth rate (CAGR) of 31.1%.

Tintri’s major competitors within the cloud management service market include Pure Storage (PSTG), Nutanix (NTNX), NetApp (NTAP), EMC / Dell Technologies, HP Enterprise (HPE), Microsoft (MSFT), IBM (IBM) and VMware (VMW).

According to management at Tintri, the company’s competitive strength includes the fact that customers can purchase its software either separately or part of a suite, and its system is purposefully built for enterprise cloud.

If Tintri prices as indicated above it could have a P/S of 2.8X; this is below the industry average of 5.7X.

Conclusion: Consider A Modest IPO Investment

Although the company believes it has competitive advantages against its stiff competition, Tintri’s financials complicate matters. Its gross margin is rising, and it is growing topline revenue, but rates are slowing down.

The company is also burning through its cash at a quick rate, and losses are increasing -- exceeding $105 million in fiscal year ending 2017.

Given the lack of a visible path to profitability, high spending need, and decreasing growth rates, investing long term in Tintri gives us pause. However, the IPO is popular and TNTR could garner significant investor attention, given it being one of few tech deals recently.

We suggest investors consider a modest IPO investment at most.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more